Daily Technical Highlights - (MAGNI, BRDHCOM)

kiasutrader

Publish date: Tue, 29 Sep 2020, 12:01 PM

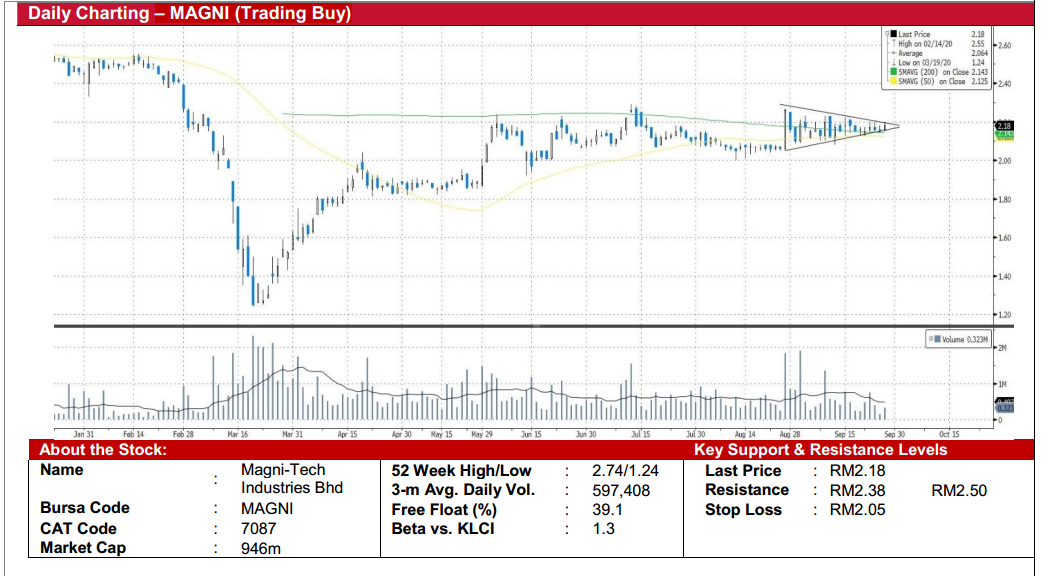

Magni-Tech Industries Bhd (Trading Buy)

• MAGNI primarily manufactures clothing for Nike with plants in Vietnam and Malaysia. They also do plastic and corrugated packaging catering to the F&B, healthcare, rubber-based, consumer household and electronic sub-sectors.

• With US-China tension rising, Magni has the potential to grab market share from its Chinese peers who also contract manufactures for Nike.

• The recent outperformance in Nike’s quarterly earnings showcase the robustness for their apparel demand and is a precursor towards the strong order pipeline for contract manufacturers like MAGNI.

• Fundamentally, MAGNI sits on healthy net cash levels of RM320m (RM0.74sen) and consistently pays out dividend on a quarterly basis with an average payout ratio of 35%.

• Technically, the stock has recently crossed above its 200sma level and has started consolidating for a good 1 month in a symmetrical triangle pattern. The current share price is also well supported by various key moving average levels: 20sma, 50sma and 200sma.

• We think there is a high probability for the stock to break out from the existing triangle pattern and retest previous resistance of RM2.38 (R1, +9% upside). Our stop loss is pegged at RM2.05 (-6% downside).

Drb-Hicom Bhd (Trading Buy)

• DRBHCOM is a conglomerate with a bulk of their contribution coming from Automotive whereby they are most synonymous with the Proton brand (50.1% stake).

• Through their partnership with Geely, Proton’s new models showcase bang for the buck products which will resonate well with our local market.

• Coupled with ongoing tax holidays, there should be a strong rebound in car sales moving forward.

• Technically, DRBHCOM has been on a gradual uptrend in a tight ascending channel since the sell down in March. Currently, it is trading at the trough of the ascending channel providing an opportunistic entry level.

• We believe the overall uptrend is well intact and a rebound from these levels could potentially see it breach the previous high of RM2.15 and hit a new high of RM2.25 (R1, +10% upside).

• Our stop loss is pegged at RM1.94 (-5% downside)

Source: Kenanga Research - 29 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

MAGNI2024-11-22

MAGNI2024-11-22

MAGNI2024-11-22

MAGNI2024-11-21

DRBHCOM2024-11-19

DRBHCOM2024-11-19

MAGNI2024-11-19

MAGNI2024-11-18

DRBHCOM2024-11-18

MAGNI2024-11-18

MAGNI2024-11-15

DRBHCOM2024-11-15

MAGNI2024-11-15

MAGNI2024-11-15

MAGNI2024-11-14

DRBHCOMMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024

gnail

huat lar magni

2020-10-01 20:43