Export manufacturers share prices dropped too much - Koon Yew Yin

Koon Yew Yin

Publish date: Sun, 07 Feb 2016, 08:51 AM

6th Feb 2016

The MYR per 1 USD chart shows the average rate for the last 3 months was Rm 4.30 to one USD and the rate on 5th . Feb 2016 was Rm 4.15 to one USD, a 15 sen or 3.5% drop. Smart investors should be able to see that this 3.5% strengthening of our Ringgit should not cause the export manufacturers share prices to drop more about 20%. For example:

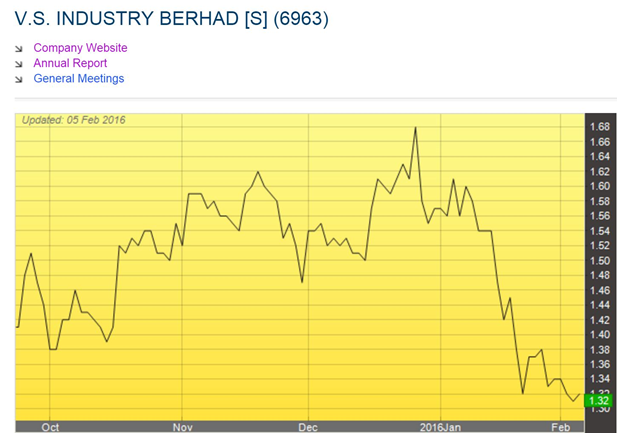

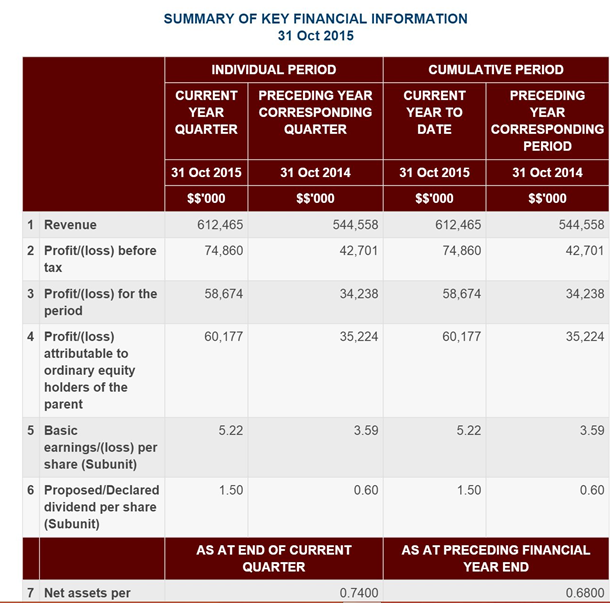

VS dropped from Rm 1.68 to Rm 1.32 a drop of 21%. Note 1st Q eps was 5.22 sen.

Focus Lumber dropped from Rm 3.02 to Rm 2.28 a drop of 25%.Note EPS for last 3 Q was 3.22, 7.8 and 9.35 sen respectively. It has no borrowing. Some of its cash saving is in US$.

Chin Well dropped from Rm 2.28 to Rm 1.84 a drop of 19%. Note 1st Q EPS was 6.07 sen.

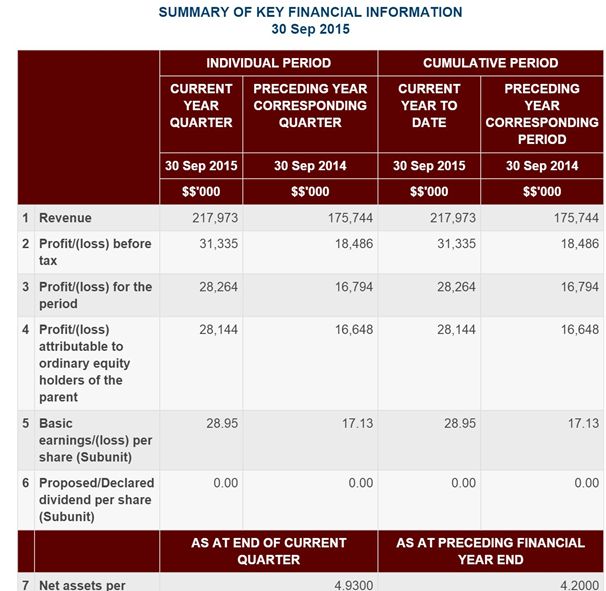

Latitude dropped from Rm 8.05 to Rm 6.63, a drop of 18%. Note 1st Q EPS 28.95 sen. It has about Rm 200 million cash saving and some portion is in US$ deposit.

Lii Hen dropped from Rm 2.97 to Rm 2.35, a drop of 21%. Note EPS for last 3 Q were 6, 7, and 8.6 sen. It is cash rich and no borrowing.

As I said before, the normal investors always over react to good or bad news and smart investors should take advantage of this phenomenon to make more profit. I strongly believe all these prices will rebound soon when investors see that their quarterly results have not been affected so much. In fact many of these cash rich companies like Focus lumber, Latitude and Lii Hen have fixed deposit in US$.

You can see charts and quarterly results for the other companies I mentioned from Bursa Malaysia. Investors should not miss this good buying opportunity to buy all these companies that comply with my share selection golden rule. Everyone will make more profit this year than last year and when the increased profit is announced its share price will surely go up.

I wish you all a happy and prosperous Chinese New Year. I sincerely hope all my articles I posted have helped you to make more money and be happier.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Aug 19, 2024

On 14th Aug 2024, I posted my article “Why people are rioting across UK”. Now I want to tell you why do people riot?

Created by Koon Yew Yin | Aug 19, 2024

If I knew politicians are so well paid, I should have been a politician. A few days ago, one old friend who migrated to Australia about 40 years ago, visited me. He told me that he was a Member of P..

Created by Koon Yew Yin | Aug 14, 2024

Riots have spread across numerous cities and towns in England, and in Belfast in Northern Ireland, over the last week in the worst outbreak of civil disorder in Britain for 13 years. Police have ma...

Created by Koon Yew Yin | Jul 30, 2024

The new poll, conducted between July 22-24 and released Sunday, found that Harris’s approval rating had surpassed Trump’s in Wisconsin, Pennsylvania, Minnesota, and Michigan. In Michigan, Harris was..

Created by Koon Yew Yin | Jul 30, 2024

As you can see below, a few people are using my name to promote sale of Initial Public Offer (IPO) shares before and after listing on Bursa Malaysia. You should not buy IPO shares because statistics..

Created by Koon Yew Yin | Jul 23, 2024

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Discussions

Same goes to ewein...when ewein 1.50, i ask sell and said buy back at 1.15...as usual, nobody believe at me...after 1 month, ewein drop to 1.14

2016-02-07 20:56

vs already given free warrants so not drop that much. export stocks price already increase so much,a few hundred percent since last year so beware. if ringgit appreciate to 3.80 the export stocks will down 30% or more.

2016-02-07 21:09

vs lowest is below 50cts last year jan,FL only 1.20 so still gain a lot since last year only. even ringgit didn't drop so much against USD. so export and glove stocks still very much overvalue

2016-02-07 21:13

Many people want to see the market to crash so bad that until they can buy Maybank at a discount of 50% from current price

I also want to buy some Maybank if it drop to 3.90 like last decade.

2016-02-07 21:28

I want to keep 99% cash now in case this time is the very moment to get it so cheap

Easy living with Maybank

2016-02-07 21:30

3.90 is one very ambitious target, I think I would still buy some of it ever drop to 5.50, 4.50 and so.

2016-02-07 21:34

A Diversify list can't be go wrong, a click at the bottom link might give some shed , before the growth story widespreading. JHM a beutiful & Nice Rm$ printing machine from its new $25/ mil. Ext. Auto Led facility

http://klse.i3investor.com/blogs/icon8888/90649.jsp

2016-02-07 21:39

bearish sentiment influence 90% of stock price,stock fundamental left with 10% . TA pointing to sell, herd reaction no holding, every body would not want be the last to carry the hot potato...let it cool.. watch the indicators..then only take position kikiki..of course need this gyration otherwise no excitement in trading...

2016-02-08 00:19

Definitely a good news to see market crash. Imagine valuable stocks with massive discount price. Goshhhhhhhhhhhhhhhh

2016-02-08 01:51

If the market ever crash you will loss your job any business went broke

Even with massive discount, you won't be able to buy some because interest rate sky rocket your car and your house will be pull back by the bank and you will worry about the food in your table than investing your money

2016-02-08 02:37

Also your ringgit cash will be worthless paper it is better to convert to USD than buying ringgit valuated plc

2016-02-08 02:39

It's always a cycle. It will recover gradually. :-)

Ringgit valued plc is still a running business that generating income.

Cash rich company will never go broke so easily.

USD will never be strong forever as it will hurt their export so much.

Although it just started and even may last for a few years but it will fall after sometimes.

It's definitely a golden opportunity for export companies to cash up their reserve.

Especially when TPPA come into force in 2018, they will need to increase their productivity to meet the demand coming.

2016-02-08 03:01

Even if they won't go broke it can never more defensive than Maybank during massive correction. I will predict 50% of the plc will be wipe out.

2016-02-08 09:28

Even if crude oil can rebound, the crash will still definitely wipe out high debt company like Shell

2016-02-08 09:29

Even if ringgit can rebound

Can ringgit be saved during a market crash?

As I said earlier ringgit will be worthless too, it would be great to keep more USD

2016-02-08 09:46

Although Zeti like to rephrase ringgit as massively undervalue, based on her valuation ringgit may have very little debt.

2016-02-08 10:01

ok lah, dont worry, just follow uncle buy on history high then should be ok. Another high is coming. previous trap people can release.

2016-02-08 10:31

What do you mean by worthless ringgit? Are you trying to say ringgit will be the worst currency depreciating against US dollar compared to other currencies? What do you say about Vietnam Dong?

2016-02-08 10:33

The financial system is made by whom

And what will the creator do to the financial system?

And the follower of the financial system?

Why the financial system choose USD to be its standard to all minor currency?

When the financial system isn't doing so well what will the minority who subscribe into the said financial system?

2016-02-08 10:38

Can you expect a better answer given by Zeti herself?

Is there a clear answer to any question?

Your teacher tell you to give one answer and it doesn't mean it can be no other answer

2016-02-08 10:44

Can you expect ringgit to be stand out from the world to perform well when the problem of ringgit is caused by its own creator?

2016-02-08 10:48

I would say ringgit would be better than certain currencies like South African rand but worse than majority of the currencies. What is your opinion?

2016-02-08 10:52

Who has the total control over the financial system?

When it goes into globalization

Everything will be dealt differently

Is it the biggest economy who has the control?

Or the small and closed economy has the control?

2016-02-08 11:00

Are you trying to say USD is the most valuable currency which means it will get even stronger?

2016-02-08 11:03

If the big economy do not feel well

it can launch a war anytime they like

the weapon itself is running the economy

2016-02-08 11:20

it could be cold war it caould be currency war it could be nuclear war, not every war will resulting in the destruction of civilization.

2016-02-08 11:26

JUST A SMALL PIN SIZE RECOVERY, BUT MASMEDIA PLUS RESEARCH HOUSE LIKE RHB AND CIMB WERE GIVING REPORTS THAT IT WAS THE END OF EXPORT STOCKS.. CIMB UPGRADED PROPERTY TO OVERWEIGHT NOW.. SO WE UNDERSTAND NOW THAT SOME ARE TRYING THEIR LEVEL BEST IN CHANGING THE THEMEPLAY FROM EXPORT STOCKS TO OTHER SECTORS THAT WILL BENEFIT FROM RECOVERY OF RINGGIT.. FOR TIME BEING IT IS JUST A SMALL PIN SIZE RECOVERY ON RINGGIT, BUT EXPORT STOCKS DROP SO MUCH.. PURPOSELY THEY ARE PUNISHING EXPORT COUNTERS BY RAISING UP LEVY S FOR FOREIGN WORKERS.. SO FROM HERE WE CAN UNDERSTAND OUR CORRUPTED GOVERNMENT HAS ALSO A DIRTY HAND HERE

2016-02-08 15:50

Just because TPPA is also pointing towards recovery of ringgit, that does not mean in a drastic manner they can change the themeplay, in their reports

2016-02-08 15:54

Why suddenly they raise levy fees for foreign workers? They are trying to hit hard export counters, because they are the one employs most foreign workers..

2016-02-08 15:58

cash rich company like flb...could easily hedge against USD if at all required... even at current level. The price dip would then be highly unjustified....dividend does not hint such vulnerability.

2016-02-08 16:01

So many hands are taking advantage of the present situation, to deviate the attention to other theme play from exports theme play...but this is not going to work out, finally ringgit is going into weaknesses again..

2016-02-08 21:56

无论是哪种阴谋论,零吉之强或弱似乎与油价脱不了关系。

最近俄罗斯喊话要与OPEC商讨減产之言一出,油价即上涨,

美元走软,这使到所有出口股皆跌。

如今全球经济不景,石油供过于求,油价已难持续増涨。

看来零吉兑美元也将趋软。

2016-02-08 23:24

I want to see Maybank to drop by 30% from last price, my pant will be very wet to see it happens, easy living with Maybank, but at the cost of large scale financial crisis, massive of household loss their jobs, massive of house and car getting pull back by the bank, massive of declared bankruptcies, massive of i3 member loss their pants too, so they will leave the forum and worry about the food on their table. :)

2016-02-09 12:34

Icon8888 ' s Article- My reshuffling porfolio in 2016. (Just right on time)

http://klse.i3investor.com/blogs/icon8888/90649.jsp

2016-02-09 21:07

I kind of disagree with Mr KYY to use MYR$ strengthen % correlate proportional to share price drop. He has to consider an adjusting factor, eg:- If MYR has weaken 30% over 2 years and the share price has benefited 150%, the factor will be 5x. Thus with recent 3.5% MYR$ strengthening with be reflected 17.5% in share price drop. So those counter price drop should be justifiable..

2016-02-15 11:15

mr koon.. what do u think bout ajinomoto... biz wise it's consider a company which practically have no competitor as it holds 90% of msg usage in the country.. with low comodities prices n some export to middle east.. maybe can have a look....

2016-02-15 21:40

.png)

Koon Bee

Hahahaha...u go to pohuat treat to read my prediction on pohuat

When pohuat >rm2, I said will drop to 1.68...nobody believe at me...after 1 month, pohuat drop from 2.08 to 1.67!!

2016-02-07 20:54