Daily Technical Highlight - (BSTEAD, CCM)

kiasutrader

Publish date: Tue, 22 Sep 2020, 09:54 AM

Boustead Holdings Bhd (Trading Buy)

• BSTEAD, as a conglomerate, appears undervalued on a sum-of-parts basis. The aggregate of its share of market cap in the listed subsidiaries and associate – namely Pharmaniaga (56% stake), Boustead Plantations (57% stake), BHIC (65% stake) and Affin Bank (21% stake) – works out to be RM2.03b currently, which surpasses the existing market cap of BSTEAD of RM1.35b. This has yet to take into consideration the valuations of its unlisted property assets (including valuable land bank).

• BSTEAD is also an indirect proxy to the Covid-19 vaccine thematic play and rising CPO prices, which have lifted the share prices of Pharmaniaga (up 94% since mid-July) and Boustead Plantations (+38% since end-August), respectively.

• Meanwhile, its major shareholder LTAT (which holds a 59.4% stake) could be deciding on whether to proceed with the preliminary proposal to take BSTEAD private – at an indicative price of RM0.80 per share – by 27 October 2020.

• From a trough of RM0.345 in March, BSTEAD’s share price has plotted higher highs and higher lows to reach a peak of RM0.825 in July before entering a consolidation mode thereafter.

• On the chart, the stock has bounced up from the lower trendline recently to end at RM0.665 yesterday, suggesting that a probable continuation of the upward momentum could be on the cards.

• This is supported by the current share price that is still trending above its 50-day simple moving average.

• Riding on the ascending price channel, BSTEAD shares could climb towards our resistance thresholds of RM0.76 (R1) and RM0.85 (R2), which represents upside potentials of 14% and 28%, respectively.

• Our stop loss level is pegged at RM0.59 (or 11% downside risk).

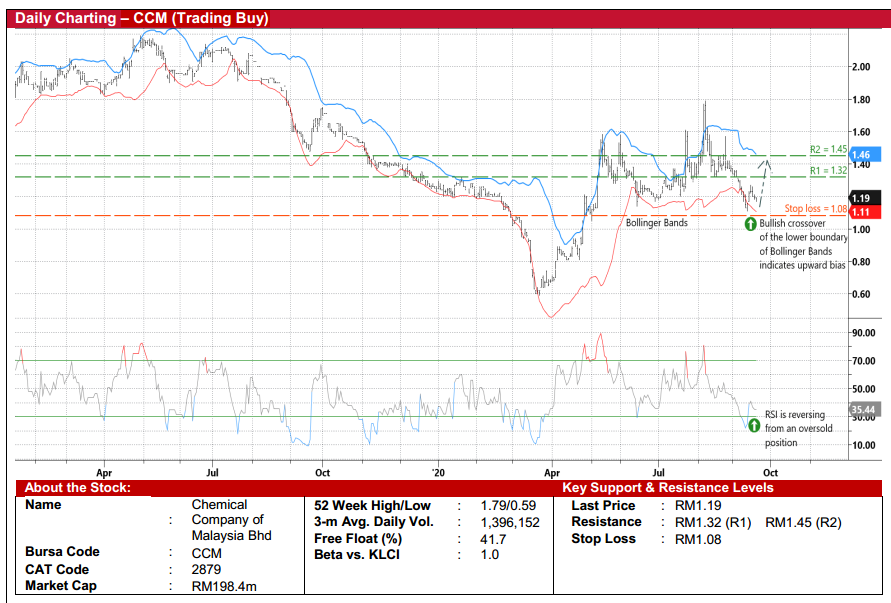

Chemical Company of Malaysia Bhd (Trading Buy)

• CCM’s share price could see a technical rebound soon after retracing from a high of RM1.79 in early August to close at RM1.19 yesterday.

• On the chart, the stock has recently climbed out from its oversold zone as shown by the RSI indicator, suggesting that a share price recovery is under way.

• The upward bias will likely be forthcoming as CCM shares pull away from the lower boundary of the Bollinger Bands.

• In view of the positive technical signals, we reckon the stock could bounce up to test our resistance hurdles of RM1.32 (R1; +11% upside potential) and RM1.45 (R2; +22% upside potential).

• We have set our stop loss level at RM1.08 (or 9% downside risk)

• CCM derives its income from two business segments: (i) chemicals (e.g. supplying chlor-alkali to industries such as water supply & water treatment, food, cleaning, plastic, soap and steel manufacturing); and (ii) polymers (mainly offering polymer coating solutions and rubber chemicals solutions for glove production).

• Consensus is presently projecting CCM to post net earnings of RM18m in FY20 and RM20m in FY21, translating to forward PERs of 11x this year and 10x next year.

Source: Kenanga Research - 22 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024