What potential message does the low equity of other directors represent - Prolexus Bhd

karadis

Publish date: Thu, 24 Jun 2021, 10:04 PM

We discussed the key personnel of Prolexus management, Lau Mong Ying (Managing Director) and Choong Chee Mun (Executive Director cum Chief Financial Officer*) in "How long does Prolexus (8966) allow making mistakes or retrieve a hopeless situation?" before.

If we pay the attention, we will find a very interesting phenomenon. What is it? Choong Chee Mun is the role of E.D. (CEO) and CFO also. He is from a financial background, joined the Group in April 2013 and was the Chief Financial Officer from 9 December 2013 to 25 September 2018. And re-appointed as Chief Financial Officer effective from 30 June 2020.

Re-appointed as Chief Financial Officer! This is the interesting part. The former CFO was promoted to E.D. (CEO), but he had to re-appoint as CFO after 1.5 years. Why is it so?

Under normal circumstances, the appointed of CFO is very critical and will not be easily changed. CFO's position in a listed group is relatively stable and will not easily leave. Even if it is changed, it is unlikely that the CEO will be a part-time CFO. Is it Lau Mong Ying (Managing Director) judged Choong Chee Mun is more suitable to play CFO instead of CEO? Or is it because Prolexus’ senior management has already had problems?

When we analyze the team of a listed company, in addition to analyzing the board of directors, we should also pay more attention to their Top Management team. Because the Top Management team has a very important key element in the sustainable development of the company. But we found that their Top Management team information is less, especially when E.D. need to be a part-time CFO role.

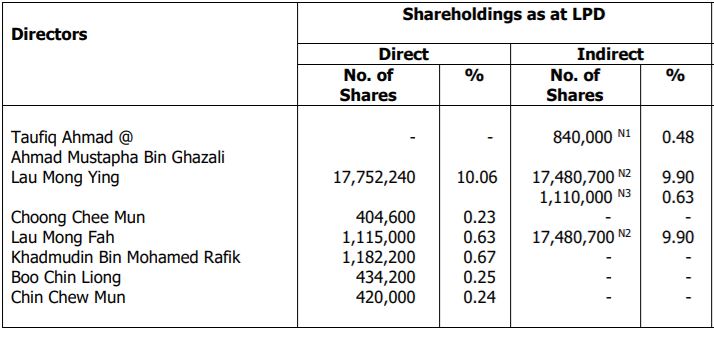

Let's take a look at the shareholding status of the directors, as shown in the figure below (SHARE BUY-BACK STATEMENT-is dated 17 November 2020).

The largest shareholders are Lau Mong Ying (Direct + Indirect = 20.59%) and Lau Mong Fah (Direct + Indirect = 10.53%), totally 31.12%. So, Prolexus can be understood as a family business.

Although Prolexus is a family business, the equity of other directors is too low, and basically no one is more than 1%. This is unhealthy. It means that Prolexus is a "one man show" public company, or other directors of Prolexus are not optimistic about the company, so that the shareholding is so low.

Even Prolexus's No. 2 - Choong Chee Mun's shareholding% is only 0.23%, and it is mainly distributed by the company rather than subscribed by itself. This also indirectly implies a message, no matter what happens, he can jump off the boat at any time. Because it is only part of the career, not the whole.

Why we discuss the Prolexus management team? Because this will determines whether Prolexus has enough courage and ability to make continuous breakthroughs, especially in this difficult environment.

What will happen to the QR that is expected to be released tomorrow? If it continues to get worse, it means that there have been problems with the apparel and fabric masks business, and it has gradually been reflected in the quarterly report.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Talk & Talk

Created by karadis | Sep 16, 2022

Created by karadis | Apr 04, 2022

Created by karadis | Oct 08, 2021

Created by karadis | Jul 29, 2021

Created by karadis | Jul 01, 2021

nubiskubissss

karatdis is back with its writing...

2021-06-25 09:27