Daily technical highlights – (NCT, SAMAIDEN)

kiasutrader

Publish date: Fri, 17 Mar 2023, 05:12 PM

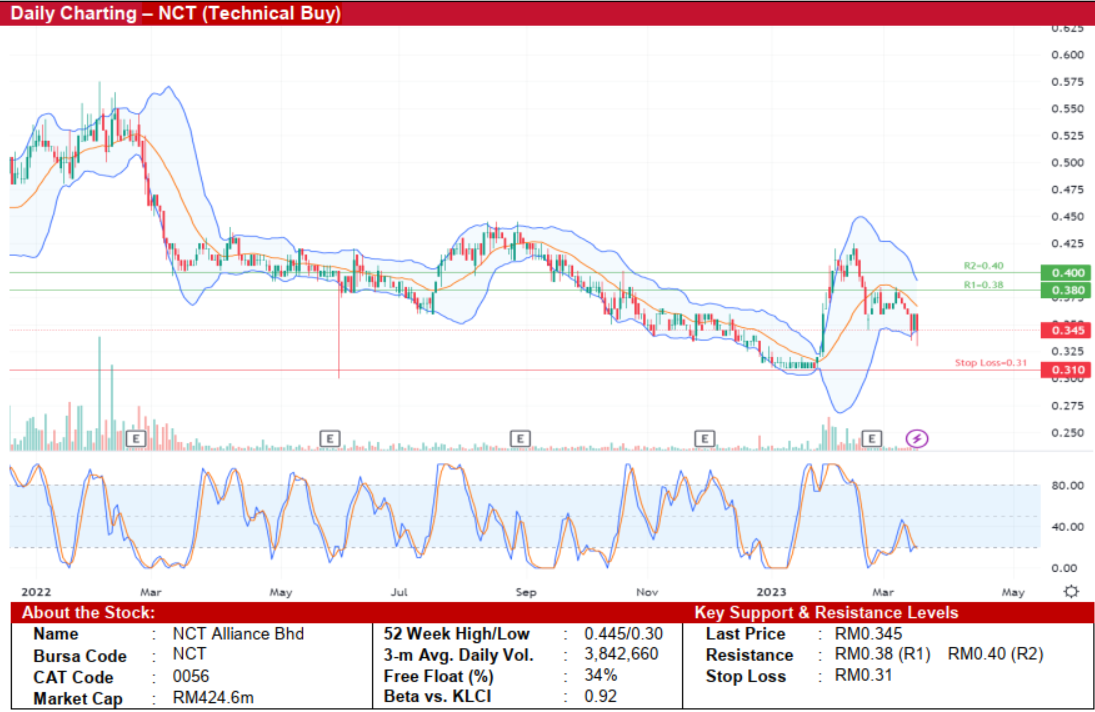

NCT Alliance Bhd (Technical Buy)

• NCT’s share price has slid from a peak of RM0.73 in March 2021 to a low of RM0.31 in January 2023 before making a rebound since then to hit a recent high of RM0.425. The shares closed at RM0.345 yesterday.

• Chart-wise, we believe the share price will resume its upward momentum as the Stochastic indicator is in the midst of climbing out from the oversold zone while the stock price has moved back above the lower Bollinger Band.

• Hence, we expect the stock to rise and test our resistance thresholds of RM0.38 (R1; 10% upside potential) and RM0.40 (R2; 16% upside potential).

• Conversely, our stop loss price has been identified at RM0.31 (representing a 10% downside risk).

• Fundamentally speaking, NCT is a real estate developer which offers property development services for various housing projects with a geographical presence mainly in Genting Highlands and Penang.

• Earnings-wise, the group reported a net profit of RM12.8m in 4QFY22 (compared with a net profit of RM17.0m in 4QFY21) mainly dragged by slower progress billings due to the raining season towards the end of last year. This took FY22 bottomline to RM43.2m (versus net profit of RM33.7m previously).

• In terms of valuation, the stock is currently trading at Price/Book Value multiple of 0.8x (or approximately at minus 0.5 SD from its historical mean) based on its book value per share of RM0.43 as of end-December 2022.

Samaiden Group Bhd (Technical Buy)

• Listed back in October 2020, SAMAIDEN’s share price has slid from a peak of RM1.26 in January 2021 to as low as RM0.53 in July 2022 before making a rebound since then to close at RM0.90 yesterday.

• On the back of a recent breakout from the ascending triangle pattern, the share price is expected to continue its upward momentum backed by: (i) the DMI Plus pulling away from the DMI Minus, and (ii) the 12-day moving average still hovering above the 26-day moving average following the MACD golden cross in March.

• This could then lift the stock to challenge our resistance levels of RM1.00 (R1; 10% upside potential) and RM1.08 (R2; 20% upside potential).

• Our stop loss level is pegged at RM0.81 (representing a 10% downside risk).

• SAMAIDEN is principally involved in the engineering, procurement, construction & commissioning (EPCC) of solar photovoltaic (PV) systems and power plants. Its other business activities include the provision of renewable energy and environmental consulting services, as well as operation and maintenance (O&M) services.

• Earnings-wise, the group reported a net profit of RM2.6m in 2QFY23 compared with a net profit of RM2.3m in 2QFY22, driven by more EPCC works carried out during the period. This took 1HFY23 bottomline to RM5m (versus net profit of RM4.3m previously).

• Based on consensus forecasts, SAMAIDEN’s net earnings are projected to come in at RM17.4m in FY June 2023 and RM21.9m in FY June 2024, which translate to forward PERs of 19.8x this year and 15.7x next year, respectively.

Source: Kenanga Research - 17 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024