Daily technical highlights – (PEKAT, SAMAIDEN)

kiasutrader

Publish date: Fri, 28 Apr 2023, 09:43 AM

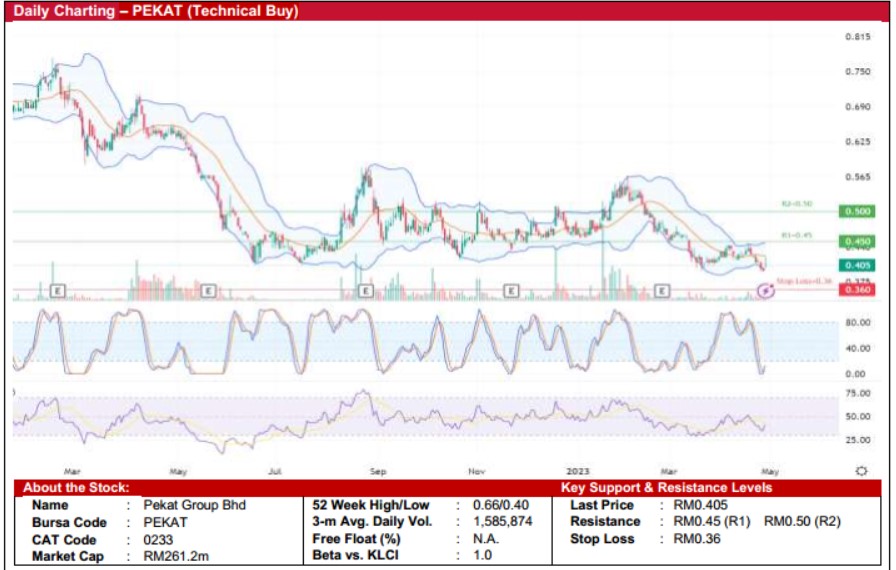

Pekat Group Bhd (Technical Buy)

• PEKAT’s share price has fallen 44% since its listing in June 2021, down from the peak of RM0.93 to close at RM0.405 yesterday. With the share price likely to find support near its 52-week low of RM0.395, a technical rebound could be anticipated.

• Chart-wise, we believe the share price will shift upward as both the Stochastic and RSI indicators are poised to climb out from the oversold zone while the stock price has moved back above the lower Bollinger Band.

• Hence, we expect the stock to rise and test our resistance thresholds of RM0.45 (R1; 11% upside potential) and RM0.50 (R2; 23% upside potential).

• Conversely, our stop loss price has been identified at RM0.36 (representing an 11% downside risk).

• PEKAT is principally involved in the: (i) design, supply and installation of solar PV (photovoltaic) systems and power plants, (ii) supply and installation of ELP (earthing and lighting protection) systems, and (iii) distribution of electrical products and accessories.

• Earnings-wise, the group reported a net profit of RM2.3m in 4QFY22 compared with a net profit of RM6.1m in 4QFY21, mainly dragged by soaring material prices and higher staff costs. This took FY22’s bottomline to RM10m (versus net profit of RM12.7m previously)

• In terms of valuation, the stock is currently trading at Price/Book Value multiple of 2.0x (or approximately at 1 SD below its historical mean) based on its book value per share of RM0.20 as of end-December 2022.

Samaiden Group Bhd (Technical Buy)

• The share price of SAMAIDEN has pulled back from a peak of RM1.03 recently to close at RM0.89 yesterday. With the shares likely to find a near term support at the current level, a technical rebound could be anticipated.

• On the chart, the share price will likely plot an upward trajectory as the Stochastic indicator is in the midst of climbing out from the oversold zone while the stock price has moved back above the lower Bollinger Band.

• Hence, the stock could climb to challenge our resistance levels of RM0.99 (R1; 11% upside potential) and RM1.05 (R2; 18% upside potential).

• Our stop loss level is pegged at RM0.81 (representing a 9% downside risk).

• Fundamentally speaking, SAMAIDEN is principally involved in the engineering, procurement, construction & commissioning (EPCC) of solar photovoltaic (PV) systems and power plants. Its other business activities include the provision of renewable energy and environmental consulting services, as well as operation and maintenance (O&M) services.

• Earnings-wise, the group reported a net profit of RM2.6m (+5% QoQ) in 2QFY23, which brought 1HFY23 bottomline to RM5m (+16% YoY)

• Based on consensus forecasts, SAMAIDEN’s net earnings are projected to come in at RM17.4m in FY June 2023 and RM21.9m in FY June 2024, which translate to forward PERs of 19.8x this year and 15.7x next year, respectively.

Source: Kenanga Research - 28 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024