Carimin - When Did I Start to Buy and When Will I Sell - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 27 Feb 2019, 10:50 AM

Yesterday I posted my article “Dayang-when did I start to buy and when will I sell”. My article has helped many people made money. Unfortunately, many people misunderstood my intention. Some people say whenever I recommend buy they should sell and vice versa.

You can see I have written a few buy recommendations before. Since the price is dropping, many of readers are interested to know my opinion. Moreover, a few people including BatuHitam who posted his article “Exposing KYY’s nonsense” on I3investor. They are angry because they must have bought it when the price has already gone up a lot.

Fortunately, many of my followers who have bought it earlier were thanking me for giving them ANG POW for the Chinese New Year as you can see their comments from i3investor.

That is why I need to write this piece.

As I said many a time before, no share can go up or come down continuously for whatever reason. After some time, it will correct itself as some investors will start to sell to take profit. After it has dropped for some time, some cash rich investors will start to buy to push the price up again.

Carimin is a good example. When I saw its profit growth for its 2 consecutive quarters, I started to buy.

When did I start to buy:

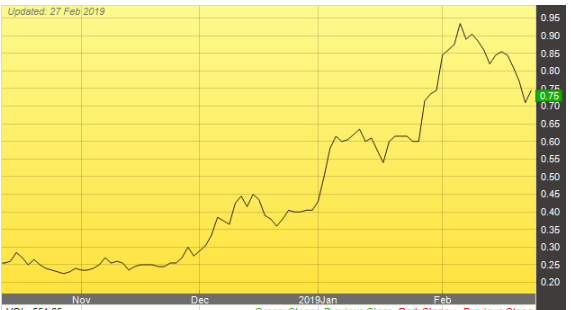

4th quarter of financial year ending June 2018 EPS -6.82 sen. 1st quarter of financial year 2019 EPS 5.01 sen which was announced on 29th Nov 2018 which complied with my golden rule, I started to buy it on 30th Nov 2019 when the price was around 28 sen. It shot up to 93 sen, 330% increase within 3 months.

You would be considered a foolish investor if you did not sell at or near its peak.

KYY Golden rule for share selection:

The company must report profit growth for 2 consecutive quarters before I decide to buy it. In addition, it must be selling below PE 10.

Among all the criteria such as NTA, Cash flow, dividend yield, debts, liabilities, cash in fix deposit, profit etc profit growth prospect is the most powerful catalyst to move share price.

When will I sell?

No share can go up or come down continuously for whatever reason. After some time, it will correct itself as some investors will start to sell to take profit. Based on this guideline I started selling. As you can see the daily volume is more than 10 million shares, there must be many other sellers. You cannot blame me for selling. I know many smart investors also follow me to sell to buy Dayang.

After it has dropped for some time, some cash rich investors will start to buy to push the price up again, just like now, as I am writing. It has gone up 4 sen with 7.9 million shares traded after 1 hour in the morning.

Why I will also sell?

I will also sell as soon as I see the company report less or reduce profit for 2 consecutive quarters. You must bear in mind that many company’s product or services are seasonal. I will not simply sell, when I see the company reported reduced profit for 1 quarter because its product or services may be seasonal.

I will also sell any of my holdings if I found a share with a better profit growth prospect than any stock among my holdings.

What is my target price for Carimin?

1st Quarter EPS 5.01 sen and 2 Quarter EPS 2.25, total 7.26 sen. Bearing in mind that its 2nd Quarter from Sept to Dec, was N-E monsoon period during which the company did less work.

Assuming its earning for the 2nd half year is the same as the 1st half year, its annual EPS will be 7.26 X 2 = 14.52 sen. Even if I based on P/E 10 which is very safe, my target price is Rm 1.42.

Many smart investors with good foresight can foresee its annual profit before the end of its financial year ending June 2019 which is about 6 months away.

Please note that I am not asking you to buy or sell. If you decide to buy or sell, you are doing it at your own risk. In any case, whether you buy or sell will not affect the share price because the daily volume often exceeds 10 million shares.

I believe Carimin has a lot more to go from the current price of 74 sen.

Note: To be really successful, investors must also have some knowledge of financial and technical analysis, understanding of human nature and business sense.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Aug 19, 2024

On 14th Aug 2024, I posted my article “Why people are rioting across UK”. Now I want to tell you why do people riot?

Created by Koon Yew Yin | Aug 19, 2024

If I knew politicians are so well paid, I should have been a politician. A few days ago, one old friend who migrated to Australia about 40 years ago, visited me. He told me that he was a Member of P..

Created by Koon Yew Yin | Aug 14, 2024

Riots have spread across numerous cities and towns in England, and in Belfast in Northern Ireland, over the last week in the worst outbreak of civil disorder in Britain for 13 years. Police have ma...

Created by Koon Yew Yin | Jul 30, 2024

The new poll, conducted between July 22-24 and released Sunday, found that Harris’s approval rating had surpassed Trump’s in Wisconsin, Pennsylvania, Minnesota, and Michigan. In Michigan, Harris was..

Created by Koon Yew Yin | Jul 30, 2024

As you can see below, a few people are using my name to promote sale of Initial Public Offer (IPO) shares before and after listing on Bursa Malaysia. You should not buy IPO shares because statistics..

Created by Koon Yew Yin | Jul 23, 2024

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

.png)