Daily technical highlights – (CTOS, SIMEPROP)

kiasutrader

Publish date: Wed, 18 May 2022, 09:33 AM

CTOS Digital Bhd (Trading Buy)

• After falling by 25% YTD to as low as RM1.35 last Thursday, which was near its post-listing trough of RM1.33 in early March 2022, the formation of a potential double-bottom reversal pattern has set the stage for CTOS shares to shift higher ahead.

• Technically speaking, a share price rebound is anticipated as both the stochastic and RSI indicators are on the edge of climbing out from their oversold positions.

• On the chart, the stock could ride on the positive momentum to advance towards our resistance targets of RM1.50 (R1; 9% upside potential) and RM1.63 (R2; 18% upside potential). We have placed our stop loss price level at RM1.26 (representing a downside risk of 9% from yesterday’s closing price of RM1.38).

• CTOS – listed on 19 July last year at an IPO offer price of RM1.10 – is a provider of credit information and analytics digital services and solutions that are widely used by banking & financial institutions, insurance and telecommunication companies, large corporations, small medium enterprises and consumers for self-check.

• After reporting net profit of RM43.1m (+10% YoY) in FY Dec 2021, that was followed by quarterly net earnings of RM12.5m (+62% YoY) in 1QFY22, consensus is forecasting the group’s bottomline to soar to RM80.7m (+87% YoY) for FY22 and RM97.4m (+21% YoY) for FY23. This translates to forward PERs of 39.5x this year and 32.7x next year, respectively.

• In terms of recent corporate developments, CTOS has been on an acquisition spree – via the purchase of strategic stakes in Juris Technologies (a fintech specialist), RAM Holdings (a credit rating agency) and Business Online Public Ltd (the largest company information bureau in Thailand) – which are expected to contribute positively to its future earnings.

• Going forward, CTOS stands to benefit from the offering of micro-lending services in Malaysia by the 5 newly announced digital banks, who may want to leverage on CTOS’ credit information and analytics digital platforms to assess the risk profiles of potential borrowers.

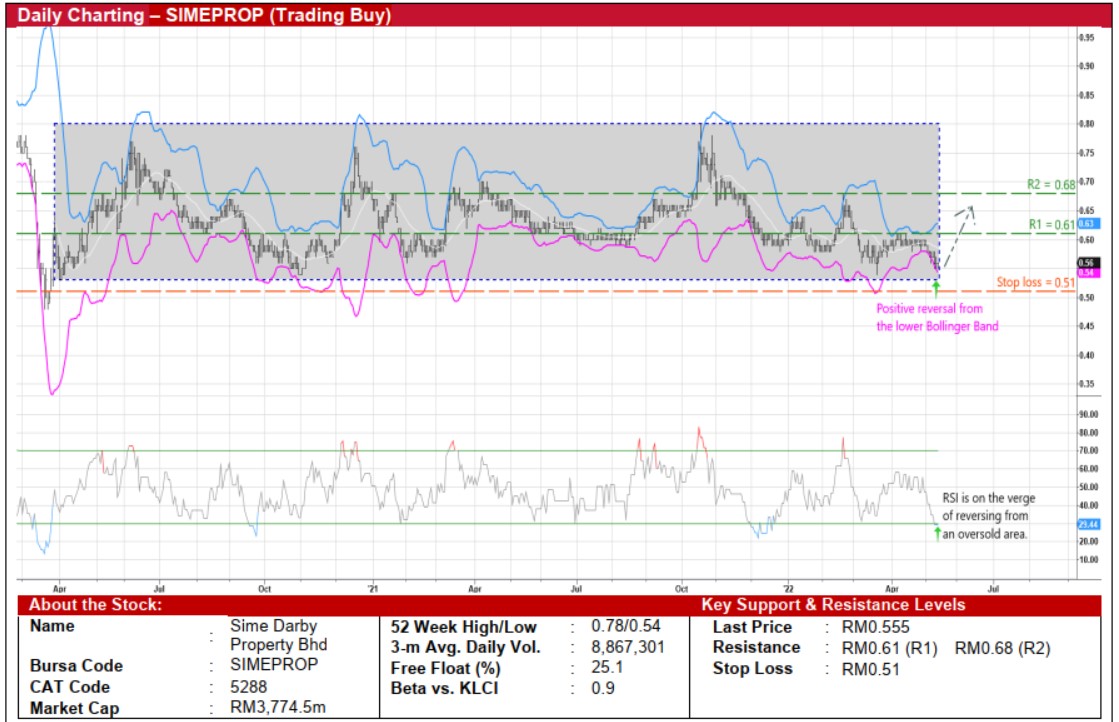

Sime Darby Property Bhd (Trading Buy)

• Presently hovering near the bottom of a rectangle pattern, a technical rebound may be on the cards for SIMEPROP shares.

• With the share price on the edge of crossing back above the lower Bollinger Band and the RSI indicator in the midst of reversing from an oversold territory, an upward shift will likely be forthcoming.

• Riding on the technical strength, the stock could climb towards our resistance thresholds of RM0.61 (R1; 10% upside potential) and RM0.68 (R2; 23% upside potential).

• Our stop loss price level is pegged at RM0.51 (or an 8% downside risk).

• Forward earnings visibility for SIMEPROP – a property developer with 24 active townships / development strategically located across the country – is backed by unbilled property sales of RM2.4b (as of end-December 2021) and new property sales target of RM2.6b for 2022.

• Hence, after reporting net profit of RM136.9m in FY21 (a turnaround from FY20’s net loss of RM501.6m), consensus is expecting the group’s bottomline to rise to RM244.0m for FY December 2022 and RM286.7m for FY December 2023.

• Valuation-wise, SIMEPROP is currently trading at a Price/Book multiple of 0.41x (or around 1 SD below its historical mean) based on its book value per share of RM1.34 as at end-December last year.

Source: Kenanga Research - 18 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

CTOS2024-11-22

SIMEPROP2024-11-22

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-20

SIMEPROP2024-11-20

SIMEPROP2024-11-20

SIMEPROP2024-11-19

SIMEPROP2024-11-19

SIMEPROP2024-11-19

SIMEPROP2024-11-18

CTOS2024-11-18

SIMEPROP2024-11-18

SIMEPROP2024-11-18

SIMEPROP2024-11-15

CTOS2024-11-15

SIMEPROP2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-13

CTOS2024-11-13

CTOS2024-11-13

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

CTOS2024-11-12

SIMEPROP2024-11-12

SIMEPROP2024-11-12

SIMEPROPMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024