Why JP Morgan downgrades Top Glove? Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 14 Dec 2020, 03:37 PM

On 12 December JP Morgan downgraded Top Glove share price to Rm 3.50, nearly 50% of its current market price of Rm 6.90. Top Glove just reported EPS 29.64 for its quarter ending November. Its previous quarter EPS was 5.32 sen, an increase of 5.7 time. Comparing to its corresponding quarter last year, it has gained 20 times.

JP Morgan also downgraded Hartalega.

JP Morgan did not downgrade Supermax and other glove stocks because it did not own them.

Supermax reported 30.58 EPS for quarter ending September. Its EPS for its previous quarter was 15.19 sen. Based on Top Glove’s performance, Supermax’s profit for next quarter ending December should be another record profit which will be announced in Mid-January, about 1 month from now.

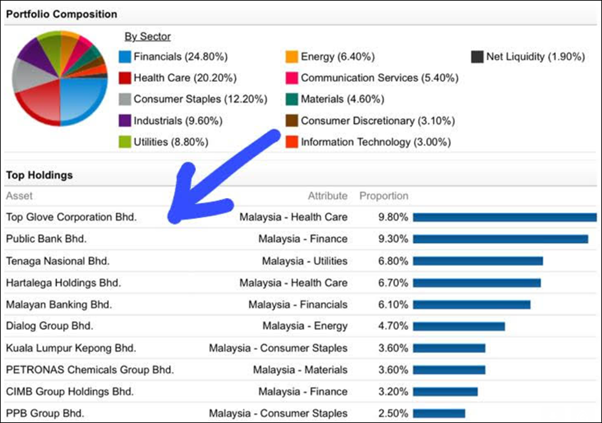

The table below shows that Top Glove is JP Morgan’s largest holding. Its 4th largest holding is Hartalega. Why should it downgrade Top Glove and Hartalega?

Obviously, JP Morgan wants to depress their share prices so that it can buy them at cheaper prices.

Due to Covid 19 pandemic the demand for medical gloves far exceeds supply and all the glove makers can easily increase their selling prices to make more and more profit. That is why Top Glove can report such an unprecedented profit. Until the pandemic is completely under control, the demand for medical gloves will continue to exceeds supply and all the glove makers will continue to increase their selling prices to make more and more profit.

This JPM article is a very poorly reasoned one. It is obvious that it is another shameful attempt to spook glove investors into selling and thereby creating buying opportunity for the fund managers in JPM.

As a serious glove stock investor, I need to debunk some of JP Morgan’s reasons for downgrading Top Glove and Hartalega.

1 JP Morgan: the price charts for all the glove stocks started to trend downwards from their peaks since September. Therefore, glove prices have peaked.

Rebuttal: Top Glove just reported EPS 29.64 for its quarter ending November. Its previous quarter EPS was 5.32 sen, an increase of 5.7 time. Comparing to its corresponding quarter last year, it has gained 20 times.

2 JPM: Glove production capacity is expected to grow 87% in the next three- to five years

Rebuttal: JPM claims that an 87% growth in production capacity (if true) over 5 years will lead to over-supply. But 87% growth over 5 years is only 13.3% per year compounded. Top Glove’s CAGR for the last 5 years was 23.6% and the 4 years before the Covid pandemic was 13.5%.

3 JMP: Additionally, glove makers' profitability is expected to be negatively affected by higher raw material prices and rising labour costs.

Rebuttal: Raw material and labour cost increases is a fact of life and applies to almost all manufacturing industries. And as cost increases applies to all competing companies, the increased costs are usually passed on to the consumer. This will not affect profitability. By bringing up the cost issue, which is a non-issue, JPM is clearly trying to stretch its argument to justify paring the fair value of Top Glove’s share price to RM3.50.

4 JPM: Retail and foreign participation are at all-time highs. It is thus difficult to find incremental dollars to drive this sector higher

Rebuttal: There is no sense to this statement. Investors come and go; buy and sell. Money will always chase profitable growth stocks when negative sentiments are proven wrong.

5 JPM: Top Glove is using cash to support capacity growth instead of debt

Rebuttal: Yes ROE will be higher with use of debt but ROE is already very high anyway. And prudence in using surplus cash is not necessarily bad.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Aug 19, 2024

On 14th Aug 2024, I posted my article “Why people are rioting across UK”. Now I want to tell you why do people riot?

Created by Koon Yew Yin | Aug 19, 2024

If I knew politicians are so well paid, I should have been a politician. A few days ago, one old friend who migrated to Australia about 40 years ago, visited me. He told me that he was a Member of P..

Created by Koon Yew Yin | Aug 14, 2024

Riots have spread across numerous cities and towns in England, and in Belfast in Northern Ireland, over the last week in the worst outbreak of civil disorder in Britain for 13 years. Police have ma...

Created by Koon Yew Yin | Jul 30, 2024

The new poll, conducted between July 22-24 and released Sunday, found that Harris’s approval rating had surpassed Trump’s in Wisconsin, Pennsylvania, Minnesota, and Michigan. In Michigan, Harris was..

Created by Koon Yew Yin | Jul 30, 2024

As you can see below, a few people are using my name to promote sale of Initial Public Offer (IPO) shares before and after listing on Bursa Malaysia. You should not buy IPO shares because statistics..

Created by Koon Yew Yin | Jul 23, 2024

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Discussions

the US is always jealous of other ppl success

just like our palm oil. We #2 largest palm oil producer in the world, that's why US have anti-palm oil campaign

2020-12-14 15:55

Tesla PE is 1000x!

Top Glove PE is only 16x!

Why Tesla PE can be allowed to be 1000x but Top Glove PE 16x already downgrade?

2020-12-14 15:56

PE 1000x for high tech. Low tech or rather no-tech such as gloves can only command PE 5x

2020-12-14 16:00

If JPM downgrade a stock because they're jealous, that's fabulous. Load up Supermax for your entire family.

2020-12-14 16:16

Here's a template of reasons when someone badmouth, downgrade a stock you own:

1. [The person/company] just want to depress the price to buy more.

2. [The person/company] is jealous.

3. [The person/company] has bad motive.

2020-12-14 16:18

actually speakup have very little gloves left

speakup speak up for Top Glove because hate to see USA bully our beloved country Malaysia. They bully us on Palm Oil. Now they bully us on Gloves.

2020-12-14 16:19

this is an old tape and recycled again and again.

Posted by Ricky Yeo > Dec 14, 2020 4:18 PM | Report Abuse

Here's a template of reasons when someone badmouth, downgrade a stock you own:

1. [The person/company] just want to depress the price to buy more.

2. [The person/company] is jealous.

3. [The person/company] has bad motive

2020-12-14 16:20

gloves are not my major holdings now

its.... XXXXXX cannot say lah. hahaha!

2020-12-14 16:21

JPM silence on new market players enticed into this new found land.

Check which are the companies in China ventured big in glove industries.

Look at the new entrance from Thailand.

Don't forget about the fly-by-nite players in Malaysia.

Also check out existing glove manufacturers expansion spree. KLK has been in rubber glove industry decade ago.

Hurdle to set up new glove manufacturing plant is damn low. A very low tech content where every Tom, Dick and Harry can join the party while the music still on. By the time music ends, all fly-by-nite go to holland.

2020-12-14 17:52

It will be very similar to face mask produced by China.

BYD as one of the biggest car manufacturer can move into unrelated face mask producing business, just like many other China's manufacturers.

I doubt it has also ventured into glove manufacturing.

Need not be long, but simply for this party.

2020-12-14 17:59

It is immaterial whether JPM issues a SELL call. After the pandemic, many new glove players will just close shop.

If you trust Buy/Sell call from the IB's, might as well try your luck tossing a coin.

Public Anal-list is the best among all Malaysian IB's, 9 out of 10 bring you to holland.......

2020-12-14 18:04

Completely misleading. JP Morgan holds topglove and hartalega because of ETF, as ETF is a passive investing

2020-12-14 21:14

JP Morgan starts accumulate supermax, as supermax listed as MSCI Malaysia constituent since end of November 2020.

2020-12-14 21:15

Hahaha. Tht jpmorgan name is jpmorgan etf, or jpmorgan owning for funds, or jpmorgan custodian?? Lol

How can a billionaires so naive and believe in some cheapskate road side news

Aiyoyoyo. Next time dunno ask invt experts mah. Not some useless forum article, which has no value and read like rubbish

2020-12-14 21:22

Hello KYY Sir, you have plagiarised large sections of my article (Debunking JP Morgan’s alarmist report on Top Glove and the Glove Sector published on 12/12/2020) and you claim in your blog description that “All materials published here are prepared by Mr. Koon Yew Yin”. It is good that you are sharing what I wrote with the readers of this site, but please have the courtesy to credit the writer from whom you filch materials the next time.

2020-12-15 01:40

Later Will come out another article"gloves bring glory for me and also bring to Holland"hihi

2020-12-15 06:49

This post is really low in quality, all based on his own "tought + feeling" to summarize his anger on drop of glove counters. Uncle please look at the overall macroeconomy, environment, social, politic and trend before make any comment...

2020-12-15 07:56

Posted by Ricky Yeo > Dec 14, 2020 4:18 PM | Report Abuse

Here's a template of reasons when someone badmouth, downgrade a stock you own:

1. [The person/company] just want to depress the price to buy more.

2. [The person/company] is jealous.

3. [The person/company] has bad motive.

...

4. [The person/company] is a lot more intelligent and knowledgeable than you, and understands how to avoid huge losses.

2020-12-15 08:12

This Uncle Koon Kunt has lost a lot of his credibility. Especially after conning his brainless followers into buying AT recently, with him cashing out.

His post here sounds so desperate. Far from his TP of RM24 (now grossly reduced to RM13), Supermax has now entered an Olympic event - "Diving".

The fact is, he had failed to correctly assess sentiment, which is far more important than fundamentals when it comes to share price. Now he is throwing a tantrum and blaming others instead of acknowledging his fault. LOSER!

2020-12-15 08:20

This is a very childish post. When someone don't agree with you, you accuse him of wanting to buy cheap by trying to press down the price..

2020-12-15 08:43

Glove producers making profit but share holders who bot in during glove mania starring at losses

2020-12-15 08:50

KYY every day also promote gloves...

Here's a template of reasons when someone promote, upgrade a stock you not yet own/own enough:

1. [The person/company] just want to push the price to let him cash out.

2. [The person/company] is greedy.

3. [The person/company] has bad motive

There you go!

2020-12-15 09:38

its very easy mah. next few months you all monitor if JPMORGAN BUY more gloves not loh

2020-12-15 09:40

@sutp

I was wondering why what he wrote gave me a sense of deja vu.

Geez, can't believe he'd stoop to plagiarising. Seriously KYY, have a bit of decency lah.

sutp, you did a good write up, and credit should be given to you.

2020-12-15 11:02

Now everyone could post comment in his article. The comment section is used to be turned off

2020-12-15 23:23

Kyy target price always go holland, the best example is Dayang>>AT>>Supermax

uncle u are now paper losing few thousand millions only, no worry just wait until supermax up to 24 then u happy lah, simple as that, dont tell me u cant wait as a long term investor.

2020-12-16 10:57

THIS IS A VERY GOOD OPPORTUNITY FOR U TO SELL YOUR GLOVES & SWITCH TO INSAS BEFORE TOO LATE LOH....!!

Posted by stockraider > Dec 16, 2020 10:54 AM | Report Abuse X

SHARP ADVANCEMENT IN INSAS SHARE PRICE COMING LOH...!!

Raider says let be practical mah...!!

If OCBC mark to market losses at SGD 8.42 as at 30-9-2020, now as at 16 December 2020 SGD 10.19, there will be a big write back of a few million back to the profit coming 31-12 2020 mah...!!

In other words Raider see a potential write back of more than rm 30m in the 2nd qtr 31-12-2020, that will basically improve the investment division profit mah...!!

This together with sengenic disposal, Insas will report more than Rm 70 million profit in December qtr loh....!!

Very sharep improvement in insas share price coming loh...!!

Sslee The investment holding & trading segment suffered a pre-tax loss of RM49.2 million due to unrealised mark to market losses of financial assets at fair value through profit or loss and derivative financial instruments (FY 2019: pre-tax profit of RM1.5 million)

Singapore OCBC price: 28/6/2019 Sing dollar 11.40

30/6/2020: Sing dollar 9.00

30/9/2020: Sing dollar 8.42

Now Sing dollar 10+. On 31/12/2020 with window dressing most likely will be close to 11.

2020-12-16 10:59

THIS IS AN EARLY INDICATION OF FUTURE IN ESCAPEABLE BAD TIME IS COMING FOR GLOVES LOH....!!

JP Morgan analysts believed that “the extraordinary phase of the industry cycle is over” and that the glove manufacturers’ increase in production capacity, which will reach nearly 90% in the next three to five years, will be reflected in the hiccups

– Of course, the increase in production capacity in the world is a fact and we are working on it ourselves. However, it is difficult to say when falling demand will overlap with growing supply. It is estimated that this will happen in mid-2022. However, we believe that we will be immune to this as we will mainly be making specialty gloves that are subject to slightly different rules. We will of course be able to produce mainstream gloves if it pays off – says Wiesław Żyznowski.

2020-12-16 11:11

Big J Shark and Big K Fish fight, we, as bilis can only hide and maybe eat popcorn

2020-12-16 11:50

.png)

speakup

aiyah the real reason is the USA is jealous we Malaysia got Top Glove the world's largest glove producer, just like the US is jealous China got Huawei the most innovative tech company in the world

2020-12-14 15:54