Plantation is due for rerating - Koon Yew Yin

Koon Yew Yin

Publish date: Fri, 16 May 2014, 09:44 AM

I can see the bull charging from the plantation

Koon Yew Yin

The general tone of the recent Palm Oil Conference (POC) 2014 was bullish. Many speakers highlighted biodiesel demand and weather issues as the main drivers of CPO price’s current rally. Most of them believe there is still upside potential for CPO prices, with projections of prices reaching MYR3,000/ton before end of 2014.

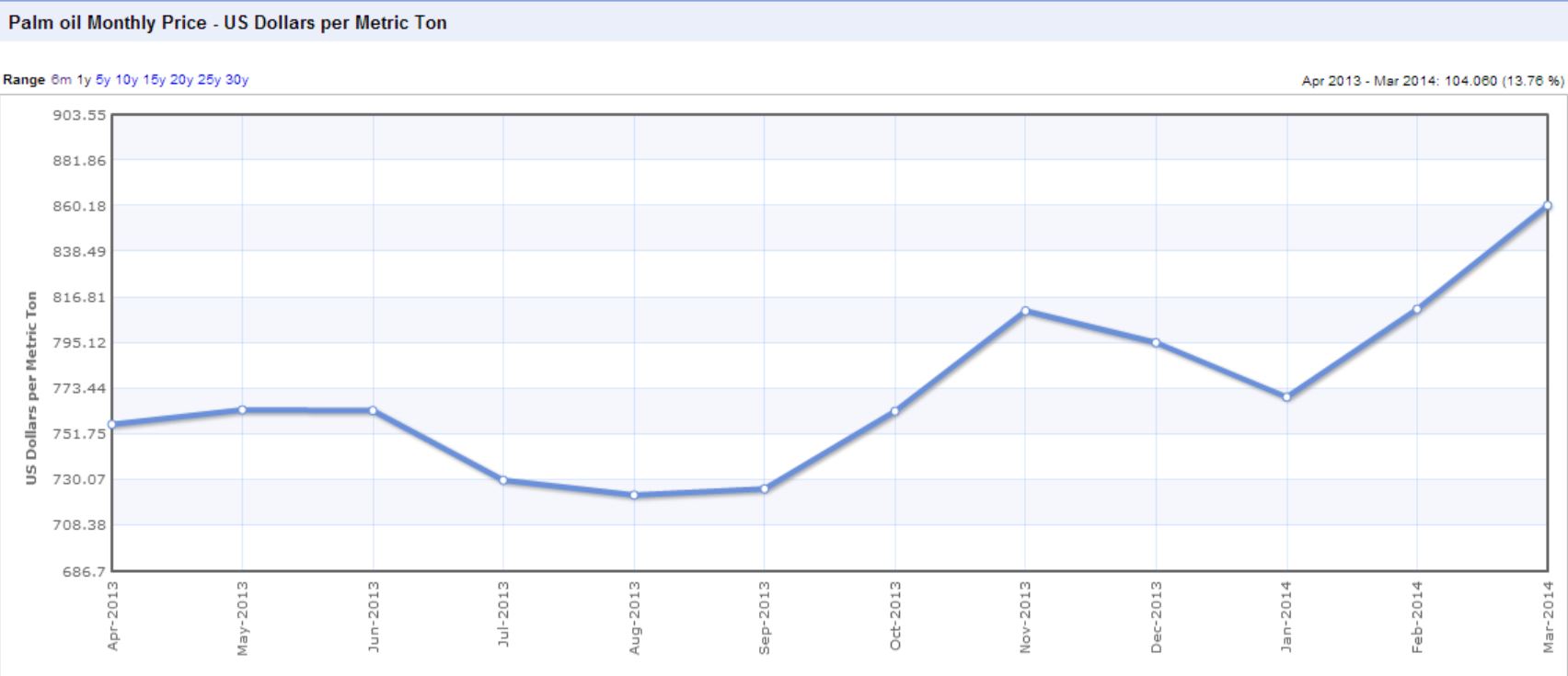

The palm oil price chart below shows that palm oil price is on an definite uptrend in the last 6 months. The important question is whether the price uptrend is sustainable in the near future.

I also have read several reports from RHB Institute Research Analyst Alvin Tai, Kenanga Research Analyst Alan Lim, Public Invest Research Sector Analyst Chong Hoe Leong and Hwang DBS Vicker Research. All of them agree that the palm oil price uptrend is sustainable for the near future and they all are bullish on plantation sector.

In fact, CPO price traded at Rm 2,700 per ton a few days ago. This is the highest crude palm oil price in the last 18 months.

The average CPO price for last year was about Rm 2,250 per ton. As a result almost all plantation shares prices are depressed due to poor earning. In view of the CPO price increase for this year, all plantation companies will make additional profit for no extra effort, money for doing nothing.

The 1st quarter result ending March 2014 for plantation companies will definitely show profit increase which will be a strong catalyst to push up share price. All companies will have to announce their quarterly result within 2 months which will be before end of this month. This time will prove me right!

As I said before, I am not an accountant and I can hardly understand all the accounting ratios, cash flow and other economic issues. But I can recognize opportunities to make money from the stock market and this one is glaring at my face. I am a trader and I am always on the lookout for cheap undervalued shares.

Almost all plantation shares have been depressed due to the poor CPO price. I cannot see any reason why plantation shares remained depressed any longer. Some of them are selling cheaper than their average price for last year. Why can’t investors see this opportunity to make money?

Felda Global Ventures has recently paid more than Rm 70,000 cash per ha of oil palm estate in Sabah. Boustead also paid Rm 70,000 per ha about one year ago.

Basing on Rm 70,000 per ha, TH Plantation, Kulim and Sarawak Plantations are the most undervalued shares with tremendous profit growth prospect as shown below:

Name issued shares Current price Market capitalization Planted area Market Cap per ha

TH Plant 877 million Rm 2.10 Rm 1,840 million 66,900 ha Rm 27,500

Kulim 1,290 m Rm 3.55 Rm 4580 m 132,000 ha Rm 34,500

Sarawak Plant 280 m Rm 2.45 Rm 686 m 30,100 ha Rm 22,800

Jaya Tiasa 973 m Rm 2.70 Rm 2627 m 62,500 ha Rm 42,000

SOP 437 m Rm 6.50 Rm 2840 m 63,000ha Rm 45,000

Please note that JT also has plywood and logging businesses. SOP also has refinery, shipping and a small property development business.

Basing on the same method of valuation the market cap per ha for plantation favourites like KLK, IOI and UP would be more than Rm 100,000 per ha but they all, except UP, have many other businesses beside plantation. In any case, I do not buy famous stocks because they are already fully priced.

I am aware that this is not the perfect accounting method of valuing company assets. If you use the same method to evaluate the assets of other plantation companies, you will find these are relatively cheaper. I consider it is good enough to help select plantation shares.

The Sarawak Plantation price chart below shows that its price tumbled from Rm 2.62 to Rn 2.45 with unusually high volume in the last few days. I think I bought almost all the shares traded in the last few days. In a case like this, many holders would follow to sell because of fear that the price might go down further. Please remember this lesson.

I can smell the bull charging from the plantation. Decide quickly and get in early of a new plantation bull run.

I am obliged to tell you that I own all the above mentioned shares. If you decide to buy these shares, I am not responsible for your profit or loss. However, I can assure you that my intention is honorable.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

I was looking out for TSH, but it was not in Mr Koon's analysis... got to find out more and compare..

2014-05-16 12:08

There are some companies distribute a decent dividends. Share price is not primarily due to low dividend payout.

Dividend Yield:

SWKPLNT - 3.27%

THPLANT - 1.72%

2014-05-16 12:12

thats right my dear. IF i say so you are not happy. Now mr Koon says so everything is correct.

2014-05-16 12:25

Well MR Koon my comment is the same as your last Blog. Those that are doing well in the last ten years will be doing good as well if not better in the next ten years.

Probably investing on Business Perspective continue to gain supreme.

2014-05-16 12:44

It's rather unrealistic for searching a plantation company giving a current dividend yield of 5%. GenP & Kluang would probably meet your criteria which offer more than 5% after taking into account special dividends.

2014-05-16 13:43

Thank you Mr Koon. I hope one day i can buy you a nice meal. I hope you are okay with vegetarian.

2014-05-16 14:32

Most Malaysian companies are young and they do not give out reasonably good dividend. All the above plantations I owned are relatively young but they all have tremendous profit growth prospect which is the most import consideration.

Even UP and KLK do not give out 5% dividend yield. How many companies in Malaysia give out more than 5% dividend yield?

It is easier for share prices of small young companies to double than old KLK or UP.

If you have been looking for dividend or you have been interested in some other type of shares, you must check to find out how well have you done. If you cannot get an average return of 15% pa, you must change your method of share selection.

2014-05-16 15:18

Mr. Koon, shall we take into consideration of debt if we using this simple calculation for market cap / ha?

2014-05-16 15:24

knchan2001, if you have read my article carefully, you would not ask such a question. If you take debt into consideration, you must also consider the age profile of the palms, FFB production per ha, production cost per ton of FFB, the number of mills etc etc. Remember, I am not an accountant!

2014-05-16 15:45

The most important is to buy a share with plenty margin of safety. If we take a look of the market capital / hectare for THPLANT, KULIM & SWKPLNT, it offers much more than enough. All these shares are still traded at dirt cheap prices.

2014-05-16 15:48

Hi. Mr Koon. can I have your comment on KM Loong Resource? This company gives 12% dividend this year. Of course, this is your comment and nobody should be held responsible. tks.

2014-05-16 21:01

klphoon, congratulation if you have bought KM Loong Resource because it has gone up from Rm 2.20 in May 2013 to close at Rm 2.90.

I cannot see that it is giving 12% dividend as you said. Where can I find it? How can the dividend be 12% which is 12% of Rm 2.90 = 35sen. Its EPS for year ending Jan 2014 is only 19.88 sen.

2014-05-16 23:33

Hi Mr Koon, Can I have your opinions on Bstead and the coming IPO Bstead Plantation?Thank you.

2014-05-17 12:47

Hello Mr Koon, I am a newbie plantation stock, just bought TSH few month ago. Can you comment TSH against your 5 favourite stock in the table? Thank you.

2014-05-17 18:14

I found the info in Chartnexus.6Aug13 (7%) and 30Oct13 (5%). The % may refer to Par Value of the share. Pls correct me if I am wrong.

2014-05-17 18:18

If based on the planted area, Sarawak Plantation shall have a market cap of RM1,300m despite of age profile of tree.

2014-05-17 18:27

klphoon55, Now you must decide to sell or not. Unless you are sure the company can make increasing profit the share will not go up further since it has gone up 30%.

I do not buy IPO because the most of the promoters cannot achieve their projection.

I looked at TSH before and I did not buy it.

2014-05-17 18:42

Hi Mr. Koon, I bought Kmloong many years ago and still keeping it.

I chose Kmloong because the >60% of the plantation land is freehold.

As for Sarawak Plantation, it is leasehold. A part from Kmloong, GenP & UMMCA are another 2 counters that possessed partial of the plantation land with freehold title.

2014-05-17 21:17

I will sell in May and go away. Enjoy World Cup in June and July.

Look again at 5191. This year, DY minimum of 5%. Yes, you read it right. 5%. Declaration of potential conflict of interest: I have already bought.

2014-05-17 22:51

Gnat, KLCI will peak in Jul n starts its correction thereafter till august. So time yourself to maximize profit. Hence, avoid both selling early or reenter early.

2014-05-17 22:58

Mr Koon, I have one suggestion for you. Since you are willing to share your knowledge in stock market, I strongly suggest that you might consider to publish a book related to stock investment.

The reasons are: the youngster nowadays struggle to live in city. The cost of living is very high. For those work as employees level, very less of them able to live comfortably due to the cost of living is too high. For instance, how many youngster afford to buy a new house in Klang Valley without the support from their family? Dr Mathathir said Chinese are rich but I knew many Chinese (or even Malays or other races) are actually not included myself. I also come from a poor family. My parents work as rubber tapper when they was young. If you able to teach them how to fish, I think it is very good for those who willing to learn to earn a better living subsequently to give their parents a better lives. Moreover, to publish a book can keep your wisdoms, knowledge and experiences which is beneficial to your own next generations and the society.

I suggest Mr Koon to collect the published articles which related to stock investment all these years, together with the topic that never written likes : how to analyze different types of business (plantations, constructions, properties, etc), how should a investor react to bull market and bear market, your own experiences when facing with financial market crisis such as during the year 1997, 2008, your strategy in portfolio management and even your own track records of successful investing or even failure in investment ( I believe a successful investor has some failure investment as well).

Mr Koon, above just my personal opinion and suggestion. Again,thanks for your sharing and I must tell you that your sharing is very beneficial especially to those young investors.

2014-05-18 02:54

I second lee's comment. I do wish to add one issue into the proposed publication of articles - buying a house in the Klang valley.

In my opinion, I think Mr Koon's take on the current property market is an important piece of puzzle to the conundrum of owning a house in this region. The mainstream media have published articles that are incredibly one-sided and extreme..For example, how raw materials will go up, how GST will cause the rise of house prices, how Malaysian demographics will contribute demand and how the latest infrastructure development will lead to price appreciation. From time to time, we do have notable figures coming into the mainstream media limelight to comment about the property market. However, most of these people have their interests tightly held in the proeprty market. The way I see it I think there is a serious conspiracy among the industry players especially the developers and speculators to pump up prices of properties in the country. I do admit sometimes, we may see one or two articles in the newspaper arguing against the rise of house prices in Malaysia. But those articles are more narrative of the uncertainty surrounding the future property market than conclusive about whether the property market is overheated.

As we all know, Mr. Koon might not be an accountant. But your vast expertise and experience in the property industry will provide important insights to whether owning a home in Klang valley is worthwhile in the current climate. Afterall, you are an individual who had consumed more salt than the younger generation consumed rice according to a chinese saying. The younger generation have not witnessed a substantial correction in property prices. Every decision made in buying the first home is important because an investment in house is a lifelong decision. In the stock market, if we are wrong, we could easily get out. But in the property market, if we are wrong, there are no way to run except facing imminent foreclosures.

I hope Mr. Koon, you could tell us your take on this topic and I believe this will benefit many many young adults in the country.

2014-05-18 09:38

500plus, what you said is right about the property market. You just have to use your common sense to see that there are so much of vacant and unsold properties. If you want to buy or rent a house or flat, you have so much of choices. When supply exceeds demand, the price must come down.

Just like making money from the stock market, you must buy before the price goes up. If you have bought properties a few years ago, you should sell before the price comes down.

To be able to make big profit you must be able to see the bull charging from the plantation. After my posting of my article, many of the readers still cannot see the bull. They don't seem to understand English. They still ask me about properties, TSH and Innoprise??

You should sell your house and rent one so that you have money to buy the shares I listed above.

I am sure all plantation companies will report better profit before the end of the month and automatically their shares will go up. Don't miss this chance to make easy tax free money.

2014-05-18 11:09

Dear Mr. Koon, it is heartening to see that many youngsters and market newbies look up to you for guidance. Hopefully, with your knowledge and experience,you may guide them from the pitfalls of the market and in life.

2014-05-18 11:09

Dear Mr Koon, thanks for the excellent analysis. after reading all your reasoning in tbe blog, i bought in immediately. with limited resources, my stock investment is always very focus. just invest in one stock or two stock at the most. it worked out for me. in these two years, double my money. MIP graduate, i did my homework each weekend. shoot only once every qtr when uptrend is clear; very disciplined. i called it SNIPRE VALUE INVESTING. dont waste bullets on so so companies. shoot with 80% to 90% sure,zero loss toleratance: always reduce my position if no profit in three days and buy back again in next uptrend. Now also follow rich people philosophy: start donating 10% profit out each year. if you need anyone to help put together the book, i volunteer.

2014-05-18 12:27

Mr.Koon at RM3000/- is it feasible for biodiesel. The cost of diesel shall be more expensive then the current pump diesel.

2014-05-18 14:35

Ya! some plantation companies are having more then one business instead of telling yield of palm oil per hectare it should be rightfully said by "yield per hectare per annum" it can range anything from 19mt of fruits per hectare per annum to 25mt. Why the disparity... thanks for responding.

2014-05-18 14:43

Dear Mr Koon,

I have suggestion for you are well, you might as well specify what type of question should be raised in yr blog such as:

1. No other than plantation..no bull shit question from properties or tech stock

2. At least Google scan for English level before posting question

3. Even asking plantation stock, strictly limited to the 5 stock you are recommended

& etc...

Haha..then you will have all the "correct question"

2014-05-18 15:20

Mr koon, thanks for sharing your knowledge ...i might consider buying some plantation stock at MY OWN risk..:)

2014-05-18 15:26

jimstock, I am so sorry that I have not answered your question about TSH and you are annoyed. As you know, I receive so many questions and it is impossible to please every reader. Moreover, I am old and usually old people are impatient because they do not have much time left.

2014-05-18 17:12

I like Mr Koon's stats shared but noticed that the top 3 recommended has very high PE. Besides that the Price to Sale is also high. These means before re-rating. I know Mr Koon has proven the market wrong many time such as Jtiasa and I note it may be niche collectors also at this point before the re-rate/revalued.

This is the same as E&O whereby obvious things are falling into place and the PE will be suddenly reduced once all approved and proceed

2014-05-18 21:40

i believe plantation stocks has value and given time the prices will shoot up simply cpo prices will be back to 3500 someday or even more

2014-05-18 22:01

I have just posted an announcement of my investment seminar on 1st June in KL. Please come so that I can meet and answer all your questions

2014-05-22 06:07

Mr Koon, I would very much love to attend your seminar, unfortunately I will be away 1st June. Would it be possible to post some of the highlights in your blog post-event? Thank you very much.

2014-05-23 16:41

Hi Mr Koon, IOI paid RM 15k / ha for land in sarawak back in 2010. Don't you think this would be a better comparison rather than RM 70k/ ha ? If I am evaluating Sarawak Plantation.

http://www.theedgemalaysia.com/features/173929-corporate-sarawak-plantations-major-shareholder-to-exit.html

2014-05-29 22:28

It's more reasonable to base on the stakes for sharing portion of planted area from joint venture , subsidiaries and associates for comparison purposes. It shows that SWKPLNT is still the lowest in term of market capitalization per hectare among three companies.

1.SWKPLNT

- Market Capitalization per hectare: RM 24,240

- Number of shares: 279,564,000 units

- Market capitalization: RM 0.749 billion

- Planted areas year 2013: 30,904 hectare ( excluding non controlling interests portion in subsidiary Pelita Suai)

2. KULIM

- Market Capitalization per hectare: RM 53,500

- Number of shares: 1,278,731,000 units

- Market capitalization: RM 4.45 billion

- Planted areas year 2013: 83,176 hectare ( Malaysia 47,107 hectare + NBPO 36,069 hectare) note: 49% stakes in NBPO of 73,610 hectare

3.THPLANT

- Market Capitalization per hectare: RM 34,450

- Number of shares: 882,910,000 units

- Market capitalization: RM 1.854 billion

- Planted areas year 2013: 53,810 hectare ( excluding non controlling interests portion in subsidiaries and associates like Hydroflow, Bakti & Sabaco, Pelita Gedong & etc)

2014-06-03 10:52

How to rerate a sector that's already overpriced ..

Most plantation have rich valuations

2014-06-03 20:46

Strange feeling why Mr Koon did not buy more stocks he recommended here. Instead he bought Latitude. If follow this blog, top 2 picks should be Swk Plantation and TH Plantation.

2014-11-23 12:11

Heng611

The price not go up is because these co don't share with you. give very little dividend. the big boss very happy now. one day will cry. other big boss collects at low price than takeover.

2014-05-16 11:58