All you need to know about AGES (KLSE: 7145) financial report

swimwithsharkss

Publish date: Thu, 25 Nov 2021, 03:26 AM

All you need to know about AGES (KLSE: 7145) financial report

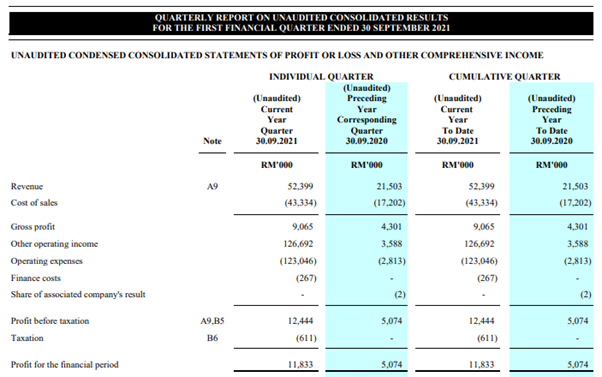

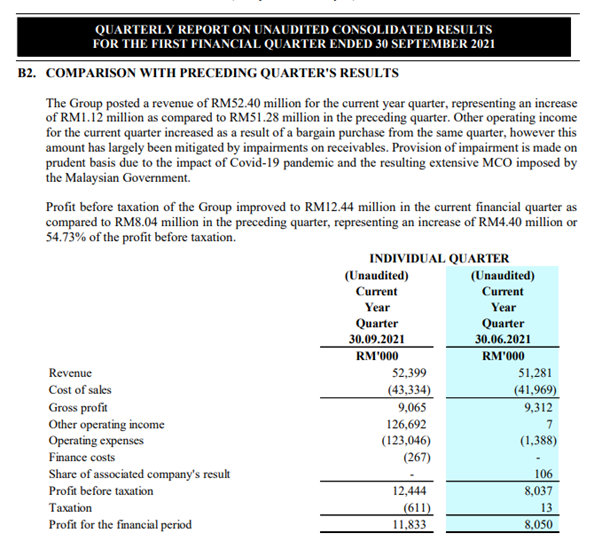

Once again, AGES had amazed me with their stellar financial performance in their 3rd quarter financial year 2021 quarterly report, where not only the company had managed to be profitable despite the challenging outlook of the market, they also managed to register both Year-on-Year and Quarter-on-Quarter growth, which is something we do not see on the construction market.

However, for investors who are nibbling down the numbers would notice 2 unusual items, namely other operating income and exceptionally high operating expenses.

What are those?

The first part of the equation is actually a one-off profit generated from the acquisition of AB5 S/B, which was acquired by the company on 17th November 2021. The acquisition of AB S/B or currently known as Ageson Industrial S/B was the key contributor for the other operating income in the nature of negative goodwill.

I think you could pretty much google negative goodwill on your own, so I will not babble any longer here.

From what we see, the company also taken the opportunity of big one-off profit in order to offset the impairment of trade receivables. Now, we know that AGES was previously owned by malicious parties who were on pursued by court cases, hence it is normal for the company to have legacy issue remaining. In tandem with the one-off profit for the company, our guestimate is the company is trying to do kitchen sinking at once to clean off their balance sheet, in order to restructure the whole proposition of the group.

Nevertheless, the extraordinary items pretty much off-set each other of them mutually, now back to the core results of the company.

As you can see here, the revenue and gross profit, which excluded one-off items by nature is still very good when compared to a Year-on-Year basis. Again, I would like to emphasis that no other property developer / construction company had able to deliver the same rate of growth. The reason for the growth of results of the company was mainly from higher billing recognized from the trading of construction material, but the property development segment was still hampered by the MCO 3.0 imposed by the government.

Actually, this is really good for them as we see even without the property development’s contribution, the company is still delivering exceptional results, just imagine what they could do with MCO 3.0, which will be the next quarter.

As we see the construction market “crashed” as a whole, this had also impacted the share price of AGES. But let’s think of this rationally, where could you find a 1.5 times PER company with the ability to remain profitable despite the market is suffering as a whole?

I believe you cannot find any substitute for AGES.

Hence, I strongly recommend BUY for AGES due to their low valuation and impressive costs management as well as profitability. I hope you will not miss out on this company!

More articles on Honestly Speaking

Created by swimwithsharkss | Feb 22, 2022

Created by swimwithsharkss | Feb 19, 2022

Created by swimwithsharkss | Jan 19, 2022