Kenanga Research & Investment

Daily technical highlights – (JAKS, WCEHB)

kiasutrader

Publish date: Wed, 16 Oct 2019, 08:49 AM

Daily technical highlights – (JAKS, WCEHB)

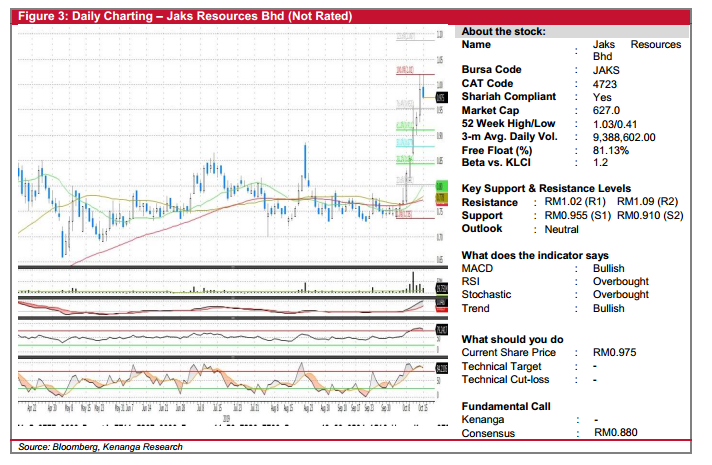

JAKS (Not Rated)

- JAKS fell 1.5 sen (-1.52%) to end at RM0.975, yesterday.

- Chart-wise, the share has been on a rally since early-October 2019 after 5-6 months of consolidation and is currently trending above all key SMAs.

- However, given heavily overbought signals from RSI, we believe a consolidation phase (RM0.955-RM1.02) is likely to happen in the near term.

- Key support levels can be identified at RM0.955 (S1) and RM0.910 (S2). Conversely, resistance levels can be found at RM1.02 (R1) and RM1.09 (R2).

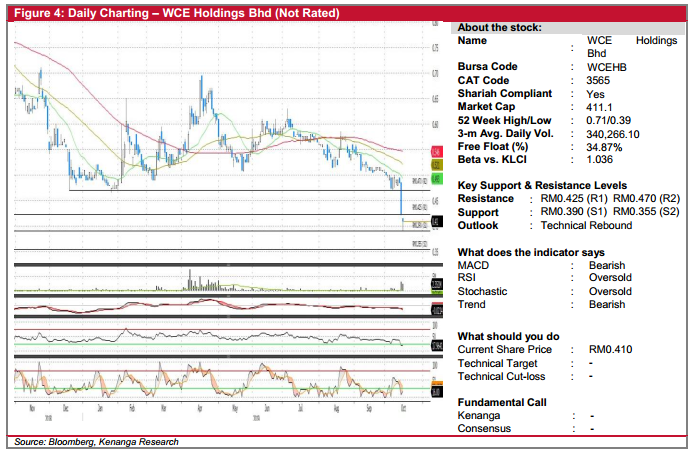

WCEHB (Not Rated)

- WCEHB fell 1.5 sen (-3.53%) yesterday to close at RM0.410.

- The share plunged after breaking below its previous support level of RM0.470. However, we opine that the decline away from its key SMAs is too steep and that a technical rebound should happen soon.

- We also note the formation of a “bullish pin bar” yesterday, signifying buying interest. Heavily oversold signals from RSI and stochastic seem to corroborate our view as well.

- Should a technical rebound happen, we look towards RM0.425 (R1) and RM0.470 (R2) as the resistance levels.

- On the other hand, any further downside should see support at RM0.390 (S1) and RM0.355 (S2)

Source: Kenanga Research - 16 Oct 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments