Institutional Investors are pushing up AYS - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 03 Jan 2022, 08:10 PM

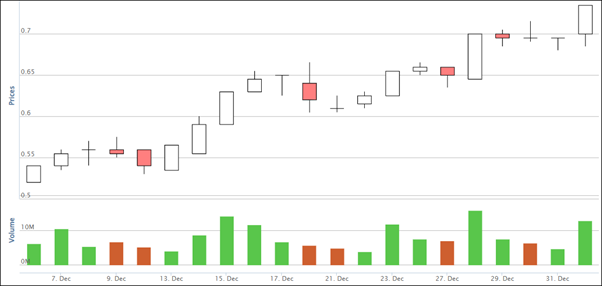

Today AYS shot up 4 sen with an increased volume of 12.9 million shares traded. AYS price chart below shows that its price was 54 sen on 6 Dec and closed at 73.5 sen today, an increase of 19.5 sen or 36% in the last 20 trading days.

AYS share placement to Institutional Investors

On 2nd November AYS share price was traded at 88 sen and the company placed out 10% of its total issued shares or 38 million shares with a discount at 76 sen to big Institutional Investors who must know the company operation and its profit growth potential.

No investors would buy 38 million AYS shares unless they know that AYS is not affected by the steel price in the open market. AYS is not producing steel. It is only buying steel from the cheapest steel producers to sell to construction contractors. When the steel price has gone up, AYS has to buys steel at higher price and pass the additional cost to the buyers.

Currently, there is no more MCO lockdown and you can see there are more construction activities in every town and city in Malaysia.

As a result, the demand for steel has increased. Based on the increased volume and increased share price, it looks like Institutional Investors are rushing to push up the share price because they have bought the placement shares at much higher price. Otherwise, they would be considered inefficient as fund managers.

My target price for AYS

Its 2nd quarter ending Sept EPS was 6.51 sen and its 1st quarter ending June EPS was 8.5 sen, totalling 15 sen for 1st half year. All these profits were achieved during the Covid 19 pandemic MCO lockdown. Currently there is no more MCO lockdown and AYS should be able to make better profit in its 2nd half year than its 1st half year.

Assuming its 2nd half year performance is the same as its 1st half year, its annual profit EPS will be 30 sen per share.

Based on PE 3, AYS should be 90 sen.

Based on PE 4, AYS should be Rm 1.20.

Based on PE 5, AYS should be Rm 1.50.

The last traded price was 73.5 sen.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

more like the vested are pushing it. better demand would see a sectoral pop, not today's trickle.

2022-01-03 21:21

Desperate time call for desperate measure. Interest is adding up daily. Double down his bet now

2022-01-04 15:32

abang_misai

Koon, you sudah makan obat?

2022-01-03 21:11