Traders Brief - Downside Bias Amid Negative Spillover From Dow

HLInvest

Publish date: Thu, 03 Oct 2019, 08:59 AM

MARKET REVIEW

In line with 1.3% or 343 pts skid on Dow, Asian markets ended lower as sluggish US manufacturing data stoked fears of a global economic slowdown and reignited concern over the impact of the US-China trade war. To recap, ISM said US manufacturing activity tumbled to more than 10-year low in September, underscored the damaging effects of the prolonged trade war with China. Major losers were KOSPI (-2%), ASX 200 (-1.5%), Indonesia (-1.4%) and Singapore (-1.4%).

Tracking weak regional markets, KLCI tumbled 14.5 at 1574.9, led by selldown in banking (PBBANK, MAYBANK and HLBANK) and telco (MAXIS and DIGI) stocks. Trading volume increased to 1.85bn shares worth RM1.44bn as compared to Tuesday’s 1.80bn shares worth RM1.27bn. Market breadth was negative with 265 gainers as compared to 516 losers.

The Dow plunged 494 pts or 1.9% at 26078, with a back-to-back slide of more than 3.2% or 837 pts. The slump was triggered by nagging worries about political turmoil and growing signs of domestic weakness following the release of bearish ISM manufacturing report on Monday, sending investors scurrying for cover in safe assets (US 10Y yield -0.04% to 1.6%).

TECHNICAL OUTLOOK: KLCI

After slipping below multiple key SMAs and 1581 (15 Aug low) supports coupled with overnight 1.9% slump on Dow, KLCI is expected to witness a selling spree towards lower supports at 1571 (14 May low), 1564 (weekly low BB) and 1550 levels, reflected by the long black candlestick with bearish MACD and falling RSI. Stiff resistances are pegged at 1589 (10D SMA) and 1600 psychological barrier.

In wake of a bearish 2-day slide from Dow, KLCI is expected to witness another day of selling spree today. Sentiment is likely to remain tepid amid anxieties over earnings disappointments and the uncertain outlook of Malaysian government bonds (still on the Watch List for potential downgrade pending the next review in March 2020) as investors await the crucial US-China trade talks on 10-11 Oct and the tabling of Budget 2020. Overall, we will likely see defensive yield seeking to be the dominant investment style in the near term. We continue to favour high divvy yielders (defensive and low MGS yield) and exporters (depreciation bias to ringgit). HLIB top picks are KLCCSS, TM, LIIHEN, TOPGLOV and MAYBANK.

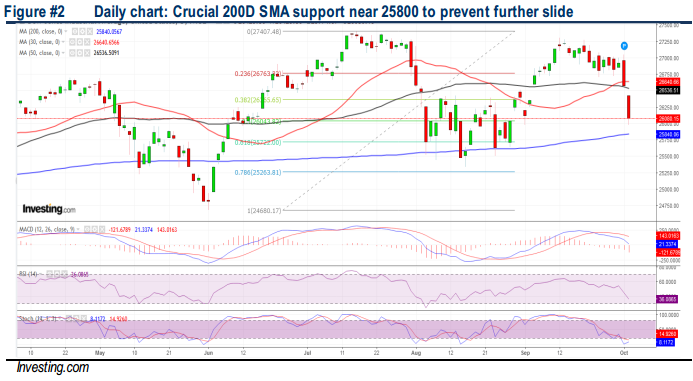

TECHNICAL OUTLOOK: DOW JONES

After hitting 1M high of 27306 (12 Sep), the Dow uptrend reversed slid to a low of 25974 (slightly above 200SD SMA at 25840) before ending at 26078. Following the multiple key SMAs supports breakdown and the two bearish Marubozu candlesticks, the Dow is likely to remain under siege with critical support at 200D SMA. A decisive fall below 25840 will trigger more selloff towards 25000-25300 territory. Stiff resistances are pegged at 26300-26600 zones.

We maintain our view that the Dow will continue its choppy mode with critical downside support near 200D SMA or 25840 levels as investors await the next course of actions by the Fed on 30-31 Oct and 10-11 Dec FOMC meetings following recent bearish set of US and global economic data, as well as closely monitoring the upcoming trade talks on 10-11 Oct. In addition, traders will be shifting their attention towards the upcoming US 3Q19 reporting season in mid Oct (consensus is predicting the S&P 500 earnings to decline 4.8% YoY from a flat performance in Q1 and Q2).

Source: Hong Leong Investment Bank Research - 3 Oct 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-15

CDB2024-11-15

MAXIS2024-11-15

MAYBANK2024-11-15

MAYBANK2024-11-15

MAYBANK2024-11-15

MAYBANK2024-11-15

MAYBANK2024-11-15

PBBANK2024-11-15

PBBANK2024-11-15

PBBANK2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-15

TOPGLOV2024-11-14

MAXIS2024-11-14

MAYBANK2024-11-14

MAYBANK2024-11-14

PBBANK2024-11-14

TM2024-11-14

TM2024-11-14

TM2024-11-14

TOPGLOV2024-11-13

CDB2024-11-13

CDB2024-11-13

HLBANK2024-11-13

KLCC2024-11-13

KLCC2024-11-13

MAXIS2024-11-13

MAXIS2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

MAYBANK2024-11-13

PBBANK2024-11-13

TM2024-11-13

TM2024-11-13

TM2024-11-13

TOPGLOV2024-11-12

CDB2024-11-12

CDB2024-11-12

HLBANK2024-11-12

KLCC2024-11-12

KLCC2024-11-12

KLCC2024-11-12

KLCC2024-11-12

MAXIS2024-11-12

MAXIS2024-11-12

MAXIS2024-11-12

MAYBANK2024-11-12

MAYBANK2024-11-12

MAYBANK2024-11-12

PBBANK2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-11

CDB2024-11-11

CDB2024-11-11

HLBANK2024-11-11

HLBANK2024-11-11

KLCC2024-11-11

KLCC2024-11-11

KLCC2024-11-11

KLCC2024-11-11

KLCC2024-11-11

KLCC2024-11-11

MAXIS2024-11-11

MAXIS2024-11-11

MAXIS2024-11-11

MAXIS2024-11-11

MAXIS2024-11-11

MAXIS2024-11-11

MAXIS2024-11-11

MAXIS2024-11-11

MAXIS2024-11-11

MAXIS2024-11-11

MAYBANK2024-11-11

MAYBANK2024-11-11

PBBANK2024-11-11

PBBANK2024-11-11

PBBANK2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-11

TOPGLOV2024-11-11

TOPGLOV2024-11-08

CDB2024-11-08

HLBANK2024-11-08

KLCC2024-11-08

KLCC2024-11-08

KLCC2024-11-08

KLCC2024-11-08

MAXIS2024-11-08

MAXIS2024-11-08

MAXIS2024-11-08

MAYBANK2024-11-08

PBBANK2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-08

TOPGLOV2024-11-08

TOPGLOV2024-11-07

CDB2024-11-07

CDB2024-11-07

HLBANK2024-11-07

KLCC2024-11-07

KLCC2024-11-07

KLCC2024-11-07

KLCC2024-11-07

KLCC2024-11-07

MAYBANK2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-07

TOPGLOV2024-11-06

CDB2024-11-06

LIIHEN2024-11-06

MAYBANK2024-11-06

MAYBANK2024-11-06

MAYBANK2024-11-06

PBBANK2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-06

TOPGLOV2024-11-06

TOPGLOV2024-11-05

CDB2024-11-05

HLBANK2024-11-05

KLCC2024-11-05

KLCC2024-11-05

KLCC2024-11-05

KLCC2024-11-05

KLCC2024-11-05

MAXIS2024-11-05

MAXIS2024-11-05

MAXIS2024-11-05

MAYBANK2024-11-05

MAYBANK2024-11-05

MAYBANK2024-11-05

MAYBANK2024-11-05

MAYBANK2024-11-05

PBBANK2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TOPGLOV2024-11-04

CDB2024-11-04

CDB2024-11-04

CDB2024-11-04

HLBANK2024-11-04

KLCC2024-11-04

KLCC2024-11-04

KLCC2024-11-04

KLCC2024-11-04

MAXIS