Daily technical highlights – (KGB, TROP)

kiasutrader

Publish date: Wed, 17 Mar 2021, 09:23 AM

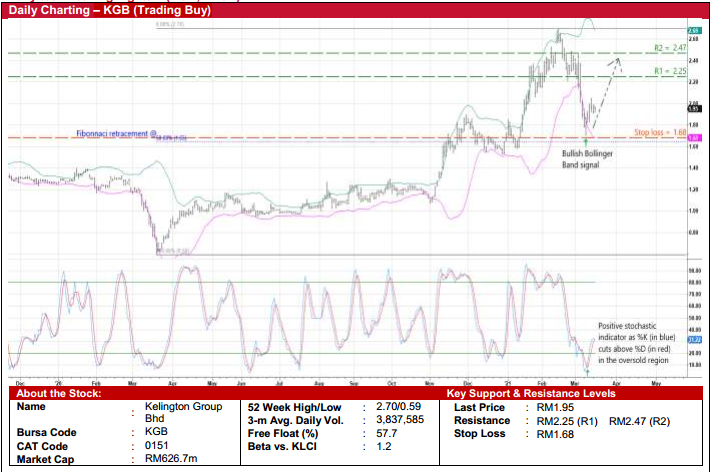

Kelington Group Bhd (Trading Buy)

• KGB’s prevailing share price weakness – down 28% from a high of RM2.70 in mid-February this year to RM1.95 currently – presents a timely opportunity for investors to pick up the shares.

• On the chart, the stock might have hit a bottom already after bouncing up from the 50% Fibonacci retracement level recently (as measured from a trough of RM0.59 in March last year to the peak of RM2.70).

• A technical rebound appears probable now given the positive signals from: (i) the Bollinger Band, which saw the price crossing back above the lower band after falling below the lower band previously, and (ii) the stochastic indicator after the %K line cut above the %D line when both values were in the oversold region.

• Riding on the renewed strength, the stock will likely climb towards our resistance thresholds of RM2.25 (R1; 15% upside potential) and RM2.47 (R2; 27% upside potential).

• We have set our stop loss price at RM1.68 (or 14% downside risk).

• Fundamentally speaking, KGB is a proxy to: (i) the fast-growing semiconductor industry (as a provider of ultra-high purity gas solutions), (ii) the resilient food & beverage business (as a supplier of industrial gases and specialty gases such as liquid carbon dioxide), and (iii) the Covid-19 vaccine rollout (as a supplier of dry ice which is required in the storage of vaccines).

• Based on consensus net profit forecasts of RM28m in FY Dec 2021 and RM31m in FY Dec 2022, the stock is currently trading at forward PERs of 22x this year and 20x next year. The Group’s balance sheet is strong with net cash backing of RM76.5m (or 23.8 sen per share) as of end-December last year.

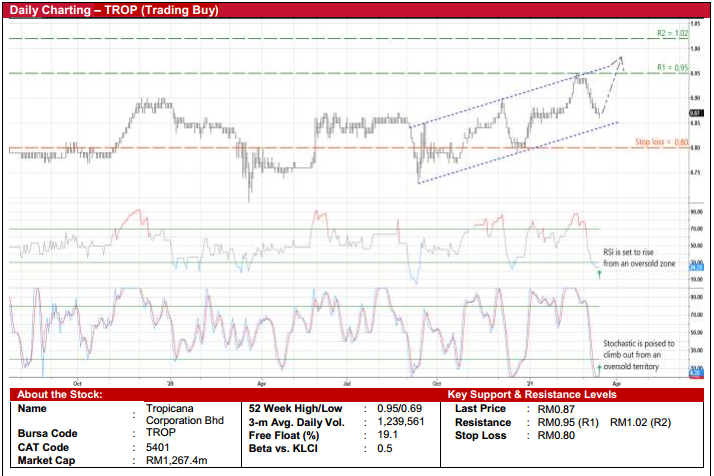

Tropicana Corporation Bhd (Trading Buy)

• A technical rebound could be on the horizon for TROP shares following the 8% pullback from a recent high of RM0.95 in the second half of February this year to close at RM0.87 yesterday.

• Most likely, the share price will stage a reversal soon as both the RSI and stochastic indicators are poised to climb out from their oversold territory.

• With that, we reckon the stock will probably trend higher within an ascending price channel to challenge our resistance targets of RM0.95 (R1) and RM1.02 (R2). This represents upside potentials of 9% and 17%, respectively.

• Our stop loss price is placed at RM0.80 (or 8% downside risk).

• From a fundamental valuation perspective, TROP – a property developer with other diversified business interests in property management, property investment, recreation & resort and investment holding – is currently trading at an undemanding Price/Book multiple of 0.26x (which is at -1SD below its historical mean) based on book value per share of RM3.31 as of endSeptember last year.

Source: Kenanga Research - 17 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-25

KGB2024-11-25

KGB2024-11-22

TROP2024-11-22

TROP2024-11-22

TROP2024-11-22

TROP2024-11-22

TROP2024-11-21

KGB2024-11-21

TROP2024-11-20

TROP2024-11-19

KGB2024-11-19

TROP2024-11-18

KGB2024-11-18

KGB2024-11-18

KGB2024-11-18

TROP2024-11-18

TROP2024-11-18

TROP2024-11-18

TROP2024-11-18

TROP2024-11-15

KGB2024-11-15

KGB2024-11-15

KGB2024-11-15

TROP2024-11-12

KGBMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024