A Deep Reflection onto AGESON BERHAD (KLSE: 7145) Quarterly Results

swimwithsharkss

Publish date: Sat, 19 Feb 2022, 04:56 PM

The share price for AGES has been trading downwards ever since they announced exercising share consolidation and rights issue, which had already been approved by Bursa.

Will this quarter’s result be the saving grace for AGES?

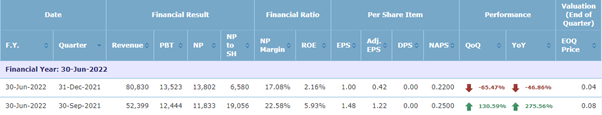

On the surface, AGES had recorded a dip in net earnings for both YoY and QoQ quarters. But is this really all to it?

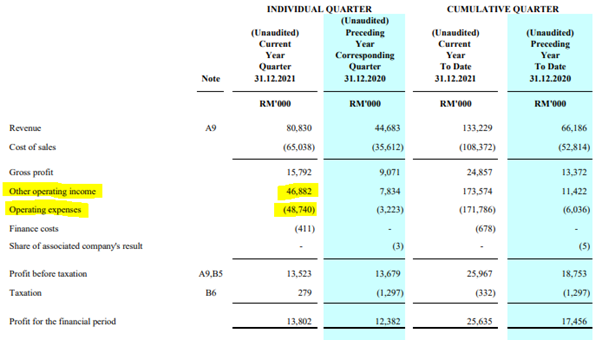

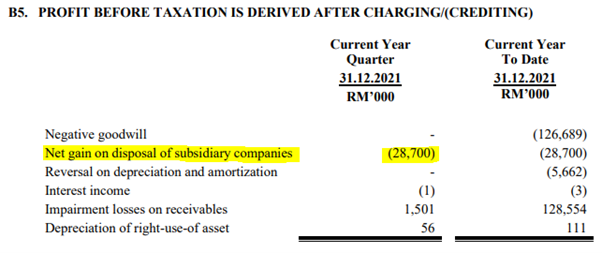

We noticed a very significant jump in both “Other operating income” and “Operating expenses” item as highlighted above. This is very likely to be a gain and expenses from the disposal of one of their subsidiary companies, which are not making good money now.

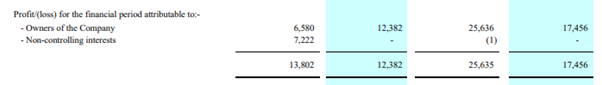

As a result, the profit attributed to the owners of the company, a.k.a. shareholders, had seen a split-off onto non-controlling interests.

This explains the dip in terms profit numbers. We believe this is likely to be one-off, as the consolidation will not extend to another quarter.

Nevertheless, the revenue of the company had extended to RM80.8 million despite the slow down in net earnings. This was mainly contributed by the increase of trading revenue from construction material, as the property development segment were still impaired by the COVID-19.

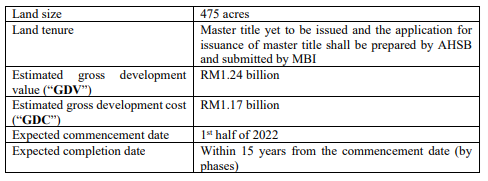

A 75% owned subsidiary by the company had ventured into a development rights agreement with Menteri Besar Incorporated (Perak) to develop a land size of approximately 475 acres, with an estimated GDV of RM1.24 billion, and the GDC was approximately RM1.17 billion, which means there will be a pre-tax profit of RM70.0 million across the years.

The development is expected to start by 2022 1H.

The company is also in the midst of developing 5 acres of land in Gombak, which consists of 56 units of semi-detached houses and 4 units of bungalows, with a total GDV of RM95.2 million and GDC of RM79.2 million.

The development is expected to start by 2022 2H.

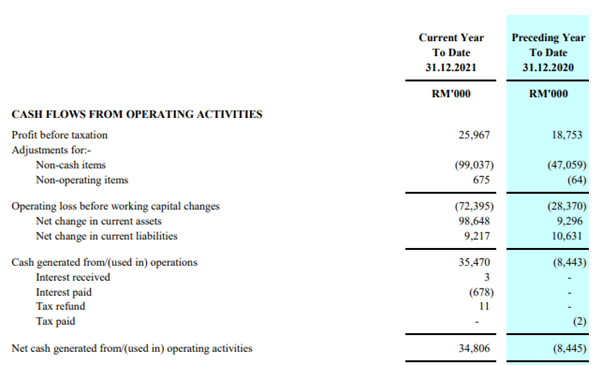

We also see a tremendous improvement in their operating cash flow.

All in all, this is a pretty quarter results by AGES, considering two of their property development projects have not launch yet.

On an averaged 4 quarter basis, AGES is currently trading at 1.16 times PER, and on a normalized quarter based on 2022FY2Q basis, the company is trading at 1.78 times PER, well below the 6 to 8 times current construction 1 year forward PER.

Bear in mind, we have not factor in the potential earnings from the upcoming development projects.

So, we think the best timing to enter AGES pro-rights issue, with a forward PER of 3 times, investors should expect a potential gain of close to 100% based on their current valuation.

More articles on Honestly Speaking

Created by swimwithsharkss | Feb 22, 2022

Created by swimwithsharkss | Jan 19, 2022

Created by swimwithsharkss | Nov 25, 2021

.png)