Dayang’s Price Rise is not Reflected on Naim - Koon Yew Yin

Koon Yew Yin

Publish date: Sat, 19 Oct 2019, 12:28 PM

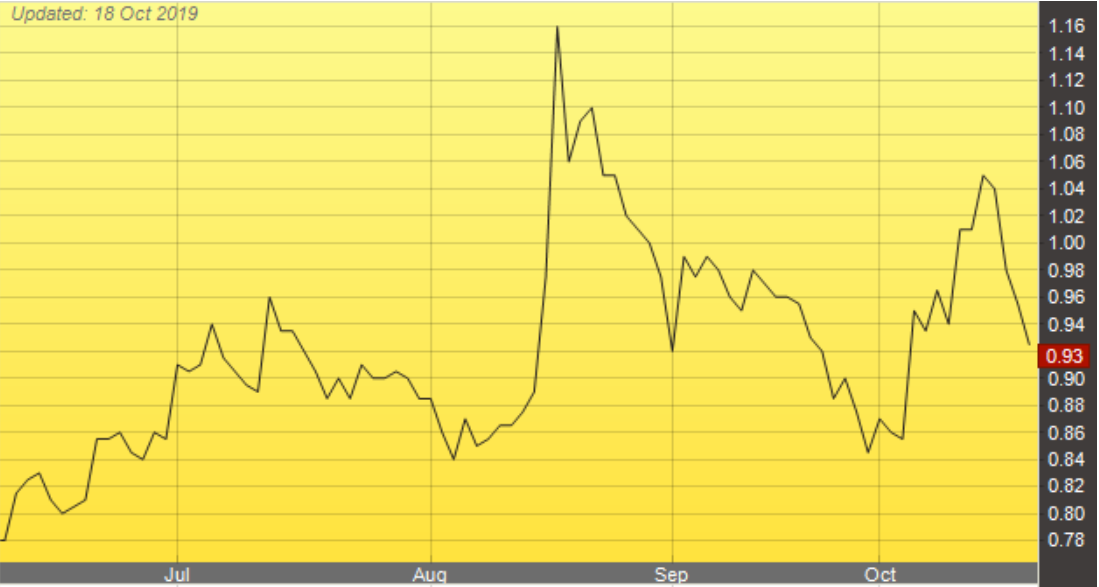

On 19 Aug 2019, Naim was shooting up from Rm 1.01 to Rm 1.16 sen, an increase of 15 sen or 15% , many investors called to ask why I did not recommend them to buy.

Naim is the controlling shareholder of Dayang. It owns 26% of the total issued shares of Dayang. Dayang has a total issued of 965 miilion shares and Naim owns 251 miilion shares. Naim has a total issued of 500 million shares.

Based on the current prices, Naim’s market capitalization is 500 million shares x 93 sen = Rm 465 million. Naim’s 26% of Dayang is worth 251 million X Rm 1.86 = Rm 466 million.

Many Naim’s shareholders are hoping for Naim to sell all its Dayang shares so that Naim’s all other assets will be free of charge.

Many investors asked why don’t I sell Dayang to buy Naim?

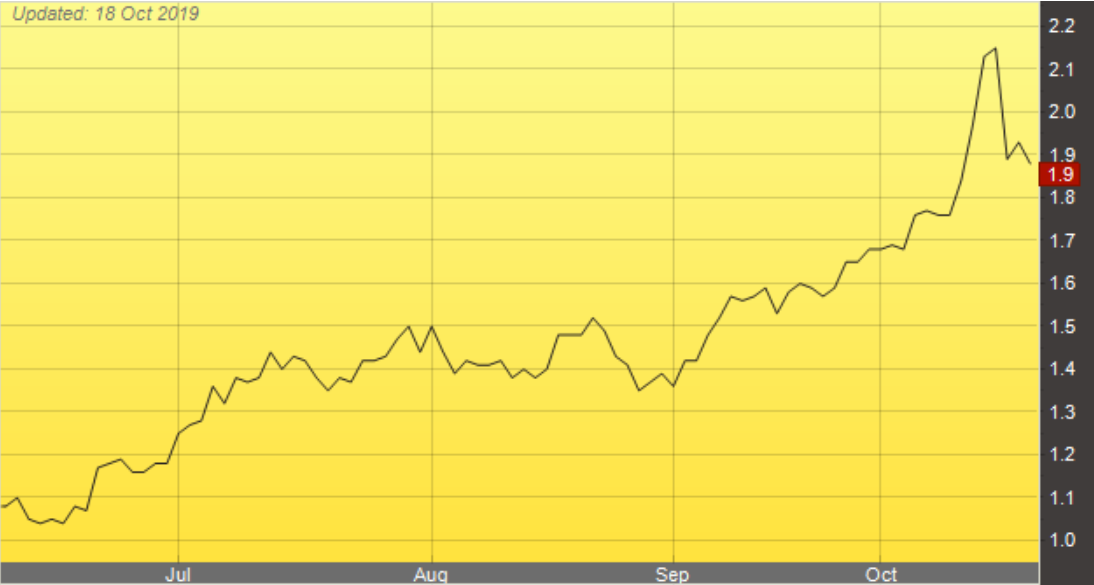

In the last 4 months Dayang has gone up from 90 sen to peak at Rm 2.15 while Naim has been fluctuating like a YOYO.

As I said many a time before, no stock can go up or down continuously for whatever reason. After a while it must change trend. Dayang’ s price chart shows that its price corrections have always been quite small but the latest correction is quite severe unfortunately.

Small investors are selling while rich funds are buying

Every day more than 10 million shares changed hands. Many small investors are selling to take profit while many rich fund managers are buying aggressively because they expect the company has very good profit growth. Its eps for 1st quarter was -0.46 sen, its eps for 2nd quarter was 5.71 sen and they expect its eps for 3rd quarter to be better than its 2nd quarter.

Dayang is the largest maintenance contractor in this region where Petronas has discovered a total of 163 oil fields and 216 gas fields. Dayang has very few competitors such as Carimin, Uzma and Petra Energy which are comparatively small.

Off shore oil rig: The average price for offshore oil-drilling rigs is approximately US $650 million.

Mini floating city: Offshore rigs vary in the specific type and layout, but they're often like mini floating cities, with all of the amenities needed to live and work out on the ocean. No matter where the oil rig is located, it operates 24 hours a day, seven days a week no matter what the weather is like.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Aug 19, 2024

On 14th Aug 2024, I posted my article “Why people are rioting across UK”. Now I want to tell you why do people riot?

Created by Koon Yew Yin | Aug 19, 2024

If I knew politicians are so well paid, I should have been a politician. A few days ago, one old friend who migrated to Australia about 40 years ago, visited me. He told me that he was a Member of P..

Created by Koon Yew Yin | Aug 14, 2024

Riots have spread across numerous cities and towns in England, and in Belfast in Northern Ireland, over the last week in the worst outbreak of civil disorder in Britain for 13 years. Police have ma...

Created by Koon Yew Yin | Jul 30, 2024

The new poll, conducted between July 22-24 and released Sunday, found that Harris’s approval rating had surpassed Trump’s in Wisconsin, Pennsylvania, Minnesota, and Michigan. In Michigan, Harris was..

Created by Koon Yew Yin | Jul 30, 2024

As you can see below, a few people are using my name to promote sale of Initial Public Offer (IPO) shares before and after listing on Bursa Malaysia. You should not buy IPO shares because statistics..

Created by Koon Yew Yin | Jul 23, 2024

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

.png)