Daily technical highlights – (SCOMNET, DRBHCOM)

kiasutrader

Publish date: Thu, 24 Feb 2022, 10:42 AM

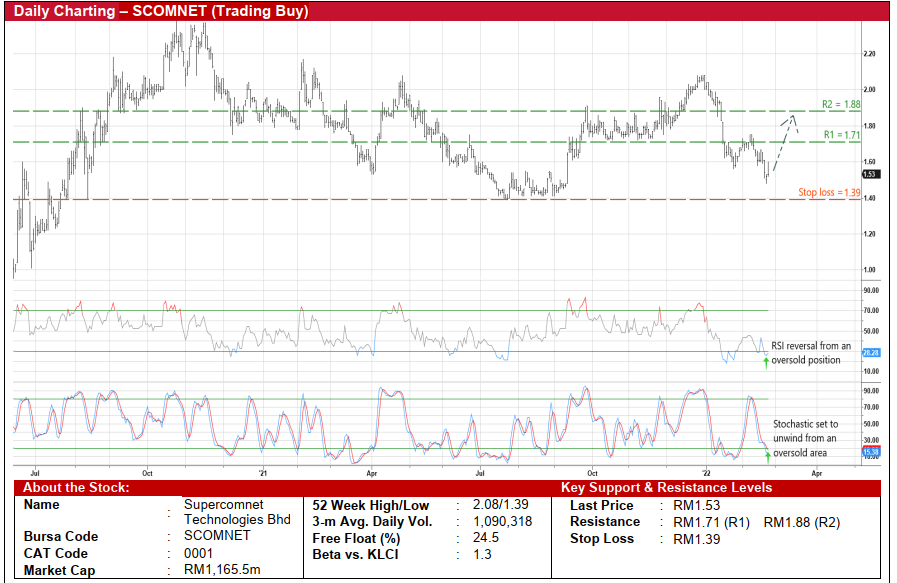

Supercomnet Technologies Bhd (Trading Buy)

• After falling from a recent high of RM2.08 in end-December last year, SCOMNET’s share price – which ended at RM1.53 yesterday – could stage a technical rebound ahead.

• With both the RSI and stochastic indicators in the midst of reversing from their oversold positions, the stock will probably climb in tandem.

• On the way up, SCOMNET shares are expected to shift towards our resistance thresholds of RM1.71 (R1) and RM1.88 (R2). This translates to upside potentials of 12% and 23%, respectively.

• Our stop loss price level is pegged at RM1.39 (or a 9% downside risk).

• The group has just announced net profit of RM8.0m (-4% YoY) in 4QFY21, taking full-year net earnings to RM25.3m (+8% YoY) on the back of turnover of RM145.4m (+13% YoY) in FY21.

• In the business of manufacturing and assembling advanced high technology wires and cables, SCOMNET derives its revenue mostly from the medical devices (62% of 4QFY21’s sales), industrial (namely electrical appliances & consumer electronics) (27% of sales) and automotive (11% of sales) segments.

• With a debt-free balance sheet, SCOMNET is financially backed by cash holdings of RM45.2m and unit trust investments of RM102.3m (both of which added up to 19.4 sen per share) as of end-December 2021.

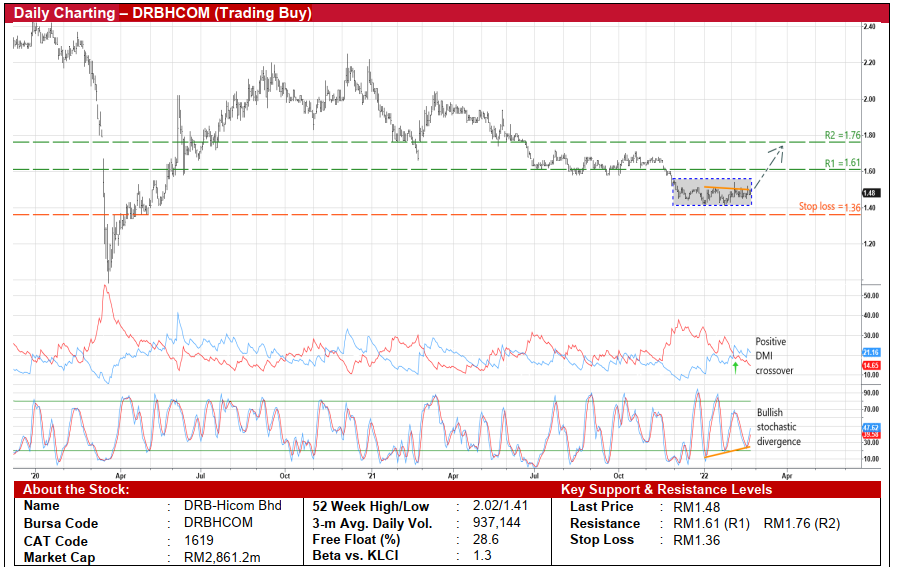

DRB-Hicom Bhd (Trading Buy)

• A probable breakout from a short-term rectangle pattern could be in store for DRBHCOM shares after moving sideways since end-November last year.

• On the chart, the share price will likely show an upward bias following: (i) the appearance of a bullish divergence pattern by the stochastic indicator (which has formed rising bottoms in the oversold zone as the price was weakening); and (ii) the DMI Plus crossover above the DMI Minus.

• With that, the stock is expected to advance towards our resistance targets of RM1.61 (R1; 9% upside potential) and RM1.76 (R2; 19% upside potential).

• We have set our stop loss price level at RM1.36 (representing an 8% downside risk from the last traded price of RM1.48).

• Earnings-wise, DRBHCOM – which is involved in the automotive, services and properties businesses – reported net loss of RM413.9m in 9MFY21 (compared with 9MFY20’s net loss of RM431.9m) as businesses were disrupted by the Covid-19- related movement restrictions.

• Consensus is currently forecasting the group to make losses of RM233.0m in FY December 2021 before swinging back to the black with net profit of RM263.2m for FY December 2022 and RM381.0m for FY December 2023. This translates to forward PERs of 10.9x this year and 7.5x next year, respectively.

Source: Kenanga Research - 24 Feb 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024