Jaks: Why the Share Price is Falling? Koon Yew Yin

Koon Yew Yin

Publish date: Fri, 16 Mar 2018, 08:53 AM

Many people have asked me why JAKS’ share price continues to fall. There are several reasons. Recently I have written 2 articles under the titles “Can Star Forfeit the Rm 50 Million Performance Guarantee?” and “Jaks Has the Right to Claim for Additional Cost”. You can see these 2 articles on my blog.

The reasons are as follow:

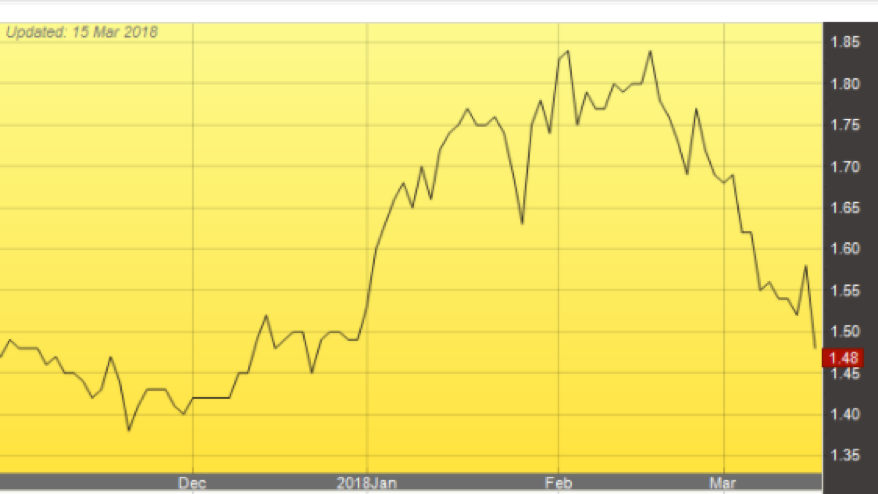

1 The share price started to fall when it reached its peak at Rm 1.83 because no share can continue to go higher or fall for whatever reason. It will change trend sooner or later.

2 The bad publicity caused by Star’s legal action to forfeit the Rm 50 million performance guarantee. In the stock market, investors always over react to good or bad news. In this case, the bad news encourages weak shareholders to dump their holdings without second thought. The analyst from Affin Hwang made a reassuring statement yesterday that the Star claim is a small matter.

3 The share price continues to fall because of the share placement announcement. Under the rule of the Securities Commission, a public listed company can issue not more than 10% of the total issued shares to place out to small investors at the average of the 5 days’ closing price before the share placement with a maximum of 10%. The controlling shareholders took advantage of the lower share price to placed out about 50.7 million shares at Rm 1.39 to receive about Rm 70 million.

About the same time last year, the company had placed out 10% of the total issued shares.

Many shareholders would naturally feel cheated because the placement price was 10% lower than the open market price. As a result, many would dump their shares.

As a substantial shareholder:

If I sell or buy, I need to report and the company needs to make the necessary announcement. I have not dump any of my shareholdings. As I said many a time my reason for buying the share is that I believe Jaks has very good profit growth prospect especially when the power plant is completed. Jaks will receive more than Rm 100 net profit every year for 25 years.

This is the reason why the directors and the controlling shareholders bought so many shares. Jaks had placed out twice 10% of the total issued shares plus their original holdings of more than 30% to be able to control the company. I believe they have more than 50% of the total issued shares. They have bought so many shares because they believe the company has a fantastic profit growth prospect.

The CEO Andy Ang:

I must say Andy Ang is an exceptionally clever and shroud business man to be able to secure the 1,200 MW power plant contract from the Vietnamese Government and completely sub-contract to the Chinese party who has the technical ability and financial capacity to complete the power plant, which is valued at about Rm 7.76 billion.

The most important consideration is that Jaks does not need to borrow money from banks to finance the project and does not need to lay a brick to construct the huge power plant. In fact, the Chinese Sub-contractor and JV partner pays Jaks Rm 454 million during the 3 years of construction. Now I understand Jaks has already received about one third of the Rm 454 million.

In my 60 years’ experience in the construction contracting industry, I have never seen such a juicy contract as Jaks’ power plant contract. As an independent power producer selling electricity to the Vietnamese Government at a profitable rate for 25 years.

In fact, this reminds me of YTL Corporation Bhd. YTL was only a small time contractor before our Malaysian Government gave YTL a power plant contract similar to the one Jaks is having.

Readers are not obliged to follow my footstep. They should do what they like. They should sell if they have a better use for their money or if they cannot wait for the power plant completion in about 2 years’ time.

Remember patience is the key to successful investment.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Aug 19, 2024

On 14th Aug 2024, I posted my article “Why people are rioting across UK”. Now I want to tell you why do people riot?

Created by Koon Yew Yin | Aug 19, 2024

If I knew politicians are so well paid, I should have been a politician. A few days ago, one old friend who migrated to Australia about 40 years ago, visited me. He told me that he was a Member of P..

Created by Koon Yew Yin | Aug 14, 2024

Riots have spread across numerous cities and towns in England, and in Belfast in Northern Ireland, over the last week in the worst outbreak of civil disorder in Britain for 13 years. Police have ma...

Created by Koon Yew Yin | Jul 30, 2024

The new poll, conducted between July 22-24 and released Sunday, found that Harris’s approval rating had surpassed Trump’s in Wisconsin, Pennsylvania, Minnesota, and Michigan. In Michigan, Harris was..

Created by Koon Yew Yin | Jul 30, 2024

As you can see below, a few people are using my name to promote sale of Initial Public Offer (IPO) shares before and after listing on Bursa Malaysia. You should not buy IPO shares because statistics..

Created by Koon Yew Yin | Jul 23, 2024

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

.png)