Traders Brief - Negative Bias Tone Likely to Prevail in the Near Term

HLInvest

Publish date: Fri, 14 Feb 2020, 09:16 AM

MARKET REVIEW

Asia’s stock markets trended lower as investors focused on a spike in the number of new confirmed Covid-19 cases reported in China’s Hubei province due to a change in methodology. Also, market participants fled for safe haven assets such as gold. The Shanghai Composite Index and Hang Seng Index fell 0.71% and 0.34%, respectively, while Nikkei 225 slid 0.14% .

Similarly, the spike in Covid-19 cases spooked the investors and the FBM KLCI traded lower for the session to close at 1,539.16 pts (-0.24%). Market breadth however was positive with 452 gainers vs. 361 decliners, accompanied by 2.74bn worth RM2.30bn. Construction stocks such as ECONBHD, GAMUDA and SUNCON were traded actively higher for the session ahead of the potential announcement of stimulus measure by government.

Wall Street ended lower as traders digested the jump in reported Covid -19 cases and the possible impact on the China and global economy; shares that are related to casino (Wynn Resorts and Las Vegas Sands) and aviation (United and American Airlines) that are having exposure in a China were hit badly for the session. The Dow declined 0.43%, while S&P500 and Nasdaq slid 0.16% and 0.14%, respectively.

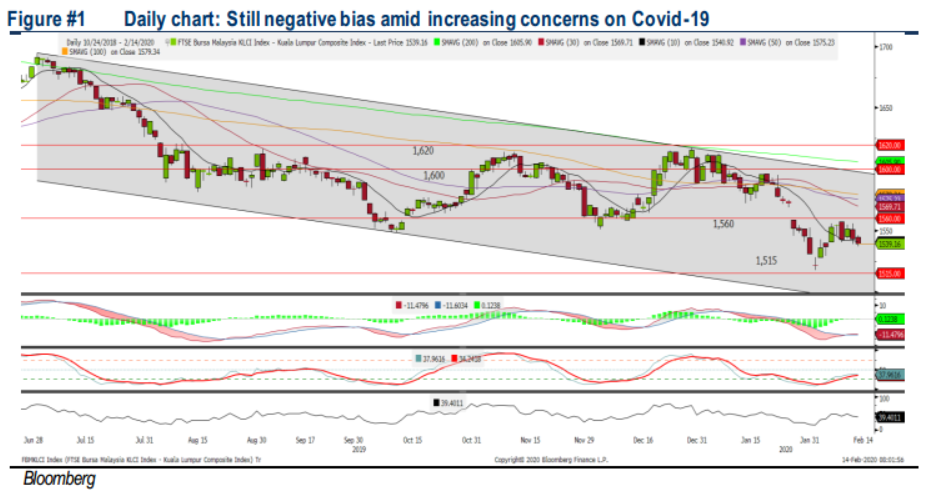

TECHNICAL OUTLOOK: KLCI

The FBM KLCI ended lower for the second day and the MACD Indicator has turned flattish. Meanwhile, both the RSI and Stochastic oscillators have turned sideways below 50 as well. Hence, we believe the upside could be limited for KLCI at this juncture. The resistance will be envisaged around 1,560, while support is set along 1,515.

Following the prolonged Covid-19 outbreak, coupled with a spike in confirmed cases (after a change in methodology) above 60k cases as well as the lower-than-expected Malaysia’s GDP growth rate of 3.6% in 4Q19, we may anticipate further downside risk on the Bursa Exchange. However, construction sector and building material segment have seen some trading interest yesterday and may sustain at least for the near term. The FBM KLCI’s trading range is set around 1,515-1,560.

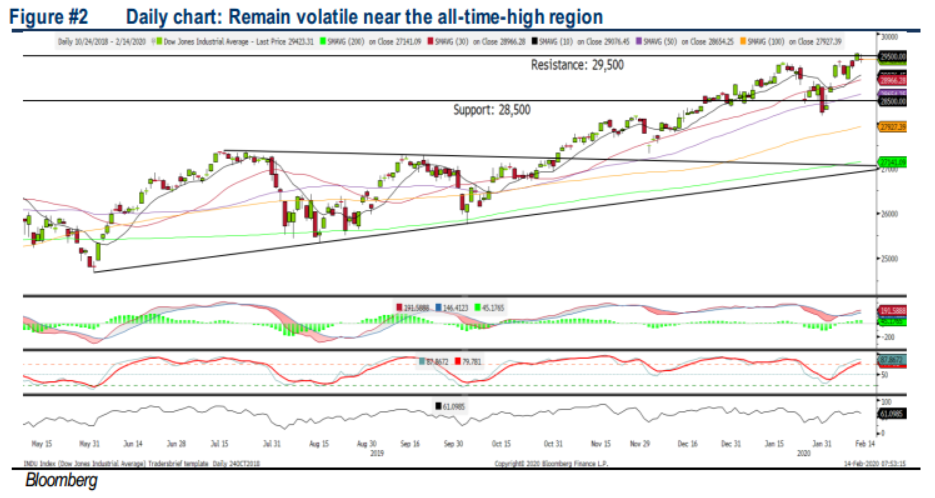

TECHNICAL OUTLOOK: DOW JONES

The Dow retreated from the all-time-high region as profit taking activities emerged. The MACD Indicator, however is still pointing upwards (indicating that the trend is still positive). However, the Stochastic oscillator is hovering in the overbought region; could be suggesting that the recent trend may warrant a mild retracement. Resistance is set around 29,500, while support is anchored around 28,500.

With the fluctuations between the positive and negative territories on Wall Street over the past week, we believe market will remain choppy in this prolonged Covid -19 outbreak due to the uncertain impact of the situation towards the economy (the central bank will be monitoring closely on the potential global economic fallout from the virus). At this juncture, investors will be focusing on the ongoing reporting season for trading opportunities in the near term. The Dow’s trading range will be located around 28,500-29,500.

Source: Hong Leong Investment Bank Research - 14 Feb 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024