Daily technical highlights – (MALAKOF, TSH)

kiasutrader

Publish date: Wed, 08 Dec 2021, 09:13 AM

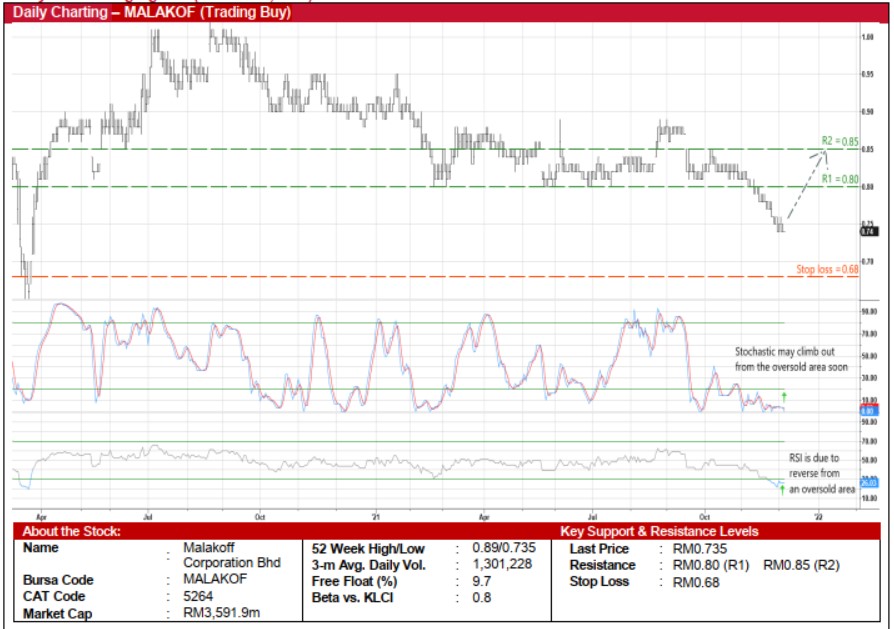

Malakoff Corporation Bhd (Trading Buy)

• MALAKOF is an independent power and water producer whose core businesses include power generation, water desalination, operations & maintenance and waste management & environmental services.

• In the most recent quarter ended September 2021, the group posted net profit of RM67.2m (+32% YoY), which took 9MFY21’s bottomline to RM245.3m (flat YoY).

• Looking ahead, consensus is forecasting MALAKOF to make net earnings of RM322.7m in FY December 2021 and RM329.5m in FY December 2022, which translate to forward PERs of 11.1x this year and 10.9x next year, respectively.

• In addition, based on consensus DPS estimates of 6.0 sen for FY22 and 5.8 sen for FY23, the stock currently offers appealing FY22-FY23 prospective dividend yields of 8.2%-7.9%.

• Technically speaking, MALAKOF’s share price has slipped into the oversold territory after sliding from a recent high of RM0.845 in early October this year to close at RM0.735 yesterday, back to where it was in early April last year.

• Following which, a technical rebound may be due soon as both the stochastic and RSI indicators are poised to climb out from their oversold positions.

• With that, the stock could advance towards our resistance thresholds of RM0.80 (R1; 9% upside potential) and RM0.85 (R2; 16% upside potential).

• We have placed our stop loss price level at RM0.68 (or a 7% downside risk).

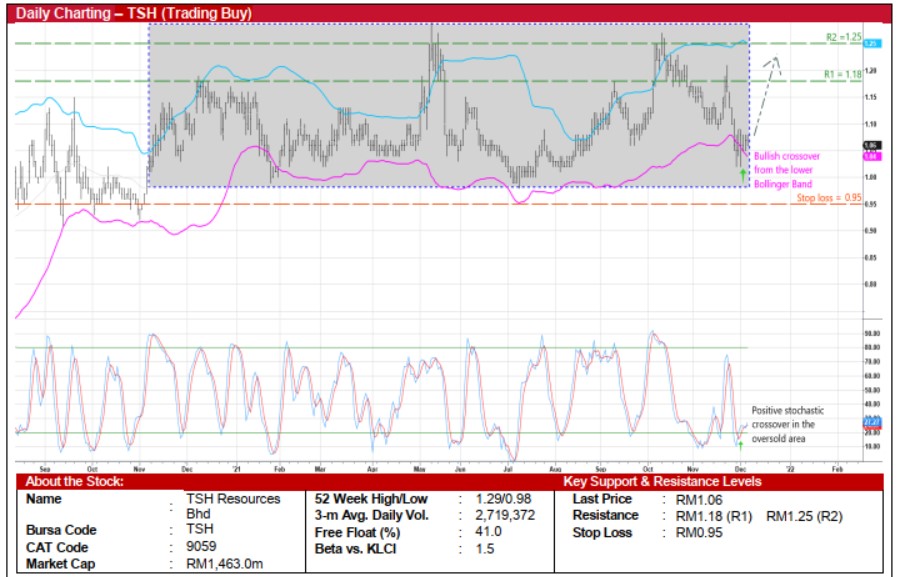

TSH Resources Bhd (Trading Buy)

• TSH shares may show a positive bias ahead following a pullback from a recent high of RM1.27 in October this year to hover near the bottom of a rectangle pattern currently.

• On the chart, an upward shift in the stock is probable based on the bullish technical signals triggered by the share price’s recent crossing back above the lower Bollinger Band and the stochastic indicator’s reversal from an oversold area.

• On the way up, TSH shares could rise towards our resistance targets of RM1.18 (R1; 11% upside potential) and RM1.25 (R2; 18% upside potential).

• Our stop loss price level is set at RM0.95 (or a 10% downside risk from yesterday’s close of RM1.06).

• Fundamentally, TSH – a plantation group in the business of oil palm cultivation and processing of fresh fruit bunches into crude palm oil (CPO) and palm kernel – stands to benefit from the rising CPO price (with the spot month futures contract up 36% YTD to RM5,176 per MT presently).

• Reflecting the impact, the group announced net profit of RM105.6m (+129% YoY) in 9MFY21 after deriving an average CPO price of RM3,357 per MT during the period (versus RM2,352 per MT previously).

• Going forward, TSH is forecasted to log net earnings of RM166.3m in FY December 2021 and RM121.0m in FY December 2022 based on consensus forecasts. This implies forward PERs of 8.8x this year and 12.1x next year, respectively.

Source: Kenanga Research - 8 Dec 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024