Daily Technical Hightlights - ( Kerjaya, VStechs)

kiasutrader

Publish date: Fri, 18 Sep 2020, 01:49 PM

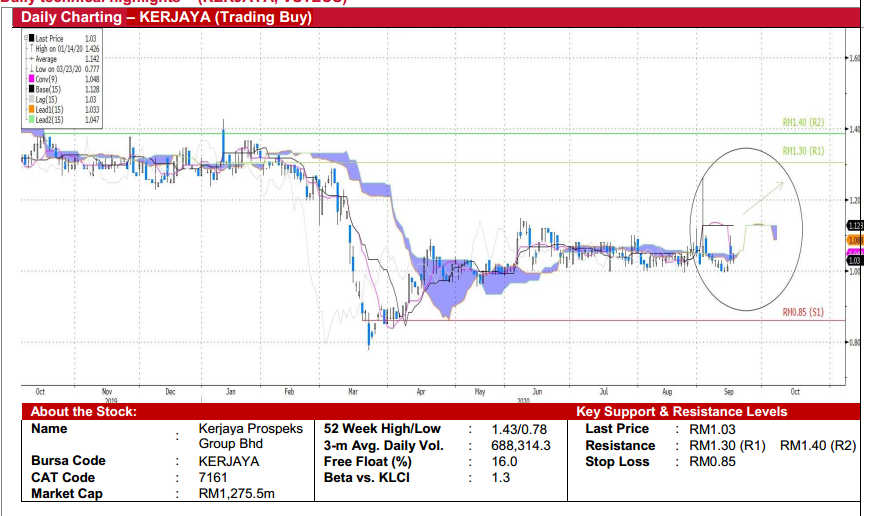

Kerjaya Prospek Group Bhd (Trading Buy)

• KERJAYA is a construction group that is involved in the supply, installation, stones works and provision of contract workmanship services.

• The group recently announced that it had bagged a RM204m contract win from Gamuda Land. This marks the 4th contract win for the year, bringing the group’s current outstanding order-book to RM3.6b (or 3.4x FY19 revenue). In addition, the group will be launching 2 property projects namely Monterez, Shah Alam and Yakin Land North Kiara, which have a cumulative gross development value of RM630m

. • Chart-wise, the stock has been consolidating between RM0.995 and RM1.11 since early April this year. However, we notice that the emergence of Bullish “Kumo Clouds” is showing early signs of a potential uptrend.

• Thus, should the buying momentum resume, we expect the share price to rise towards its overhead resistance levels of RM1.30 (R1; 26% potential upside) and RM1.40 (R2; 36% potential upside).

• Our stop loss is pegged at RM0.85 (or 17% downside risk)

. • Consensus is currently projecting full-year earnings of RM110.6m in FY20 and RM153.0m in FY21. This translates to forward PERs of 12x this year and 8x next year. Meanwhile, the group is in a net cash position of RM184.9m or RM0.13/share as of 2QFY20.

VSTECS Holdings Berhad (Trading Buy)

• VSTECS provides e-commerce systems and solutions in Malaysia through three segments, namely: (i) ICT distribution, which is primarily involved in the reselling of retailer goods, (ii) Enterprise systems to tap into system integrators and corporate dealers, and (iii) ICT Services.

• The group is poised to benefit from the accelerated digitalisation theme as more firms may subscribe to its Enterprise infrastructure and systems, given the “work from home” culture. • In 2QFY20, the group experienced an increase in revenue to RM448.8m (+20% QoQ) while its net income increased marginally to RM7m (3% QoQ). This took its 1HFY20 earnings to RM13.8m (+30% YoY).

• Technically, the stock has retraced from an all-time high of RM2.76 (on 6th of Aug) to find support at its 100-day SMA on 11th of September this year. We believe the stock could potentially be bottoming out with its RSI nearing an oversold region while there are preliminary signs of a potential bullish MACD Crossover.

• Should the stock find support at its current level (by forming a higher low), our overhead resistance levels will be set at RM2.09 (R1) and RM2.22 (R2) based on the Fibonacci retracement lines. This translates to potential gains of 12% and 19%, respectively.

• Our stop loss is pegged at RM1.68 (10% downside risk).

Source: Kenanga Research - 18 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-25

VSTECS2024-11-22

KERJAYA2024-11-22

KERJAYA2024-11-21

KERJAYA2024-11-21

KERJAYA2024-11-20

KERJAYA2024-11-20

KERJAYA2024-11-19

KERJAYA2024-11-19

KERJAYA2024-11-19

VSTECS2024-11-15

VSTECS2024-11-14

VSTECS2024-11-14

VSTECS2024-11-14

VSTECS2024-11-14

VSTECS2024-11-14

VSTECS2024-11-13

VSTECS2024-11-12

KERJAYA2024-11-12

KERJAYA2024-11-12

KERJAYA2024-11-12

KERJAYAMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024