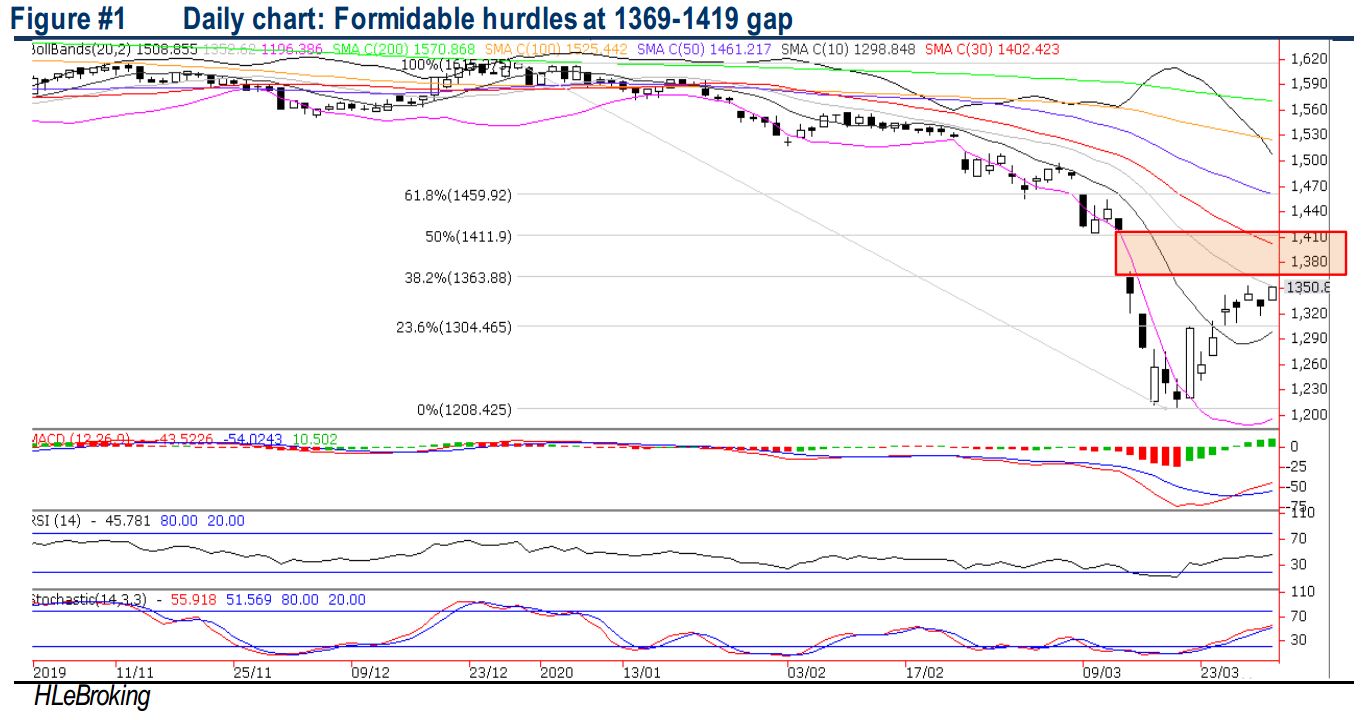

Traders Brief - Facing Formidable Hurdles at 1369-1419 Zones

HLInvest

Publish date: Wed, 01 Apr 2020, 09:35 AM

MARKET REVIEW

Global: Tracking Dow’s 690-pt surge overnight, the benchmark MSCI Asia APEX 50 index gained 1.9% to 1165, boosted by a better-than-expected China’s official manufacturing PMI for March at 52.0 (consensus: 45), indicating an expansion and defying expectations of a contraction amid surging Covid-19 cases globally. Overnight, the Dow slipped 410 pts or 1.8% to 21917 (-23% QoQ/-14% MoM) amid worries over the worsening outbreak in the US as the COVID-19 confirmed cases shot past 140k (source: WHO on 31 March), officially become the country most affected worldwide.

Malaysia: Taking cue from the Dow’s 3.2% rally overnight and the 1Q2020 window dressing activities, KLCI rallied 22 pts or 1.7% to 1350.9 pts (-15% QoQ and -8.9% MoM), led by strong gains by PCHEM, SIMEPLT, TENAGA, MAYBANK and GENTING. Trading volume increased to 3.52bn shares worth RM2.88bn as compared to Monday’s 2.83bn shares worth RM1.86bn. Market breadth was positive with 708 gainers as compared to 185 losers.

TECHNICAL OUTLOOK: KLCI

After a 25% or 404-pt Covid-19 carnange from YTD high of 1612 (7 Jan) to a low of 1207 (19 Mar), KLCI rebounded 143 pts to close at 1350 (31 March). Although technical readings continue to expand positively, KLCI could face profit taking pullback as the strong exponential growth of catastrophic Covid-19 infections worldwide raised concerns over the damaging impact on global economy. Short term resistances are 1353 (26 March high), 1363 (38.2% FR) and the formidable hurdles at 1369-1419 gap (16 March). Conversely, failure to hold at 1320 (50H SMA) support will trigger further selling spree towards 1300/1270 levels.

MARKET OUTLOOK

Tracking the 1.8% retracement on the Dow overnight, KLCI could experience profit taking pullback after rallying 11.8% or 143 pts from a low of 1207 as the strong exponential growth of a catastrophic Covid-19 infections worldwide raised concerns over the damaging impact on global economy. We reiterate SELL INTO STRENGTH strategy and rebalance portfolio to sectors that are deemed to be more defensive as the world has clearly entered a recession (based on IMF) due to the coronavirus pandemic.

Source: Hong Leong Investment Bank Research - 1 Apr 2020

More articles on HLBank Research Highlights

Created by HLInvest | Jul 19, 2024