Hengyuan’s profit growth is doubtful - Koon Yew Yin

Koon Yew Yin

Publish date: Sat, 07 May 2022, 11:42 AM

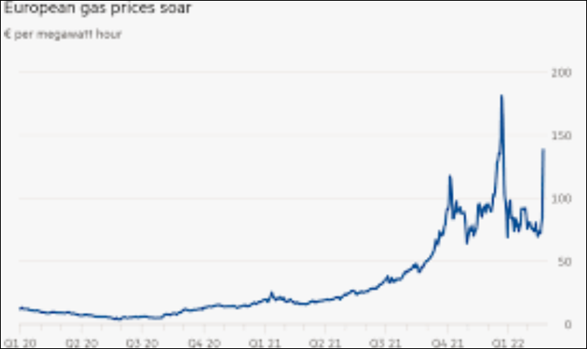

Russia invaded Ukraine on 24 February. Russia is one of the largest petroleum producers in the world. Due to sanctions on Russia, oil and gas prices have sky rocked in Europe as shown on the chart below.

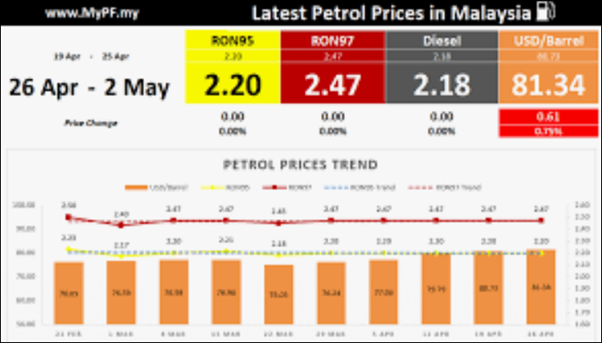

In Malaysia petrol and gas prices have not gone up as shown on the chart above.

Description of Hengyuan:

Hengyuan Refining Co Bhd is engaged in refining and manufacturing of petroleum products in Malaysia. The company’s operating units in its refinery consist of two crude distillers, a long residue catalytic cracker, two naptha treaters and a merox plant, two reformers, and a gasoil treatment plant. Its product portfolio consists of liquefied petroleum gas (LPG), gasoline, diesel, aviation fuel, fuel oil components, and chemical feedstocks like light naphtha and propylene. Its segment consists of manufacturing of petroleum products with all of the operations in Malaysia. Majority of its revenue is derived from the sale of refined petroleum products.

Unfortunately, many less informed investors rushed to buy Hengyuan Refining and push up its share price as shown on the price chart below.

Hengyuan buys crude oil from Petronas to produce various petroleum products for sale.

Hengyuan reported 59.93 sen EPS for the quarter ending December and 18.01 sen loss for the quarter ending September. How could it lose money in its previous quarter?

It made unprecedented profit because Hengyuan bought the crude oil when the price was low as shown on the price chart above. The oil in its storage tanks have appreciated in value.

In my opinion, Hengyuan’s profit growth prospect is doubtful because Petronas being one of the largest petroleum producers in the world, will also increase its selling price.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

uncle Koon, for your reading pleasure:

https://klse1.i3investor.com/blogs/2017/2022-05-07-story-h1622469652-Hengyuan_2_pictures_says_a_thousand_word.jsp

2022-05-07 12:02

Frequently asked questions on refinery like HRC for investors knowledge:

https://investor.esso.co.th/en/frequently-asked-questions

Why are refined product prices set based on singapore market prices?

.........

Oil is a commodity product in a market which is highly competitive. Pricing policy or production and sale strategies of a market player can impact the overall market as the other players may consequently make price adjustments in order to maintain their competitiveness. Therefore, the to-be reference oil price should be determined by demand and supply capabilities in free markets within a given proximity. This approach which is similar to what is done with agricultural goods such as fruit reference prices at Tai market or rice reference prices at Kumnun Song market.

The three major oil trading regions are North America, Europe and Asia Pacific. The AP trading hub is in Singapore as it is the biggest exporting country in the region. Singapore reference prices are not refined product prices set by Singapore government or refineries. They essentially are the prices of products which are traded in Singapore by oil traders in the region.

Thailand is in the AP region and located near Singapore; therefore, it is logical that Singapore oil prices are used as reference prices. Singapore oil prices not only reflect equilibrium prices of free markets in the region but also globally align with the other regional trading hubs.

2022-05-07 12:31

HengYuan (and PetronM) share price is going up NOT because of high oil price. If that's the case, it would have gone up many months ago.

Hengyuan (and PetronM) share price is going up because restriction has been relaxed and people are not starting to utilize more petrol. Simple as that.

2022-05-07 12:39

The 5 years crude sourcing from Shell is over by 22 Dec 2021, I believe Hengyuan being a smart China management would have sourced crude oil from Russia:

https://www.euractiv.com/section/energy-environment/news/the-fossil-fuel-companies-profiting-from-europes-oil-trade-with-russia/

The company’s refining margins jumped to staggering levels in March, according to media reports.

Compared to the previous ten-year record of $9.3 per barrel on refined products, MOL earned $34.9 per barrel of oil refined in March.

This is largely due to the much lower price of the Russian export oil blend (REBCO) used in MOL’s refineries compared to other types of oil.

2022-05-07 12:49

Hihihaha! Grandpa Koon still doesn't know what he is talking about! Maybe once Hengyuan hit RM20, he will make a uturn and promote it aggressively! Grandpa Koon is always late for the party anyway!

2022-05-07 12:50

The beauty is that their margin (as a minimum) are fixed against Brent at Means of Platts Singapore for the next 5 years while they are free to source crude from anyone to expand it....

its like there is a minimum margin but no maximum

simply brilliant!

2022-05-07 12:55

Dear Mr Koon,

It is clear that you are selling oil palm and buying Heng Yuan. However you must remember what happened in the past in Heng Yuan where you and many others were burnt badly. Remember, what goes up must come down. Especially a cyclical stock like Heng Yuan. All the promoters will disappear when Heng Yuan crashes to the depths of the world, and when the 'crack spread' and one off inventory gains turn to losses

Sincerely,

EMSVSI

2022-05-07 13:00

Hurricane Harvey is a temporary blip in 2017...it is incomparable to whats happening now

A new golden age of oil refiners

https://www.home.saxo/en-mena/content/articles/equities/a-new-golden-age-of-oil-refiners-04052022

https://klse1.i3investor.com/blogs/Crackspreads/2022-05-06-story-h1622444383-Why_crack_spreads_for_refined_oil_products_have_NOT_peaked.jsp

Posted by emsvsi > May 7, 2022 1:00 PM | Report Abuse

Dear Mr Koon,

It is clear that you are selling oil palm and buying Heng Yuan. However you must remember what happened in the past in Heng Yuan where you and many others were burnt badly. Remember, what goes up must come down. Especially a cyclical stock like Heng Yuan. All the promoters will disappear when Heng Yuan crashes to the depths of the world, and when the 'crack spread' and one off inventory gains turn to losses

Sincerely,

EMSVSI

2022-05-07 13:05

Someone should remind damn old fox by writing 50 reasons never to listen to KYY as he got f Ed in Jake’s, Dayang, TG etc

2022-05-07 14:13

People were talking that Heng Yuan would touch RM30 since late 2020 but it didn't happen. Will it happen this time around? It is very controversial indeed.

2022-05-07 14:16

Sunspel coupons code is best code provided by Sunspel . Amazing Discount Offers, Get Sunspel & Promo Codes and save up to 10% on the offer, so get the code helps you to save on coupon and promo codes

https://uttercoupons.com/front/store-profile/sunspel-coupons

2022-05-07 14:44

lowest HY can drop will be at 3.50 level..currently ride on the profit slowly sell few lots to collect profit and look for other stock which will spike up

2022-05-07 17:45

Shandong-based independent refinery buying Russian crude discounted $35 per barrel against Brent crude

MAY 4 2022

https://www.ft.com/content/4f277a24-d681-421a-9c94-29d6fd448b20

China’s independent refiners have been discreetly buying Russian oil at steep discounts as western countries suspend their own purchases and explore potential embargoes because of the war in Ukraine.

An official at a Shandong-based independent refinery said it had not publicly reported deals with Russian oil suppliers since the Ukraine war started in order to avoid attracting scrutiny and being hit by US sanctions.

The official added that the refinery had taken over some of the purchase quota for Russian crude from state-owned commodity trading firms, which are seen to represent Beijing and have mostly declined to sign new supply contracts.

Many western companies are self-sanctioning or struggling to secure the insurance, shipping or financing needed to buy Russia’s commodity exports, raising expectations that energy-hungry China will step in and buy the unsold barrels.

The purchases from China’s independent refineries reveal how some importers are bypassing traditional routes to access cheap Russian oil, helping Beijing maintain a low profile as the west barrages Moscow with sanctions.

.......

Brian Gallagher, head of investor relations at Belgian tanker group Euronav, said the consolidation of Russia oil on to larger ships for transport to Asia was “unusual”. But with Urals discounted $35 per barrel against Brent crude, he added that Chinese refineries were motivated to buy.

2022-05-07 20:47

very simple...

1. high profit margin (high Crack Spread)

2. high inventory level (high oil price)

3. high demand (restriction lifted)

4. high cost, high profit loh but better margin now

so, why doubtful ?

2022-05-07 21:56

You think Year 2017 have cheap crude oil buy?

And make the earning 200m and 300m per quarter?

Mislead people again?

2022-05-07 23:52

KYY is damn ignorant that it is the Malaysian government paying the difference between international price and local subsidized price .

It is going to cost the government over RM28 bil as crude stay well above usd 100 .

——————————

Malaysia's 2022 petroleum subsidy to rise to RM28b from RM11b in 2021 if crude oil prices remain above US$100/barrel — Tengku Zafrul

2022-05-08 06:40

Petronas being one of the largest petroleum producers in the world, will also increase its selling price. >>>If Hengyuan bought 109.7/barrel from petronas, she will sell 135/barrel. KYY know nothing about crack spread? I dont think so, He purposely ignore the crack spread and inventory gain.

https://www.tradingview.com/chart/mgDGRZGu/?symbol=NYMEX%3ACL1%21

Oil enjoy a marvelous uptrend , from the chart , obviously Hengyuan will made huge profit from the inventory gain.

https://www.tradingview.com/chart/mgDGRZGu/?symbol=NYMEX%3ACL1%21

and please check the crack spread , is record high.

PAT 900 M is doubtful , but 300 m to 800 m is certain.

2022-05-08 09:17

Below is what KYY wrote in 2017. He explained how crack spread determines profitability of a refinery. Now he said doubtful. That’s how cunning he can be !

————————————

Hengyuan: Detailed explanation of its profit margin or crack spread

admin admin

4 years ago

I have written several articles recommending buy on Hengyuan which you can find on my blog. Those who have bought should be laughing and some wanted to know why I am so bullish to buy Hengyuan.

I am not asking you to buy to push up the price to make me richer because based on the huge volume traded daily, obviously big financial institutions are buying aggressively. These financial institutional investors have their experts to analyse the stock in detailed before they buy.

Let me try to give you a clearly understanding of Hengyuan’s business operation.

Hengyuan is in the oil refinery business. It buys crude oil to refine it into several types of oil products which are selling at different prices. The most expensive is high grade petroleum and the cheapest is bitumen tar for the road surface.

Its profit essentially depends on its margin of profit or crack spread.

Crack spread is a term used on the oil industry and futures trading for the differential between the price of crude oil and petroleum products extracted from it. The spread approximates the profit margin that an oil refinery can expect to make by “cracking” the long-chain hydrocarbons of crude oil into useful shorter-chain petroleum products.

In the futures markets, the “crack spread” is a specific spread trade involving simultaneously buying and selling contracts in crude oil and one or more derivative products, typically gasoline and heating oil. Oil refineries may trade a crack spread to hedge the price risk of their operations, while speculators attempt to profit from changes in the oil/gasoline price differential.

Factors affecting the crack spread

One of the most important factors affecting the crack spread is the relative proportion of various petroleum products produced by a refinery. Refineries produce many products from crude oil, including gasoline, kerosene, diesel, heating oil, aviation fuel, asphalt and others. To some degree, the proportion of each product produced can be varied in order to suit the demands of the local market. Regional differences in the demand for each refined product depend upon the relative demand for fuel for heating, cooking or transportation purposes. Within a region, there can also be seasonal differences in demand for heating fuel versus transportation fuel.

The mix of refined products is also affected by the particular blend of crude oil feedstock processed by a refinery, and by the capabilities of the refinery. Heavier crude oils contain a higher proportion of heavy hydrocarbons composed of longer carbon chains. As a result, heavy crude oil is more difficult to refine into lighter products such as gasoline. A refinery using less sophisticated processes will be constrained in its ability to optimize its mix of refined products when processing heavy oil.

The crack spread chart

The chart below shows Hengyuan’s crack spread which has been low in the 1st half year and is improving for the 2nd half year.

As a result, its 1st half year eps was only Rm 1.20, as announced its 3nd quarter was Rm 1.21 and 4th quarter should be better than the 3rd quarter. Assuming its 4th quarter eps is Rm 1.30, its total eps for the year will be Rm 3.71 per share.

Assuming it will be selling at P/E 5, the price should be Rm 18 per share, when its 4th quarter result is announced before the end of February 2018. Can you find another stock with similar quality selling P/E 5?

2022-05-08 13:29

Indonesia’s Pertamina eyes cheaper Russian oil

https://www.energyvoice.com/oilandgas/asia/399254/indonesias-pertamina-eyes-cheaper-russian-oil/

“Politically, there’s no problem as long as the company we are dealing with was not sanctioned. We have also discussed the payment arrangement, which may go through India,” she told parliament members.

Indonesia holds the G20 presidency this year and has said it will remain neutral amid the Russia-Ukraine conflict, which has sparked the biggest humanitarian and geopolitical crisis in Europe since World War Two. The Indonesian government has raised concerns about the invasion but stopped short of condemning it.

2022-05-08 15:28

SUPERB NEWS! this is truely fantastic for Hengyuan...

They can guzzle all the RUSSIAN CRUDE they want!!

....................

Malaysia does not recognise unilateral sanctions, remains non-aligned to any side

https://www.malaymail.com/news/malaysia/2022/05/08/saifuddin-malaysia-does-not-recognise-unilateral-sanctions-remains-non-alig/2057677

2022-05-08 15:28

Hahaha uncle Koontz don't rush in later with margin All in rm30 again ah then

2022-05-08 16:47

Be careful. Uncle Koon wants to buy cheap. That's why giving talking nonsense hoping to bring the price down. Always do opposite what he says. Talking from his own self interest.

2022-05-08 16:50

When he say lousy things about a share, he is accumulating..

When he promote something, he is actually selling.... lol...

First said Jaya Tiasa is the best.... now say Subur Tiasa is the best... Ding donging the blind followers...

Now say Hengyuan’s profit growth is doubtful..... (accumulating???)...then when Hengyuan's result out in few weeks time he will write...."why I buy Hengyuan" or "why I sia lang hengyuan"... by the time the profit announce the price is about RM12.00??? =D

LOL.....

Please read his blog carefully and read between the lines..... "It made unprecedented profit because Hengyuan bought the crude oil when the price was low as shown on the price chart above. The oil in its storage tanks have appreciated in value."

Hengyuan share price hits RM18 back in 2017/2018 when oil price was $60++

Now oil price is constantly trading above $100, what's the new target price? RM38??? =D

2022-05-08 17:38

Saudi Arabia's Energy Minister Prince Abdulaziz bin Salman said on Monday the gap between crude prices and prices for jet fuel, diesel and gasoline was around 60% in some cases due to lack of investment in refining capacity.

https://www.reuters.com/world/middle-east/saudi-energy-minister-says-gap-between-crude-prices-fuel-mobility-prices-around-2022-05-09/

2022-05-09 22:56

probability

What would you need to justify a TP of RM 12 with PE 5?

.......................................................

(PE 5 is conservative considering its just the beginning of golden age for refinery now)

If you see Q4 21'results which delivered EPS of 60 cents. You only need such performance on average every quarter for TP of RM 12 with PE5.

During this quarter, the Gross Profit added with other Operating Gains was MYR 309m.

This is the gross refining margin you need with a stable oil price (not dropping) in order to deliver EPS of 60 cents per quarter as you have not even subtracted the manufacturing cost.

Lets see what is the average crack spread you would need to deliver the above earnings going forward:

Barrels processed / sold per Qtr average 10.5 m

Gross refining margin per barrel needed:

= ( MYR 309 ) * (1/4.2) / (10.5 m barrels)

= USD 7.0/brl

Hope with the above people will realize its not that hard to hit RM 12 with current refining margin exceeding USD 20 / brl

2022-05-07 12:00