OSK is underrated - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 22 Mar 2021, 10:35 PM

OSK Holdings Berhad (“OSK” or “the Company”) began its stockbroking business in 1963 and was listed on the Kuala Lumpur Stock Exchange in 1991. OSK grew over the years to become a regional investment bank under OSK Investment Bank Berhad (“OSKIB”).

In 1997, OSK diversified into properties through its subsidiary company, OSK Property Holdings Berhad (“OSKPH”). When OSKIB became a regulated entity in 2007 by Bank Negara Malaysia, the shares of OSKH were distributed to the shareholders of OSK to comply with regulatory requirements.

In 2012, OSKIB merged with RHB Investment Bank Berhad in a share swap exercise resulting in OSK becoming a major shareholder in RHB Banking Group – the 4th largest bank in Malaysia, an investment holding position that OSK continues to hold 10% of the total issued shares of RHB until today.

Currently the last traded RHB share price is Rm 5.41 per share. Its market capitalisation is Rm 21,694 million. Its total issued shares is 4,010 million.

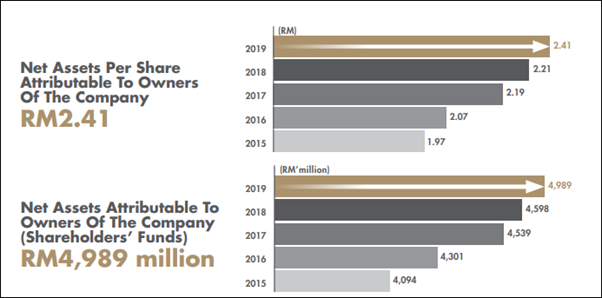

The last traded OSK share price is 98 sen and its market capitalisation is Rm 2,059 million. Its 10% of RHB is worth Rm 2,169 million which is more than its market capitalisation. Its NTA Rm 2.41 as you can see from its 2019 annual report.

After the merger, OSK Group in 2015 is transformed OSK into an enlarged entity with diversified business interests in five key segments, namely, Property, Construction, Financial Services, Industries and Hospitality.

OSK partners EPF in A$2.8b Melbourne project, first phase completed by 2020

OSK Holdings Bhd and Employees Provident Fund (EPF) as its financial partner to develop an upcoming five-acre (2.02ha) mixed-use development in Melbourne, Australia, with an expected gross development value (GDV) of some A$2.8 billion (RM9.39 billion).

The pension fund is taking a 49% equity interest in Yarra Park City Pty Ltd (YPC) for A$154 million, which holds the development rights for the Melbourne Square project located in Southbank, In a joint statement yesterday, EPF chief executive officer (CEO) Datuk Shahril Ridza Ridzuan said Melbourne Square will be the pension fund’s second development venture overseas after the Battersea Power Station project in London, the UK. EPF has a 20% stake in the consortium developing the Battersea project, together with property developers Sime Darby Bhd and S P Setia Bhd which have an equal stake of 40%.

EPF is partnering OSK, which owns the remaining 51% stake in YPC through its subsidiary PJ Development Holdings Bhd. PJ Development holds the stake via its wholly-owned Australian unit PJ (A) Pty Ltd (PJA) and Equity & Property Investment Corp Pty Ltd, a 27.4%-owned associate of PJA.

“The Melbourne property development befits EPF’s long-term objectives and will be a good addition to our overseas portfolio. The increasing demand for residential [property] in Melbourne will enable EPF to generate returns for its members,” said Shahril.

OSK CEO and group managing director Tan Sri Ong Leong Huat said Melbourne Square marks the group’s maiden foray into Melbourne.

“Melbourne Square will be an important destination within the world’s most liveable city as it also represents one of the last pieces of sizeable prime land available for an iconic development in Melbourne. We are delighted to partner EPF on this exciting project, and we hope to deliver a project which all Malaysians can be proud of,” Ong added.

In a filing with Bursa Malaysia yesterday, OSK said PJ Development had entered into a share sale agreement with EPF to sell its entire stake in Yarra Development Holdings (Australia) Sdn Bhd, which will in turn complete the subscription of new subscription shares representing a 49% stake in YPC.

OSK added that the stake disposal is expected to increase the group’s net earnings by A$38.2 million and make a foreign exchange gain on the total investment in YPC of RM49.2 million or 12.86 sen per share for the financial year ending Dec 31, 2017.

“The original cost of investment in YPC during May 2014 to February 2015 by PJ Development was A$94.1 million (RM267 million),” the group said.

Barring any unforeseen circumstances, the stake disposal and YPC subscription are expected to be completed within six months, said OSK.

According to OSK and EPF, the Melbourne Square development will transform a former carpark bounded by the West Gate Freeway and Kavanagh, Balston and Power streets in Southbank into a mixed-use community and retail centre.

“The project aims to give Southbank a ‘green heart’ with a public park and network of leafy spaces, as well as critical community infrastructure such as a childcare facility and a supermarket along with other retail options.

“Melbourne Square will comprise four towers of residential apartments, a retail mall, an office tower and a hotel/serviced apartment tower. The project will be developed in five stages over eight to 10 years,” they added.

Phase 1 of the development, which recently received the planning endorsement by the Victoria state government’s Department of Environment, Water and Planning, will feature two residential towers housing over 1,000 apartments, with a GDV of over A$900 million.

“Phase 1 will provide a showcase of green spaces and essential amenities including a beautiful urban park, a childcare centre, a supermarket, restaurants and cafés, and a comprehensive set of residential amenities.

“The scale of the site has enabled YPC to deliver a differentiated set of features that should set Melbourne Square apart from the other residential projects that are on offer in Melbourne city,” said OSK and EPF.

YPC has appointed a list of top-tier consultants for the project, including multiple award-winning Cox Architects to design the master plan and phase 1 of the project, Carr Design for interior design services, Sinclair Brook for project management and CBRE as the sales agent for phase 1, which was launched this month.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

Hit and run. Max 30%. Sedikit sedikit lama-lama jadi Bukit. Dulu punya Gunung gloves sudah runtuh!

2021-03-22 22:53

Tomorrow Uncle KOON will be selling off OSK to make a quick buck. Promote then sell to the clowns who start chasing OSK.

That's KYY's modus operandi.

2021-03-22 23:00

sekejap KPS, sekejap MRNB, sekejap OSK.

At umur 90, what is money to you? a burden?

At umur 90, still need do stock promotion? a desperation or a noble vocation?

I rasa ini satu keseksaan untuk uncle.

2021-03-22 23:16

Keyman188 very nervous & naive...

Keyman188 feel very scary behind the Master...

Keyman188 no so concern uncle...

Do you know who is the pilot of this co. !!!...

2021-03-22 23:17

Uncle I know the title for your next post already...

Instead of xxx stock is underrated, just say:

Koon Yew Yin is overrated

2021-03-23 00:18

Please do more charity instead of sucking naive retailers blood sweat money.

2021-03-23 00:42

hi uncle, u want see my writings mou... can see if it is UNDERRATED mou?

https://klse.i3investor.com/blogs/hearmeblow/2021-03-23-story-h1542931247-Other_than_Underrated.jsp

2021-03-23 00:44

Uncle Koon any progress on below:

https://koonyewyin.com/2020/05/23/trump-lost-his-way-groping-in-the-dark/

Quote, “Xingquan delisted from Bursa

This reminds me of Xingquan International Sports Holdings delisted from Bursa Malaysia for noncompliance with SC listing rules. The company failed to submit audited annual report. CIMB was the underwriter at Rm 1.60 for its IPO and the company raised more than RM 100 million. CIMB invited me to visit its factories in Xiamen, China. I have more than 100 million shares and I have engaged a legal firm called Chan & Associates to recover my loss. Unfortunately, this is another one of my bad investments.” Unquote

I wrote the below to SC yesterday:

https://klse.i3investor.com/blogs/Sslee_blog/2021-03-23-story-h1542931251-Justice_for_Xingquan_minority_shareholders.jsp

2021-03-23 07:42

Stale news. Shahril Ridza Ridzuan is now MD of Khazanah.

He resigned as CEO of EPF since Aug 2018, almost 2 1/2 years ago.

Still can goreng?

2021-03-23 08:12

pls la stop it la.. u dont write anything la pls. we dont need your recommendation. you just sit there quietly pls uncle. buy ur own share.. we are not interested to know what r u buying. after you sabotage mnrb now come and sabotage my osk.. go away la pls la. beg 9 u go away.

2021-03-23 09:27

enuf is enuf uncle, your influence is so much lesser compared to last time, u need to understand that your words make no sense to any investor anymore strongly proven from the way u suggested for glove counters. Your evil intention is simply just too obvious, please continue to do charity and assist more students via your kyy scholarship and please do stop buying call anymore.

2021-03-23 09:39

old man is a crook...those of you who dont know him might think this old man is an angel or is helping u .. but he cld be helping his own wallet.. :)

2021-03-23 09:45

I wont chase this. I will consider EUPE before uncle publishes article about EUPE

2021-03-23 09:54

Do ppl even follow this uncle's pick these days? You guys think market really follow fundamental meh? I really miss OTB than KYY tbh. KYY is the same as tan teng boo....

2021-03-23 15:50

Uncle lose a lot of money in gloves... you all faster help him recover... otherwise he cant fall asleep and keep writing articles to promote his CHEAPBUY.

2021-03-23 16:07

The last prediction with KPS caused a fake bubble and many are now holding hot potatoes

2021-03-23 16:51

It's always easy to blame someone else for a negative outcome when the shameless decision maker is yourself, right?

2021-03-23 17:12

@Sslee 23/03/2021 7:42 AM

...

Well-researched and exceptional effort by Sslee here. He "does something" constructive which helps small fry investors. Thank you.

2021-03-23 18:05

I bid lifetime goodbye to YTL and Osk shares or property projects since 9 years ago...

Never touch them... Ya, berjaya counters also... Still holding Bermaz auto ard rm2. 80

Lose my pants on all these 3 world renown brands. Now kyy wants to talk abt Osk!!!!

Bye bye

2021-03-24 08:59

when will KYY write to say about Eden...nta 77cts, ECRL projects and Muhyddin linked stock...maybe KYY and operators are collecting silently ????

2021-03-24 10:24

in most of the good sifu, they will tell you WHEN THE TIME HE POST THIS ARTICLE, HE OWN THE SHARE. EVEN TELL YOU HIS AVERAGE PRICE, YOU MAY TRADE AT YOUR OWN RISK.

simply because you costs is not same with his cost. when the time you enter, the price might already expensive. Wish you the best always.

2021-03-24 13:27

“It takes 20 years to build a reputation and five minutes to ruin it”. - Warren Buffett

2021-03-24 19:16

have a look at my blog post OSK Revisited: https://klse.i3investor.com/blogs/milosh/2021-06-06-story-h1566076037-OSK_5053_Revisited_Jun_21.jsp

2021-06-06 11:40

learnbyheart

lately everyday uncle boost one counter per day..and exit yesterday's pick. easy money from another fool people

2021-03-22 22:46