Use margin finance is good or bad? Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 11 Nov 2021, 09:32 AM

Ever since the announcement of the Budget 2022, practically all the listed stocks have fallen in price. As a result, all the investors including myself who used margin finance, would have margin calls. I am not ashamed to admit that I also have to sell some of my holdings to meet margin call.

So, the question “use margin finance is good or bad?” for investors?

Yesterday I wrote and posted an article with the title “How to use margin finance to make more money” in which I only mentioned all the advantages without mentioning some of the disadvantages.

Margin finance is a double-edged sword. It cuts both ways. It can have both favourable and unfavourable consequences.

Margin finance is not for novice investors. Unless you have the necessary experience in selecting good growth stocks, you should not use margin finance and hope to make more money.

As I said before, I have been borrowing money to do more business or to buy more stocks to make more money. Of course, it is risky to borrow money or use margin finance, no risk no gain. If I dare not borrow money, I would not have co-founded so many listed and unlisted companies, namely Muda Jaya, Gamuda, IJM, MBMR, Rubberex etc.

Stock market crash is not so frequent

The stock market plunging so badly like the current situation is not so common. As I said in my previous article namely “Budget 2022 is killing investors”, on the first day after the Budget 2022 announcement, Rm 33 billion was wiped off from the market capitalisation of Bursa.

The prosperity tax increase from 24% to 33% for profit exceeding Rm 100 million is the biggest culprit. Institutional and foreign investors are dumping their holdings because they expect to see all the big companies to report reduced profit due to the additional taxes. The plunging of the big cap stocks is pulling down all the smaller cap stocks including all the steel stocks.

Comments on i3investor

Steel price does not affect AYS’ profit.

I often see many commentators on AYS forum said that the share price of AYS is dropping because the steel price is dropping in China. That is not true because AYS is not a steel manufacturer. It is a steel trader. It buys steel from the cheapest steel producer to sell to construction contractors.

Even during the Covid 19 MCO lockdown, AYS reported 8.5 sen EPS in its latest quarter ending June. Currently there is no more MCO lockdown, AYS should report better profit than EPS 8.5 sen in its next quarter ending Sept. which be announced before the end of this month. Investors with good foresight should be waiting patiently to see the coming profit announcement.

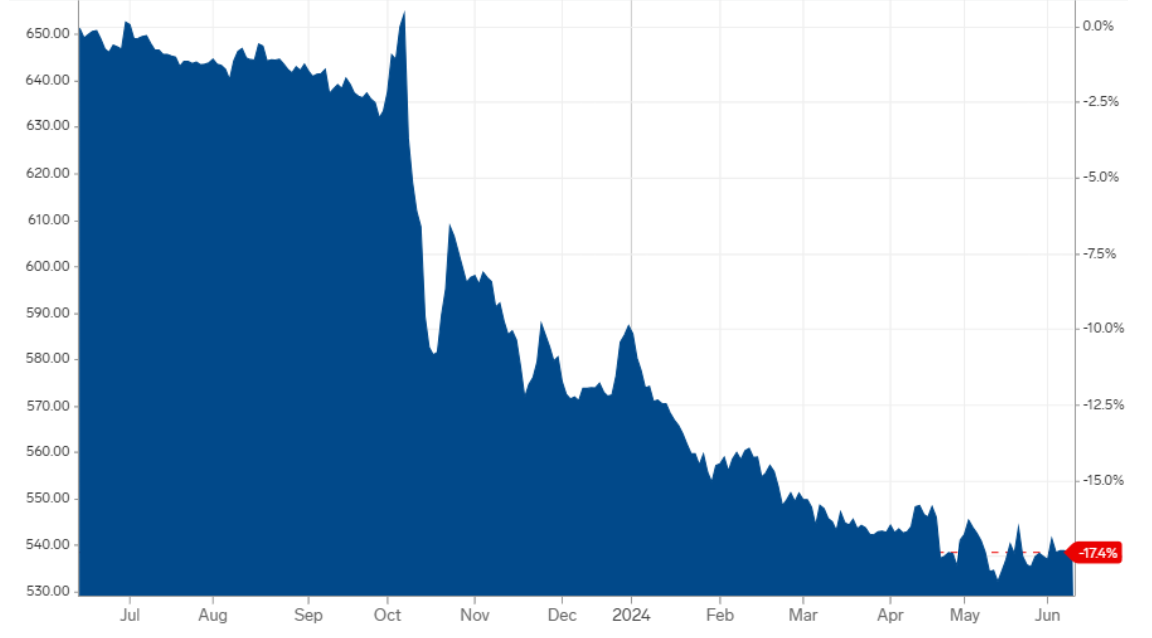

It has been dropping ever since the Budget 2022 announcement. The last traded price is 63 sen. It is ridiculously cheap. I checked and found out that AYS is the cheapest steel stock among all the steel companies in terms of PE ratio.

As I said before no stock can go up or down continuously for whatever reason. After some time, its trend will change. The best time to buy any stock at its pivoting point when it starts to rebound. AYS should rebound soon.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

If u have lands to sell in Ipoh when u meets margin call then ok lah can hentam 99

2021-11-12 08:54

for a bull market ,to use margin trading ,you get an add-on advantage, for side-way ,stagnant market , it is worthless, but in a bear market , margin trading could make you bankrupt.

2021-11-12 15:55

If you look at the balance sheet, rota, roe, dy etc this company is comparatively speaking not great in my view.. Steel counters like tongher, cscstel looks like safer bets provided steel prices are adversely impacted...

2021-11-12 21:30

Colgate

Uncle still can fool Newbies but not Oldbies. You so desperate ask Newbies to use Margins to buy your stock? Haha

2021-11-12 05:49