[ FBMKLCI , TOP 100 , MID , SMALL CAP ] - BULL IS COMING TO TOWN !!! Part 2 - J4 Investment Capital

J4InvestmentCapital

Publish date: Sun, 23 Sep 2018, 08:03 PM

[ FBMKLCI , TOP 100 , MID , SMALL CAP ] - BULL IS COMING TO TOWN !!! Part 2 - J4 Investment Capital.

First of all , we did successfully found the bottom of the 3 main Index on the 18th of July 2018 right before the BULL RUNS .

From the list below where we stated on that day about the factors that cause the HUGE PLUNGE on June , there are now a few changes :

1. General Election on 9th of May 2018 ( Digested )

2. BN Loss ( Digested )

3. Trade War between U.S. and China ( On-going )

4. Unstable MYR and USD ( On - going )

5. US Interest Rates ( On - going )

6. Weaker Quarterly Report ( Starting to improve )

7. Newly formed government ( Starting to improve )

8. Delay of the list of cabinets ( Digested )

9. Cancellation of HSR , LRT 3 , ECRL ( All have been brought back to the table )

10. Welcome to the 1 trillion debt country . ( Digested )

Out of 10 factors , 4 have been digested , 3 are currently on-going and there are a few factors that should be highlighted .

1. The trade war between U.S. and China which began in the early of 2018 has made the world’s markets full of fear . Now , the U.S. is starting to play it soft and trying to make China solves it under the table. They knew that the China has no longer got much bullets to play with and I believe that they might solve it right after November 2018 after the Midterm - Election in U.S. .

2. The Midterm - Election in U.S. is a crucial moment where Donald Trump will know whether he is doing the right thing for the people during his President period . He needs to show the people the good side of him which includes the economic in U.S. and all over the world . That is why we could see Dow Jones Index has broke a NEW HIGH on Friday .

3. Cancellation of HSR , LRT 3 and ECRL is also another point to highlight and is the key to determine the future of Construction and Steel stocks in the next few years . During this period, our government has switching the projects ON and OFF repeatedly making all the related stocks to be so volatile . However , I believe that in the end those projects will still continue its progress either by cutting the cost or to delay it .

4. There are a few sectors where we should focus in , in the next few quarters :

- Semiconductors : Due to the trade wars , the China has switched their semiconductor ‘s market to our country and trying to get orders as our country is consider CHEAP enough than U.S.

- Export sectors : The U.S. Fed Interest Rate is going to rise in the coming weeks which will make USD even higher than previous .

- The undervalued stocks : After the corrections we faced in the past few months , there are some stocks which are extremely undervalued and should be corrected to its value soon .

Technical Analysis on Index :

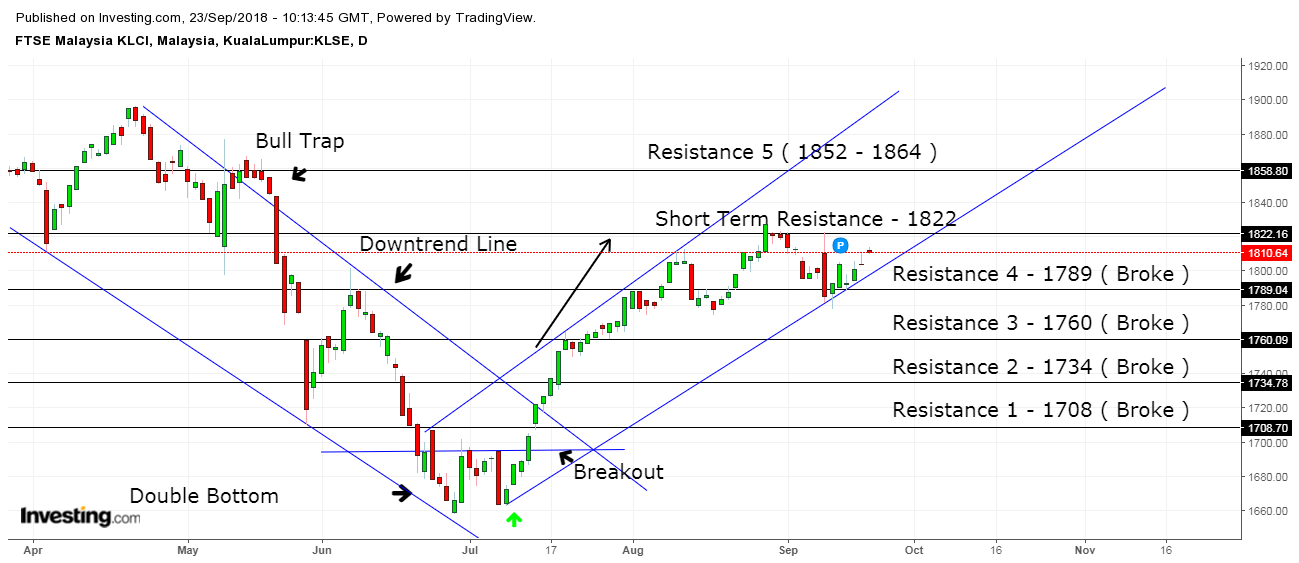

KLCI INDEX

From the chart above , KLCI Index is still currently on the right track despite it has suffer from a few small correction in August and September . As long as it does not fall below the trend line and Support Line ( Resistance 4 - 1789 ) , it is still consider alright . During the coming period , it is expected to move up along the trend , reaching the short term resistance at 1822 . The resistance 5 line is expected to be broke near November if everything goes right . We are giving out a TP of 1815 - 1840 .in the next few weeks .

KLCI Mid Cap :

From the chart above , we can see that it failed to pass through the resistance 4 ( 15576 ) despite a few attempts. It then plunges down back on the long-term uptrend line and creating a strong support line at 14655. However , the rebound might faces some challenges near the resistance 1 at 14987 and fall back to the trendline . As long as the KLCI Index going well , Mid-cap index might not suffer any problem and continue to reach our target price at 15355 in the next few weeks .

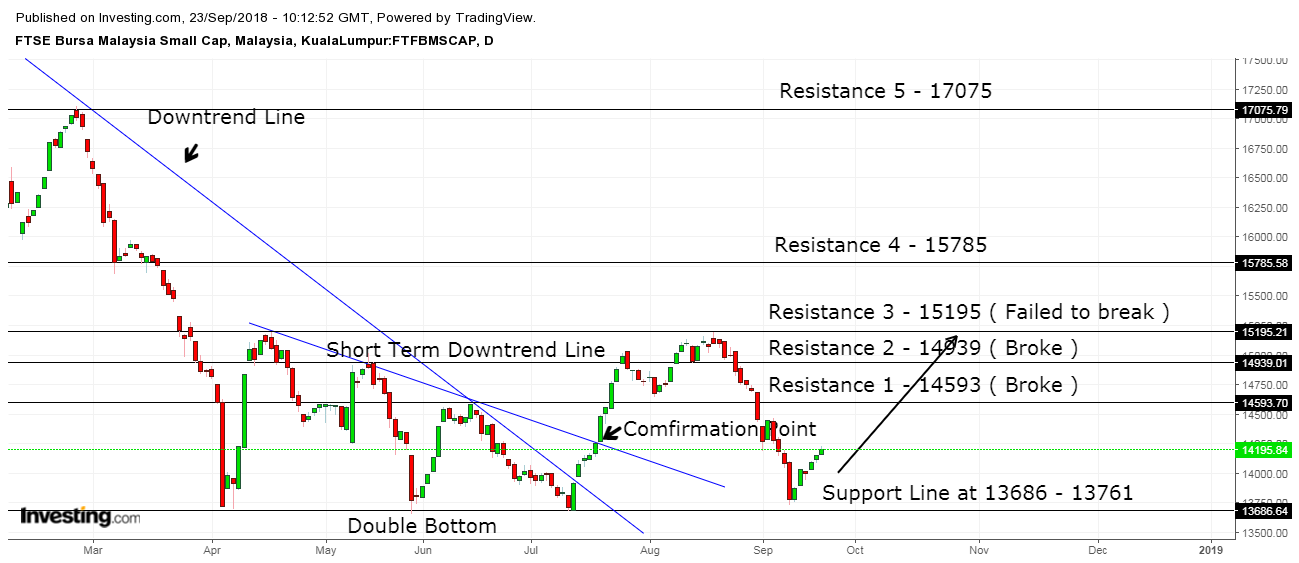

KLCI Small Cap :

From the chart above , the KLCI Small cap index suffers a huge plunge back to the original position after it failed to breakthrough the resistance 3 at 15195 . This has made the support line around 13686 - 13761 stronger and might continue to move around the region . We are giving a target price of 15000 in the next few weeks as the global market returned to bull state .

Index Analysis(23/9/18) :

Candlestick Chart : DJI index

Light purple : HSI

Dark Purple : KLSE

1) Region A

-The region where global market started the first wave spike , however , KLSE did not goes in line with the global market moves due to unstable geopolitical reason . HSI trended upwards with the movement of the US DJI Index .

2) Region B

-The preliminary stage before the bullish market action started . At this point , HSI has started to rally before the US market skyrocketed , it is due to the heavy plunge before it . KLSE was still remaining dormant at this moment .

3) Region C

-The temporary pause in the preceding hyper-bullish market .

i) DJI enters the consolidation period

ii) HSI followed the US market move .

iii) KLSE followed the global market move too .

-The reason of the heavy plummet at the end of region c is mainly due to the impending trade war and tariff impose .

4) Region D

-This is the point where three market started to show divergence , in the midst of tense global market sentiment , US stock market and Malaysia stock market started to rebound to where it belongs . On the other hand , HSI did not go with the movement of the global market , it is following the China Stock Exchange .

After understanding the comparison between the 3 markets , we can boil it down into some corollary .

During region A , B and C , Malaysia market are the worst among them , it is because what we have mentioned above , the unstable geopolitical reason and the vague fiscal policy and others . However , our team see it as a charging bull , Malaysia market has digested the negative sentiment earlier than Hong Kong and other country all around the world . Therefore , in the midst of bad market sentiment , Malaysia has limited downside potential because the investors have already digested the news being released . It is the time for KLSE Index to shine , we rate Malaysia market as a bullish market . Other than that , we believe that the mega infrastructure is temporarily being procrastinated , a developing country needs good infrastructure and of course job opportunity to develop well. Malaysia new government will not cancelled any of it , they will continue it very soon in a few years time . Malaysia will be having a tough time to make the country financial healthy again , after the restructuring process , Malaysia will be maintaining its robust growth in every aspects . For the global market recession , we believe that it will not be so soon , we predict that it will be falling at the end of 2019 -the mid of 2020 .

Disclaimer : Information above is for sharing and education purposes , not a buy and sell advice , please refer to ur advisory for any buy or sell call , buy and sell at your own risk .

Happy investing !

Feel free to visit our FB Page , gives us a LIKE and share it out so that we can share more things to you !!!

https://www.facebook.com/J4-Investment-Capital-398139627315097/

J4 Investment Capital.

More articles on J4 Investment Capital

Created by J4InvestmentCapital | May 20, 2019

Created by J4InvestmentCapital | Apr 10, 2019

Created by J4InvestmentCapital | Mar 31, 2019

Created by J4InvestmentCapital | Jan 17, 2019

Created by J4InvestmentCapital | Jan 16, 2019

Created by J4InvestmentCapital | Jan 15, 2019

jiunn

I agreed with your view on FBMKLCI BULL MARKET provided index can now above the critical 200-day SMA at 1,799…

2018-09-24 14:33