Kenanga Research & Investment

Weekly Technical Review - 15 June 2020

kiasutrader

Publish date: Mon, 15 Jun 2020, 12:56 PM

Asian markets ended mostly lower, tracking Wall Street’s overnight performance

- Last Friday, Asian stocks ended mostly lower, as investors took a cue from Wall Street’s overnight losses following fears of a “second wave” of coronavirus.

- Back home, the FBMKLCI slipped by 11.23 points (-0.72%) to finish at 1,546.02.

- Following the formation of a “Golden Cross”, the index managed to close the gap that was opened during the mid-March market meltdown, which sees it now trading above all of its key-SMAs.

- On the chart, our resistance-turned-support levels are identified at 1,530 (S1) and 1,500 (S2). On the upside, our resistance levels are at 1,570 (R1) and 1,600 (R2).

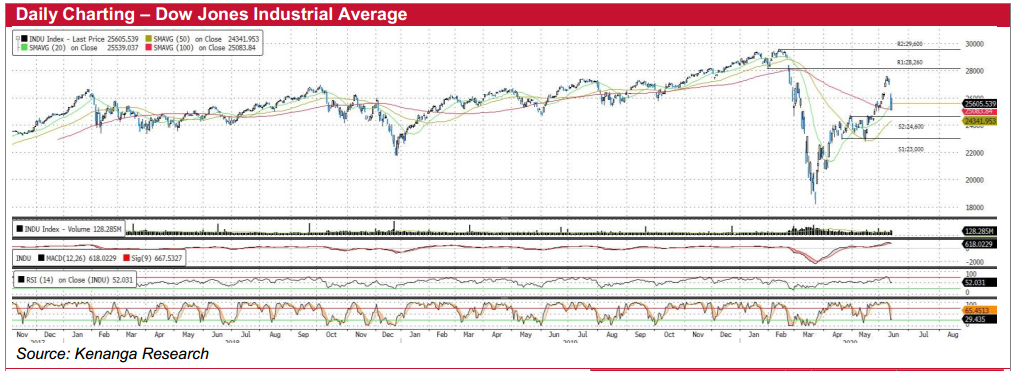

Wall Street closed higher despite rising coronavirus cases

- U.S stocks closed higher last week Friday, after a steep decline in its previous session. Meanwhile, cases of Covid-19 are rising despite the U.S. recovering from lockdown measures.

- The Dow gained 477.37 points (+1.90%) to end at 25,605.54.

- Chart-wise, given the bullish signal from the MACD indicator, the index is experiencing an intermittent technical rebound from its oversold position.

- On the way up, its major resistance levels are placed at 28,260 (R1) and 29,600 (R2).

- Conversely, support levels can be found at 24,600 (S1) and 23,000 (S2)

Source: Kenanga Research - 15 Jun 2020

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments