Kenanga Research & Investment

Daily Technical Highlights – (FPGROUP, GTRONIC)

kiasutrader

Publish date: Fri, 20 Sep 2019, 11:31 AM

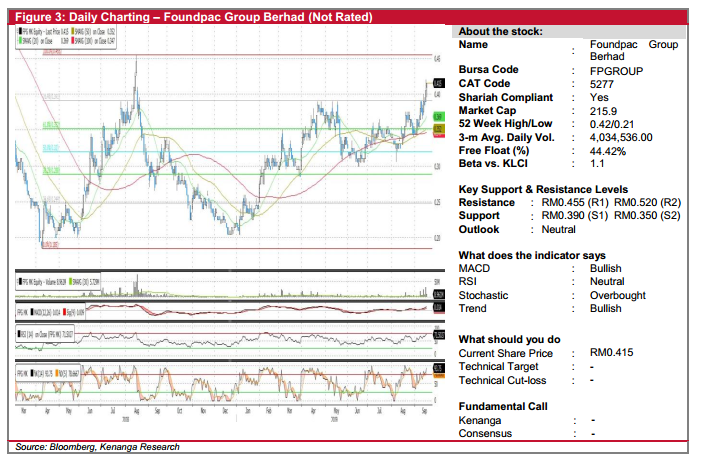

FPGROUP (Not Rated)

- FPGROUP gained 1.5 sen (+2.47%) to close at RM0.415 yesterday.

- The share has been on a rally after breaking above all its key SMAs in August (after releasing a good set of results).

- However the rally appears overextended and we opine the share should undergo a consolidation or retrace closer to its moving averages in the near term.

- Key support levels to look out for are RM0.390 (S1) and RM0.350 (S2).

- Nevertheless, should buying momentum continue, resistances can be found at RM0.455 (R1) and RM0.520 (R2).

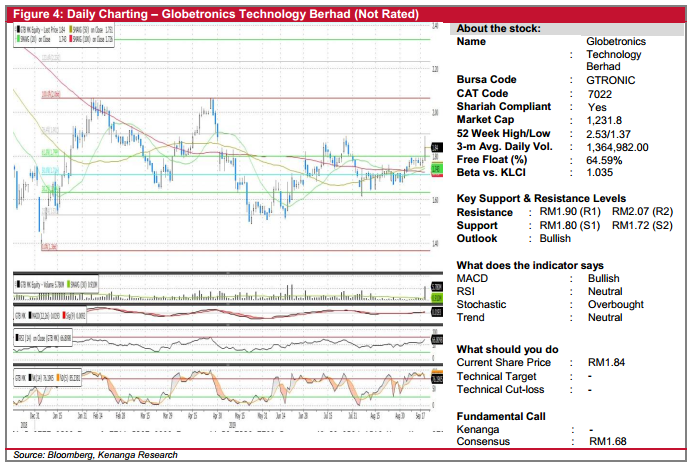

GTRONIC (Not Rated)

- Yesterday, GTRONIC rose 6.0 sen (+3.37%) to end at RM1.84.

- Chart-wise, the share has been slowly inching upwards after its plunge in early-Aug 2019. Yesterday’s close saw the formation of a long bullish candlestick, indicating buying momentum.

- Coupled with encouraging signals from key momentum indicators and the fact that the share remains above its key SMAs, we believe buying momentum could remain strong.

- From here, resistances can be found at RM1.90 (R1) and RM2.07 (R2).

- Conversely, downside supports can be identified at RM1.80 (S1) and RM1.72 (S2).

Source: Kenanga Research - 20 Sept 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments