Has SK Wong triggered the MGO button of Bright Packaging unintentionally? (with AGM updates)

kakashit

Publish date: Wed, 13 Apr 2016, 10:25 AM

http://klse.i3investor.com/blogs/kakashit/91359.jsp

In previously article, I mentioned that Bright’s revenue has been improved with a healthy net cash balance sheet, supported by Philip Morris’s long term contracts.

This time I would like to investigate mgo issue after many unsolved questions had been raised in the AGM and also a little bit history of Bright

Figure 1 So closed, man!

This is the shares acquisition of SK Wong under Wong SK Holdings s/b, it shows that SK Wong’s shareholding had been increased to 32.98% dated 29th Dec last year.

“According to SC rules, Mandatory General Offers means any person who is or a group of persons who together are entitled to exercise or control the exercise of at least 33% of the voting shares in a company (or such other percentage as may be prescribed in the Malaysian Code On Take-Overs and Mergers 1998 as being the level for triggering a mandatory general offer) or who is or are in a position to control the composition of a majority of the board of directors of such company.”

The total ordinary shares of Bright is 142,839,700, it only takes a further 0.02% or 34k shares roughly for SK Wong to trigger the alarm of mgo.

Why is SK Wong trying to dance on the cliff?

And who is SK Wong?

Figure 2: Once upon a time the most successful richman and award winning young entrepreneur at the age of 30.

“Dato' Ricky Wong Shee Kai (born 12 December 1981 in Kuala Lumpur) is a Malaysian investor, entrepreneur and philanthropist. He is the CEO and founder of Asia Media, Malaysia's largest Transit-TV network operator,[1] three-time winner of the JCI – Creative Young Entrepreneur Award. He washonoured as a Young Global Leader by the World Economic Forum, Davos in 2014. (source-Wikipedia)”

And how he became the largest shareholder of Bright Packaging?

On 10 February 2014, non-executive director Datuk Seri Syed Ali Alhabshee has ceased to be a substantial shareholder of the company following the disposal of his entire shareholding in a direct business transaction to Wong. Wong currently holds a 32.81% stake in Bright Packaging. In October 2013, Wong emerged as a dominant shareholder in Bright Packaging Industry Berhad, a main board listed company on Bursa Malaysia. This is the second public-listed company in which the 31-year-old Wong has a controlling stake after Asia Media. Wong acquired a 22.73% equity stake in the packaging company which also owns two freehold sites with a combined area of 136,998 square feet in Prime Klang valley's Subang Hi-Tech Industrial Park where its headquarters and factories are located. As of 31 August 2013, debt-free Bright Packaging had cash of $19.94 million while net assets per share stood at 62 cents. The market reacted positively after news of Wong's investment was made public and the stock increased another 17% on news of its expansion plan through rights issue. News of Wong's interest in taking the company private were denied by the Board in its annual general meeting held on 24 February 2014. Wong has quietly built up his stake in the company and currently holds 32.81% which is just short of the 33% threshold required to trigger a mandatory general offer. (source- Wikipedia)

Intriguing issues have been raised by some observant minority shareholders of Bright at the recent Agm.

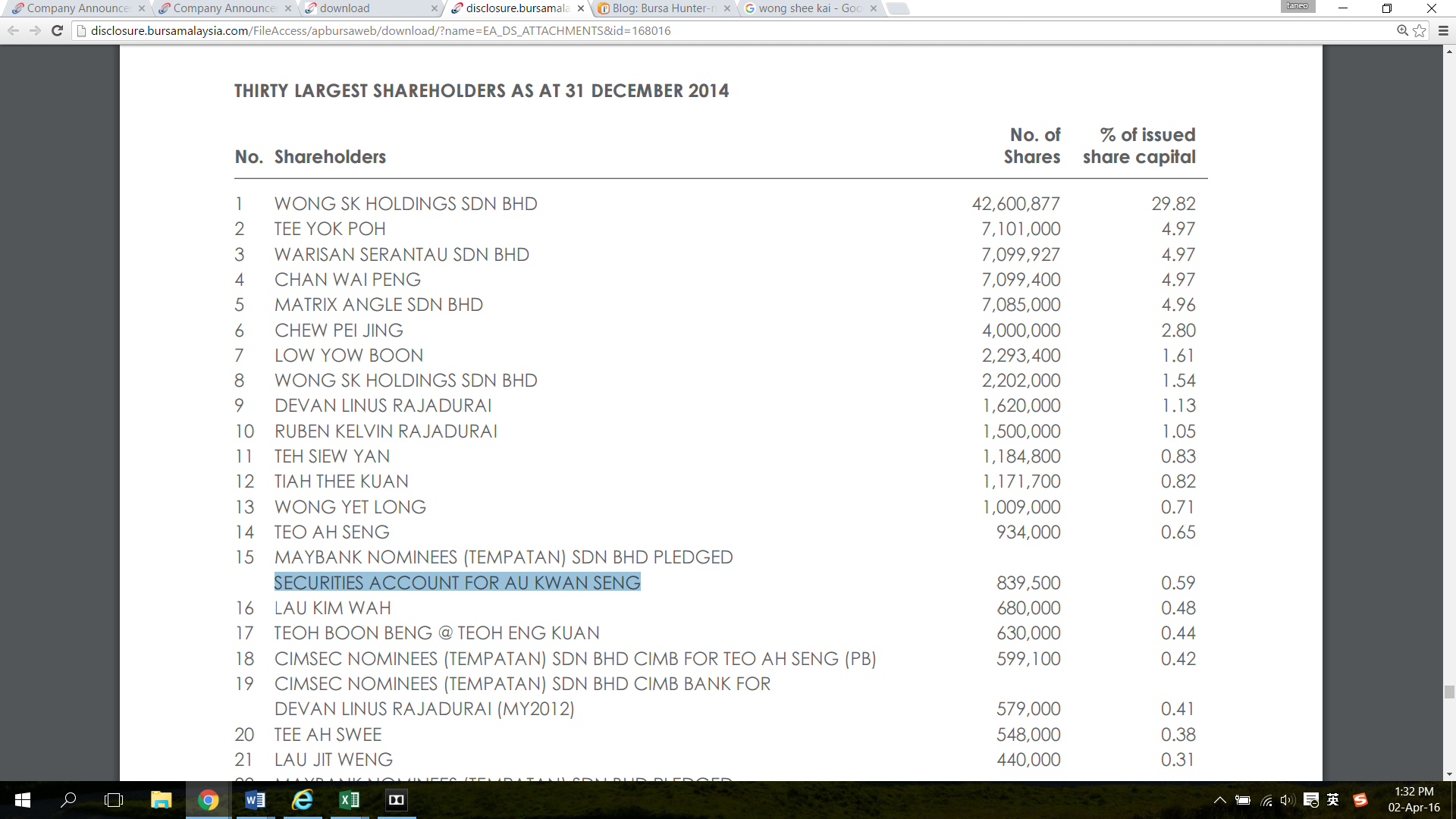

Doubt 1: Shareholdings info is getting less transparency

Can you notice the differences of shareholdings disclosed info between 2015 annual report and 2014 annual report of Bright Packaging?

In 2015, the individuals or parties names are not stated under the pledge securities accounts.

However in 2014, everything is so transparent whereby all the individuals’ name were stated.

As we’re investing in the public listed company, we have the right to know who is in Bright.

Are the controlling shareholder SK Wong trying to hide something?

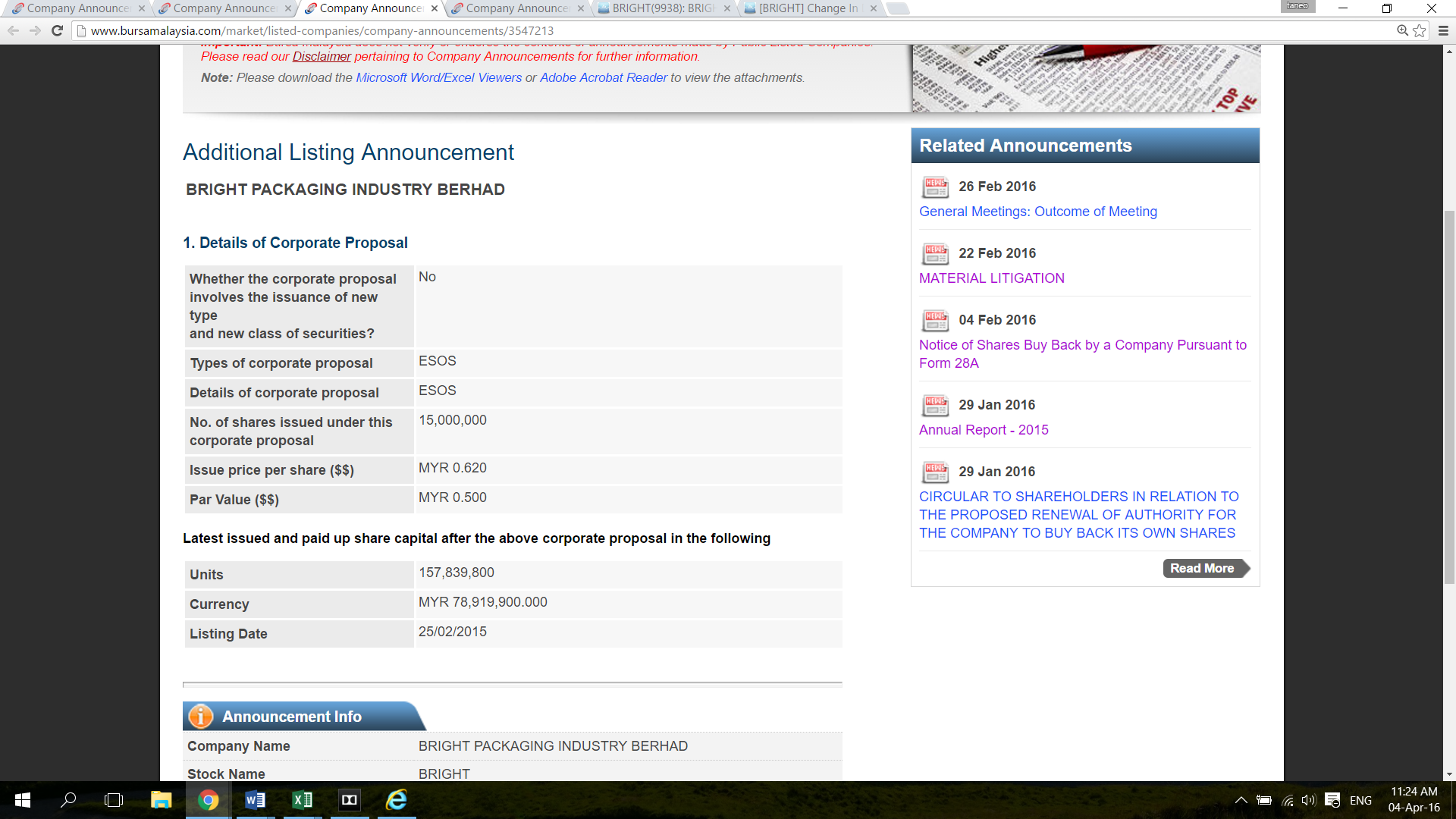

Doubt 2: Massive ESOS at the premium of market price

The purpose ESOS is to give reward the hardworks of the employees in the company and usually it is 5% below the market price. ESOS usually is exercised progressively.

But the ESOS of Bright seems like out of norm.

On 25th Feb 2015, there was 15m shares of ESOS being exercised at 62cents

On 27th Apr 2015, there was 6.4m shares of ESOS being exercised at 62cents again,

The average market price of both days were 55cents, that’s mean the premium of the ESOS is 13%, and a total of RM13.3 mil of cash being pumped into the company generously.

In 2015, the total fee plus bonuses of the BOD is not more than RM400k and none of the directors have taken up the ESOS.

How come the employees of Bright are so rich and generous?

Doubt 3 Very insisting on sharebuybacks and issue new shares

During the AGM, the board said they will continue to grow the business using internal cash.

So some shareholders think that the resolution of issue new shares and shares buyback are not necessary, hence request a poll voting.

Surprisingly, there was a 43% of shareholders voted for the resolution.

How come all those sleeping shareholders became so active in the AGM?

After all, the resolution is not about directors bonuses. Assume SK Wong made up the 32% votes, then who are the rest of 10% who is so gancheong, unfortunately their names are not disclosed, so I am not able to make the guess.

Summary

The issues raised by minority shareholders are:

1) Who are the staff who exercised the esos and are they linked to Wong SK?

2) Due to the opacity of the disclosure of the top 30 shareholdings (whether intentional?) in December 2015, it is very possible that SK Wong could have purchased additional shares which breached the 33% MGO threshold and is attempting to mask the breach.

If this true than SK Wong will be legally obligated to launch an MGO and SC will be urged to make the investigation.

The latest purchased price that he need to make the mgo offer is 42cents.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Hunter-net-Hunter

Created by kakashit | May 08, 2017

Created by kakashit | Feb 10, 2017

Discussions

Wah....this opportunity to buy mah....!!

Undervalue & possibility may trigger MGO....!!

This is right catalyst to buy, some more technically, today got volume and momentum on upside....!!

2016-04-13 21:32

don't ever buy sk wong stocks....he's a crook and almost being kill by his best buddy a few years ago.remember AMEDIA? also tey por yee stocks also don't buy

2016-04-13 22:26

Hopefully wat u say is true since cash rich company. Will try buy some tomorrow.

2016-04-13 23:25

Raider see Bright is a margin of safety stock loh....!!

Got big discount to Nta.....net cash too....!!

At the price of Rm 0.33 it is a steal mah....!!

Don miss this wonderful opportunity mah....!!

2016-04-14 15:07

let u know, my cost is at 34cents, so dun buy anything above 35cents, in case i dun wan any ppl say i pump n dump

2016-04-14 18:37

Raider is surprise by the good gesture of kakashit....letting us know his cost.....!!

Actually he need not do that.....we should do our own analysis & assessment...whether this counter at this price good or not mah...??

2016-04-14 19:30

Kakashit u forsee this coming results for bright wil turn black? I think the release date is around the corner.

2016-04-18 11:27

joerakmo

kakashit: I think you need go back a little further to the takeover battle end 2012.Form your opinion from there. cheers

2016-04-13 16:53