Daily technical highlights – (SYSTECH, HARNLEN)

kiasutrader

Publish date: Thu, 23 Feb 2023, 09:15 AM

Systech Bhd (Technical Buy)

• Following a retracement from its recent high of RM0.375 on 16 February 2023 to a low of RM0.305 on 21 February 2023,SYSTECH’s share price is set to bounce off from the bottom of the rising channel to resume its uptrend.

• Chart-wise, we anticipate that the stock could climb higher on the back of the following positive technical signals: (i) thestrengthening momentum shown by the 21-day EMA against the 21-day SMA line, and (ii) the stochastic indicator is poised toclimb out from the oversold zone.

• Hence, the stock price is probably on the way to swing higher towards our resistance targets of RM0.35 (R1; 13% upsidepotential) and RM0.40 (R2; 29% upside potential).

• Our stop loss price is set at RM0.275 (representing a downside risk of 11%).

• Business-wise, SYSTECH is chiefly involved in three key business segments, namely e-business solutions, cyber securityand e-logistics.

• The group reported a net loss of RM0.1m in 3QFY23 (versus net loss of RM0.3m in the preceding quarter), whichconsequently widened its net loss to RM1.2m in 9MFY23 (compared to a net loss of RM0.1m in 9MFY22).

• Based on its book value per share of RM0.07 as of end-December 2022, the stock is presently trading at Price/Book Valuemultiple of 4.4x.

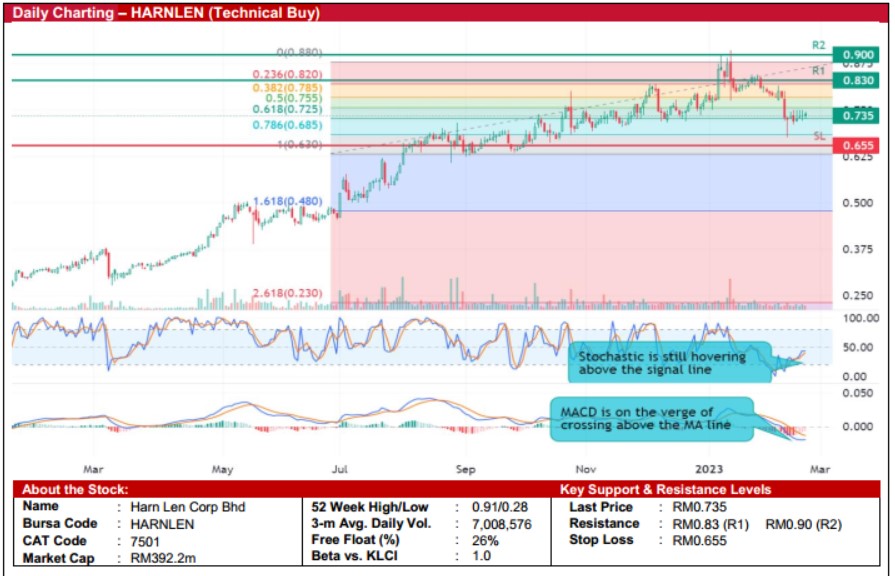

Harn Len Corporation Bhd (Technical Buy)

• After staging a breakout from the resistance line of RM0.655 in early-August 2022, HARNLEN’s share price has subsequentlytrended upwards to hit a high of RM0.91. The stock has since pulled back to close at RM0.735 yesterday (which coincidedwith the 61.8% Fibonacci retracement level).

• With the share price likely to find support at the aforementioned Fibonacci retracement level, a technical rebound could be onthe horizon as the stochastic indicator is still hovering above the signal line while the MACD is on the verge of cutting abovethe MA line.

• That said, an upward shift could then propel the stock price to challenge our resistance thresholds of RM0.83 (R1; 13%upside potential) and RM0.90 (R2; 22% upside potential).

• Our stop loss price level is seen at RM0.655 (or a downside risk of 11%).

• An oil palm plantation and palm oil milling operator, HARNLEN reported a net profit of RM10.7m in the latest quarter endedSeptember 2022 (no comparable historical result is available due to a change in its financial year-end) after delivering a netprofit of RM4.1m in FY December 2022.

• Valuation-wise, the stock is currently trading at Price/Book Value multiple of 0.5x based on its book value per share ofRM1.60 as of end-September 2022.

Source: Kenanga Research - 23 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

SYSTECH2024-11-21

SYSTECH2024-11-21

SYSTECH2024-11-18

HARNLEN2024-11-18

HARNLEN2024-11-18

HARNLEN2024-11-18

HARNLEN2024-11-18

HARNLEN2024-11-18

HARNLEN2024-11-18

HARNLEN2024-11-18

HARNLEN2024-11-18

HARNLEN2024-11-18

HARNLEN2024-11-18

HARNLEN2024-11-18

HARNLEN2024-11-18

HARNLEN2024-11-18

HARNLENMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024