Why did I buy AYS during the crash? Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 04 Nov 2021, 10:56 PM

Immediately after the Budget 2022 announcement, the stock market has been plunging in the last 3 trading days. Practically all the listed shares have been dropping so rapidly. On 1st November alone, Rm 33.8 billion was wiped off the market capitalisation of KLSE. This market crash can only mean that the Budget 2022 will not be good for our economy.

There are 2 items in the Budget 2022 proposal that will affect listed shares, investors and day traders.

1.The removal of the Rm 200 stamp duty per contract to be replaced by increasing 10 bps to 15 bps. This will discourage small investors.

2. The prosperity gain tax will be increased from 24% to 33%. All large cap companies whose annual profit exceeds Rm 100 million will have to pay more tax. This will discourage institutional and foreign investors.

When is the best time to buy shares?

The best time to buy is when most investors are fearful and rushing to sell their holdings irrespective of the quality of the stocks. I have posted many buy recommendations for AYS and I have been buying AYS which is the cheapest steel stocks in terms of PE ratio. Unfortunately, my critics choose to believe that when KYY recommends buy they should sell.

Yesterday RHB bought 1,251,500 AYS shares for me. You can confirm this if you ring Yee Ling RHB 05-2493279.

Unfortunately, in i3investors, there are a few critics hiding behind some fictitious names such as Squirtle, 007007, Zrenxy on AYS forum making senseless comments. They should check their track record to see why they are still so poor. If they keep saying that AYS is not a good stock to buy, can only mean that they do not even know how to select good growth stocks for investment.

AYS latest quarter EPS was 8.5 sen and its previous quarter EPS was 4.45 sen, a jump of about 100%. Its next quarter ending September profit should be much better as there is no more MCO shutdown. Its next quarter result will be announced before the end of this month.

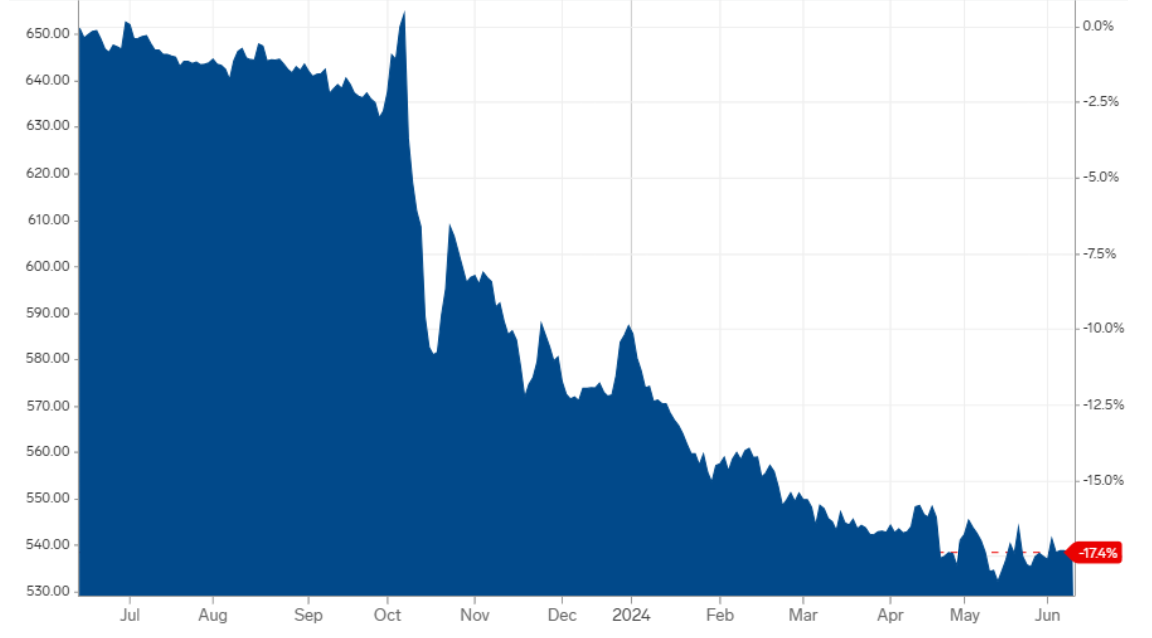

Its share price has been going up from 40 sen to a recent high of 87.5 sen on 29 Oct and closed at 70 sen yesterday as shown on the chart below.

Hong Kong stock market crashed in 1983: In fact, this situation reminds me of my experience in the Hong Kong stock market. In 1983 the Hong Kong stock market crashed when China gave notice to the British government to recover the sovereignty of Hong Kong after the 100 years lease had expired. The Hang Seng index fell below 1,000 points.

There were so many undervalued stocks on basement cheap sale. The first stock I selected to buy was Hong Reality and Trust (HKRT). The controlling shareholder was a Jew called Willock Marden. Just before the stock market crash, HKRT sold Willock House, a multi storey office building in HK Central. Each HKRT share had a cash value of $ 10 and it was selling at $ 14 before the crash. But during the crash, it was selling below $4.

As soon as China gave another 50 years lease extension, the stock market rebounded sharply. HKRT shot up higher than its price before the crash. Investors were rushing to buy HKRT at $ 16. To cut the story short, within 3 years, I bought 46% of a stock broking company called Kaiser Stocks and Shares Co. Ltd. in Hong Kong. Now Hang Seng index is 25,100.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

Wednesday sell down was because of cool down of China properties market that dumper the steels price

2021-11-04 23:21

no genuine remiser or agent representative will ever reveal the sensitive info of their client to the public.

pakai otaklah.

2021-11-04 23:46

China has more than 65 million of unsold homes and more coming into the market. Better be xtra careful le....

2021-11-05 08:03

Wakaka Unkle Koon is mention me

I is becoming femes hehe

Thankiew Thankiew

2021-11-05 09:38

Waiting for uncle to announce, "why Genetec is undervalued and why you should buy it"

2021-11-05 10:53

" The best time to buy is when most investors are fearful. " Tons of wisdom coming

from kyy.

2021-11-05 11:11

kyy does not understand Chinese communist history,and their policy, not abit.he was just lucky , 30 years ago when Deng adopted open door policy, and while Xi today introduced a close-door policy.

2021-11-05 15:21

What a big issue as AYS only make small profit 15 sen /sh as compare to Supermx 147sen/sh. From here we know what to buy.

2021-11-05 17:52

As a steel trading company, I believe AYS fair value is 40 sen to 50 sen in view of steel price volatility and recent downtrend in steel prices.

2021-11-06 09:25

Koon Bee never address on this part ( trading nature of AYS)...only talk abt good profit of last few Q n expect the good profit can last forever...

2021-11-06 09:31

Most commodity co r trading at single digit PE due to their cyclical nature in biz. Steel Co will be the same.

2021-11-06 09:34

this looks like gloves last year, ASP peaked and chart turned downtrend, now in denial mode. Mr Koon. how you have bad mouth on gloves, do you still remember?

2021-11-06 12:03

Bye bye uncle Kyy. You fear your stock goes down? My good luck with your family dog doing better tricks

2021-11-06 16:21

wineight

i will support you

2021-11-04 22:59