Kenanga Research & Investment

Daily technical highlights – (GENP, POS)

kiasutrader

Publish date: Fri, 13 Dec 2019, 09:35 AM

Daily technical highlights – (GENP, POS)

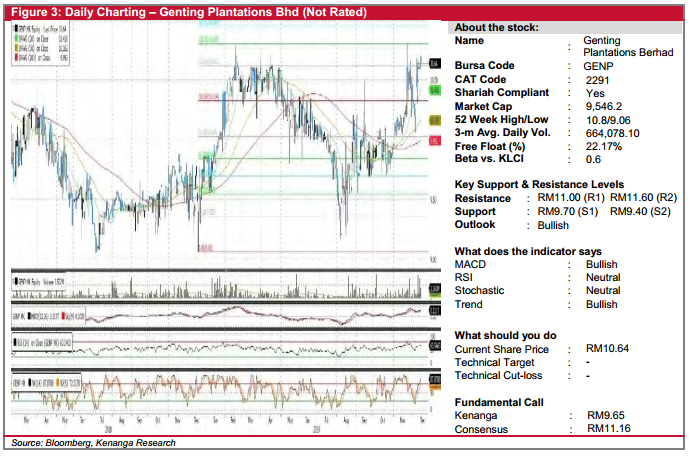

GENP (Not Rated)

- GENP grew by 4.0 sen (+0.4%) to close at RM10.64 yesterday.

- Technically, yesterday’s bullish candlestick could suggest a downtrend reversal as the share appears to have bottomed out.

- Momentum indicators appears to be leaning towards the upside with bullish MACD crossover while other oscillators are showing upticks.

- From here, should buying interest sustain, we expect next advancement towards RM11.00 (R1) and RM11.60 (R2) next.

- Conversely, immediate support level to watch out for is RM9.70 (S1), where a break below will see the share at RM9.40 (S2).

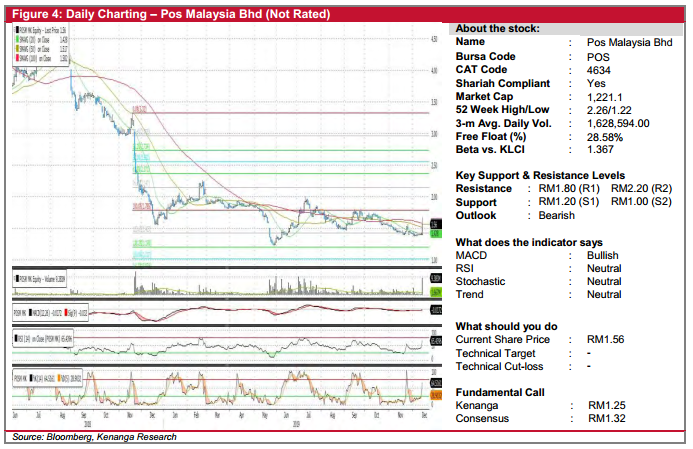

POS (Not Rated)

- Yesterday, POS rose 15.0 sen (+10.60%) to close at RM1.56, backed by stronger-than-average trading volume.

- Chart-wise, the share seems to be catching a breather from the downtrend that started in October. Notably, yesterday’s candlestick formed along long bullish inverted hammer candlestick which we believe is a sign of a potential recovery.

- Additionally, key momentum indicators are showing meaningful upticks, further reiterating the possibility of a rebound.

- Should the buying momentum persist, we expect it to test its resistance at RM1.80 (R1) and RM2.20 (R2).

- Conversely, support levels can be found at RM1.20 (S1) and RM1.00 (S2).

Source: Kenanga Research - 13 Dec 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments