Can One News - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 20 Apr 2016, 03:31 PM

On 19th April, The Star Biz reported that Can One confirmed that Kumpulan Wang Persaraan (KWAP) has made an offer to buy 30% stake of Can One’s wholly owned subsidiary F & B Nutrition Sdn Bhd. for Rm 280 million.

Basing on this deal, F & B Nutrition Sdn Bhd is worth Rm 933 million.

On 15th April 2016, MIDF Investment, on behalf of the Company, wishes to announce that:

(1) the Company has engaged with Aspire for a better price for the Proposed Disposal in view of the improved performance of Kian Joo Group over the past two financial years. However, the Company and Aspire could not come to a conclusion in respect of the price. The conditions precedent in the BSA were not completely fulfilled as it took the Company more than a year to resolve the legal suit taken by a former Director in relation to the BSA and by then, the valuation of the Company is different from that of March 2014; and

(2) the termination of the BSA and its ancillary agreements will have no impact of the earnings per share and the net asset per share of Kian Joo Group.

On this news, Kian Joo’s share price went up a few sen.

Basing on Kian Joo’s current share price of Rm 3.26 per share, the market cap of the company with 444.17 million issued shares is Rm 1,448 million.

Can One’s 32.9 % ownership of Kian Joo is worth Rm 476 million.

Plus the valuation of Can One’s F & B Nutrition Sdn Bhd of Rm 933 million, the total of these 2 holdings is Rm 1,409 million.

The whole market capitalization of Can One is only 192.15 million issued X Rm 4.06 = Rm 780 million.

It is so much undervalued.

Dude has posted one of the most comprehensive articles on Can One on 14th Feb 2016, I have ever seen on i3investor which you must see.

http://klse.i3investor.com/blogs/rarecharms/91402.jsp

http://klse.i3investor.com/blogs/rarecharms/93026.jsp

You need more than FA & TA to be able to spot Can One. You need to have the mind of an entrepreneur.

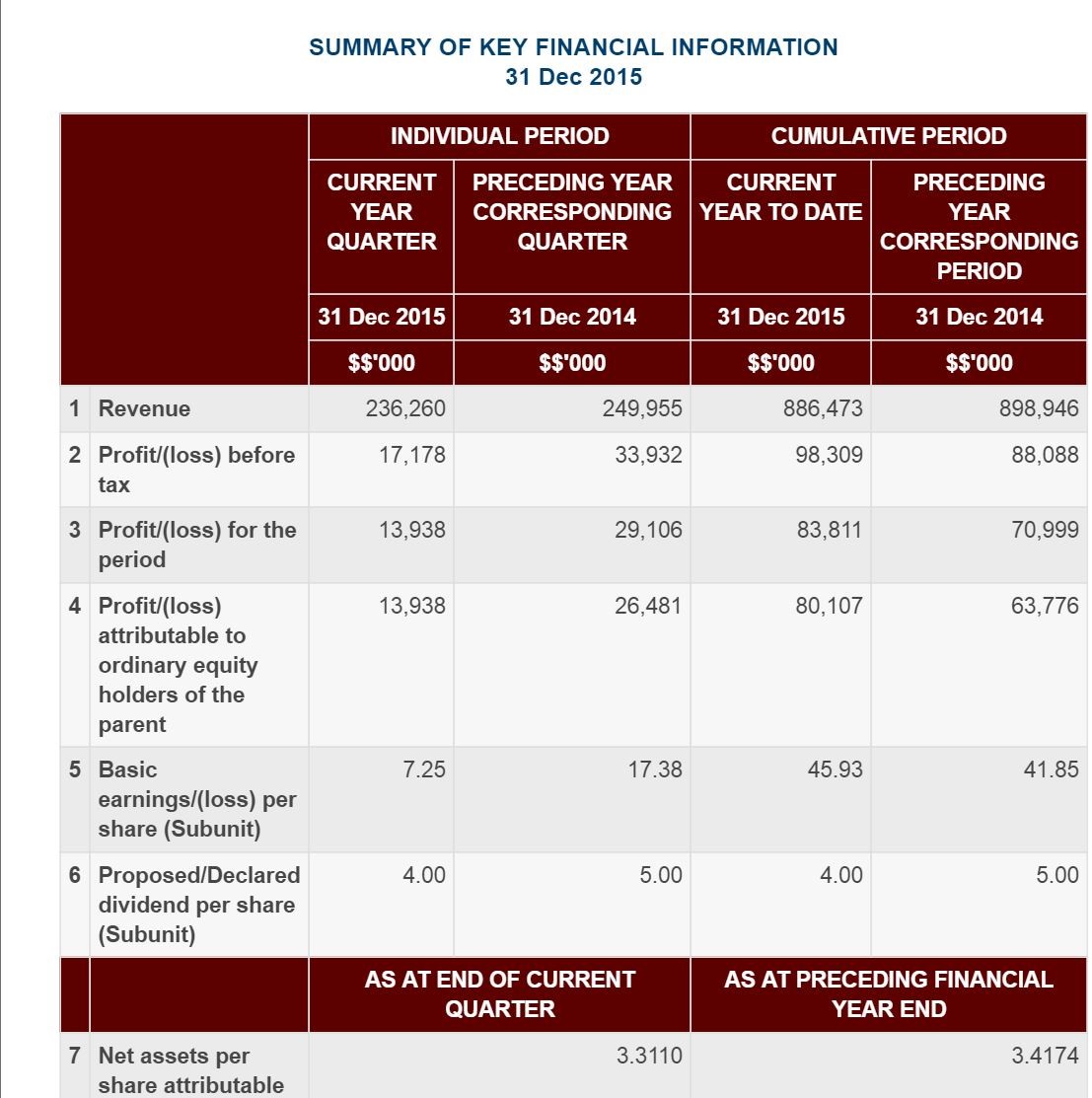

For some strange reason Kian Joo contributed less profit to Can One in the last quarter. As a result its share price has fallen from Rm 5.05 to Rm 4.05, selling at P/E below 10.

When I bought this stock, I wished the company was delisted so that I would not have to look at its price fluctuation and be tempted to sell to realise some profit.

I am obliged to inform you that I am a substantial shareholder and if you buy, you are doing it at your own risk.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

![[MQ Raya Campaign 2022] Guideline of Joining the Campaign | Let's Join Now!!!](https://mqac.i3investor.com/img/video_thumbnail/433/thumbnail.jpg)