Hiap Teck reported good profit growth despite MCO shut down - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 30 Sep 2021, 07:43 AM

After I read the article from theedgemarket.com which I have reproduced for investors’ benefit, I have to revise my article. Before weak shareholders start to sell their holdings because Hiap Teck reported reduced profit, they should read this article and the one by theedge.com.

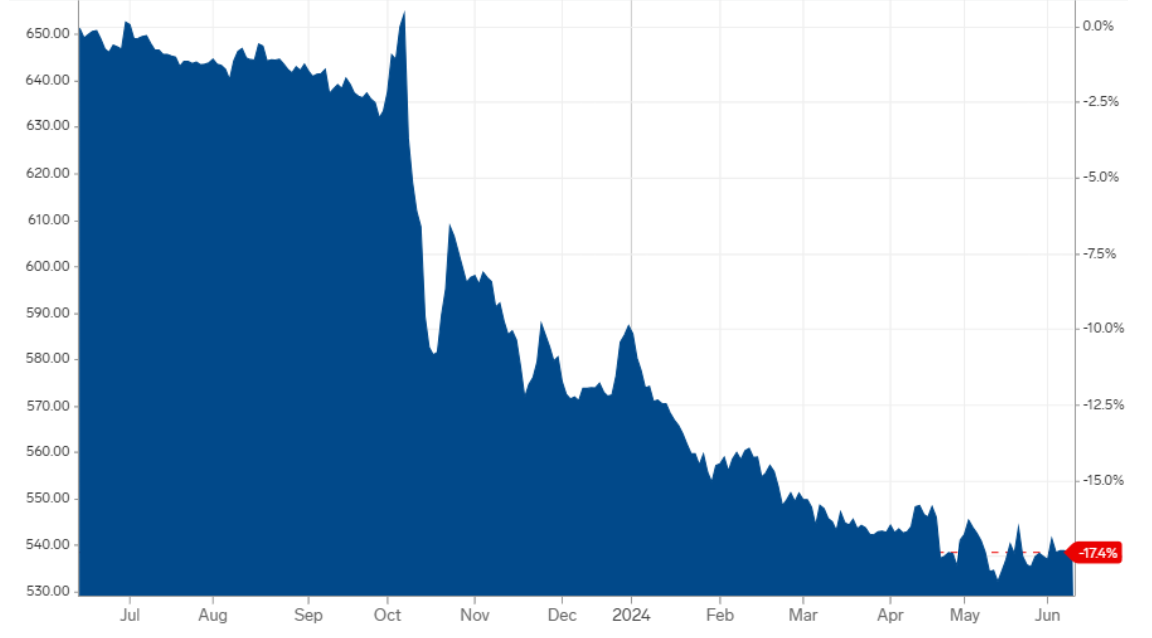

Hiap Teck just reported PAT Rm 60,484,000 or 4.26 sen for the quarter ending July. Its previous quarter EPS was 4.79 sen, a small reduction despite of 2 month shut down in its factory in Klang and 1 month shut down in its Blast furnace of Eastern Steel plant.

Despite of the 2 months and 1 month shut down, Hiap Teck can still report reasonably good profit.

On a quarter-on-quarter basis, however, net profit shrank 8.25% from RM65.93 million in the third quarter, as revenue dropped 50% from RM329.64 million, arising from lower sales at both the trading and manufacturing divisions due to the imposition of lockdown measures.

For the full financial year (FY21), Hiap Teck’s net profit saw a whopping jump to RM163.43 million from RM4.29 million in FY20. Twelve-month revenue rose 15.98% to RM1.08 billion from RM932.87 million.

“Despite all the challenges, the group recorded its highest profits ever with a profit after tax of RM163.5 million for FY21. Management is also positive on the group’s performance in the coming quarter due to the longer operating period, as the group resumed operations on Aug 16, 2021, the continued strength of steel prices and the expected recovery from the reopening of the economy,” the group said.

You can see the details below.

The reasons why I say Hiap Teck should perform much better in the next few quarters.

Vaccination

The number of people has been vaccinated is increasing very rapidly as shown on the chart below. 72.6% of our population have 1 dose and 62.4% of our population are fully vaccinated.

Covid 19 cases

The number of daily new Covid 19 cases is reducing rapidly as shown on the chart below. On 29 August the number of new daily Covid 19 cases was more than 20,000. Currently the number of daily new Covid 19 cases is about 12,500.

Based on the rapid increase of vaccination and the rapid reduction of the daily new Covid 19 cases, Hiap Teck factory and Eastern Steel Blast Furnace should be able to perform much better than last financial year. Clever investors with good foresight should be able to foresee that Hiap Teck can make more and more profit in the next few quarters.

I am obliged to inform you that 80% of my investment portfolio is Hiap Teck and 20% of my investment portfolio is AYS. I am not encouraging you to buy Hiap Teck to push up the share price to make me richer. In any case, the daily average number of shares traded is about 50 million. Whether you buy or sell will not make much difference.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Created by Koon Yew Yin | May 28, 2024

It is a human nature that most men would complain to their wives that they were overworked and the wives would tell their husbands to get some assistants. As a result, the number of staff increases...

Discussions

Morning Uncle KYY, good sharing. There is something I don't understand; the 'reversal of impairment loss of another RM66.15 million, which was provided in previous years'. Without this reversal, what actually will be the Q profit? Is the reporting Q doing well with high steel price and low feed (iron ore) price? Is it the factory not at optimum running during the reporting period? I have not yet investing and now only start follow this stock, maybe someone could explain further on this previous year impairment loss. TQ again for sharing. Happy trading and TradeAtYourOwnRisk.

2021-09-30 09:01

I do agreed with you BLee the Q4 result was not good at all.

The JV entity’s much improved performance can be attributable to the reversal of impairment loss of another RM66.15 million

which was provided in previous years. Does its mean that Without the this reversal of impairment loss this Q4 will be a loss ? Am I correct ?

2021-09-30 12:09

Mr. Koon, buy Annjoo too since it owns 100% of it businesses and has a dividend payout policy of 60%.

Hiap Teck, though may be able to make explosive profits from Eastern Steel with its rising throughput, at 35% stakes it may not be able to dictate the payout (like in JAKS situation, placed in a sea of money but unable to drink).

2021-09-30 17:40

abang_misai

Good luck uncle. I think market will sell down.

2021-09-30 07:51