Traders Brief 12 Dec 2019 - Positive Buying Tone May Extend

HLInvest

Publish date: Thu, 12 Dec 2019, 09:02 AM

MARKET REVIEW

Asia’s stock markets ended mixed prior to the FOMC meeting, where market participants were expecting the Fed to keep the rates unchanged. Also, investors remained cautious without any significant developments on the trade front between the US and China. The Nikkei 225 slid marginally by 0.08%, while Shanghai Composite Index and Hang Seng Index increased 0.24% and 0.79%, respectively.

On the local front, the FBM KLCI traded higher by 0.09% to 1,563.19 pts. Market breadth was positive with gainers led losers by a ratio of 9-to-8. Market traded volumes stood at 2.37bn shares worth RM1.71bn. Besides, we noticed the property sector was attracting decent buying interest and most of the stocks experienced breakout, accompanied by improved volumes.

Brushing aside the focus on trade front, investors were concentrating on the outcome of the FOMC meeting, where the Fed kept the interest rate unchanged (federal funds rate stood at 1.50-1.75%) and indicated that it will remain on hold for 2020. The Dow and S&P500 added 0.11% and 0.29%, respectively while Nasdaq rose 0.44%.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI regained traction after a 2-day losing streak. The MACD Line is flat, while MACD Histogram has recovered over the past week. Meanwhile, both the RSI and Stochastic oscillators are recovering above the oversold region. Hence, with the improving technic al readings, we may anticipate downside risk to be limited and poise for a rebound on KLCI. Resistance is set around 1,580, while support is located around 1,548.

With the mildly positive tone on Wall Street, we expect spillover of buying support may lift the broader market over the near term; supporting KLCI above 1,548. At the same time, traders may trade within property stocks as volumes and prices have picked up substantially yesterday and we believe the trading interest is likely to sustain until next week.

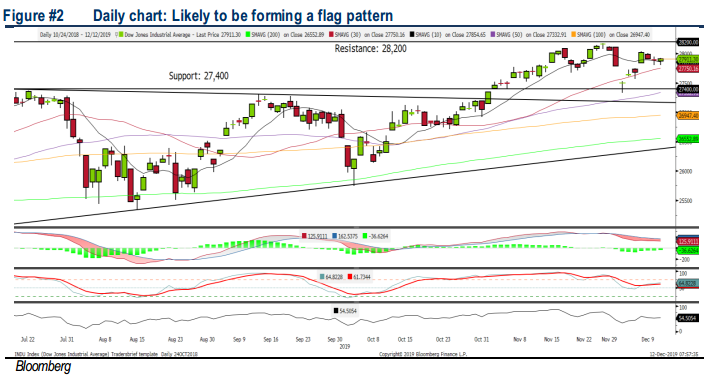

TECHNICAL OUTLOOK: DOW JONES

The Dow has snapped a 2-day losing streak and the MACD indicator remained positive (MACD Line is hovering above zero, while MACD Histogram is recovering). Meanwhile, both the RSI and Stochastic oscillators are trending higher above 50. Resistance is pegged around 28,200, while support is located around 27,400.

Despite the relief rebound on Wall Street as the Fed kept the interest rate unchanged and indicated the interest rate should remain stable for 2020, traders may still trade on a cautious tone ahead of the planned tariffs of 15% on USD156bn Chinese goods this 15th Dec. Hence, we remain cautious and expect the trading tone to be sideways on Wall Street. The Dow’s trading range could be envisaged around 27,400-28,200.

TECHNICAL TRACKER: CLOSED POSITION

We Took Profit on DSONIC Yesterday (+12.3% Gain) After Hitting Above R2 Upside Target.

Source: Hong Leong Investment Bank Research - 12 Dec 2019

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024