How inflation affects you? Koon Yew Yin

Koon Yew Yin

Publish date: Tue, 03 Jan 2023, 02:43 PM

Russia invaded Ukraine on 24 February 2022. Ukraine is one of the largest wheat producers in the world and its wheat export is being disrupted. NATO countries including US imposed trade sanction on Russia. Russia if one of the biggest wheat, fertilizer and petroleum producers in the world. As a result, the prices of wheat, fertilizer, petroleum and gas have been shooting up higher and higher.

Recently you can see everything has gone up in price and your wife and children are wanting more money from you.

Malaysia Inflation is not so bad when compared with many other countries as shown on the last 5 years below:

U.K. inflation rose to another 40-year high in July as spiraling food and energy prices continued to intensify the country’s historic squeeze on households.

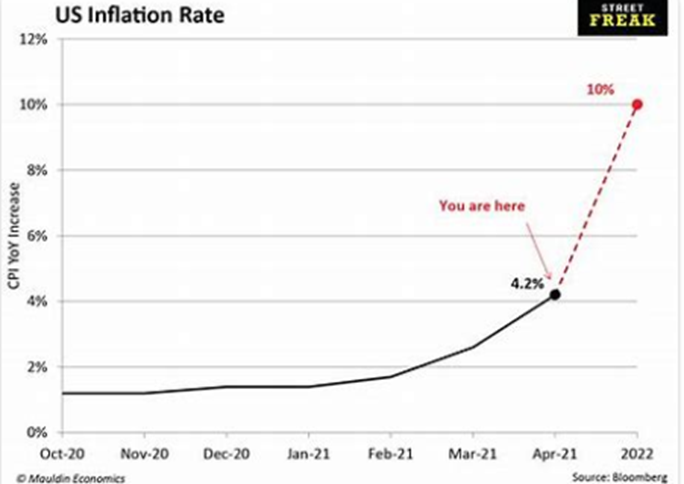

US inflation in 2022 in the wake of the COVID-19 pandemic, inflation reached 8.5%, its highest rate since 1982.

China inflation in 2022 is relatively low and under control as shown below:

The consumer price index rose 10.1% annually, according to estimates published by the Office for National Statistics on Wednesday, above a Reuters consensus forecast of 9.8% and up from 9.4% in June.

What causes inflation?

Inflation is caused by the gradual increase in the prices of goods and services throughout the economy. Low inflation is necessary for the economy, but too much inflation causes serious problems.

Inflation has spun out of control lately. According to the Bureau of Labor Statistics (BLS), in June 2022 inflation measured by the consumer price index (CPI) increased 9.1% over the prior 12 months. Despite the best efforts of the Federal Reserve to tamp down inflation, prices keep climbing.

Rising inflation rates mean everything from groceries to cars become more expensive, and it may be harder to afford everyday essentials. You can better protect your finances by understanding how inflation works and what causes it.

What Is Inflation?

If you’ve walked through a grocery store or the shopping mall lately, chances are you’ve been shocked to see how much prices have increased on all sorts of things. The cost of everything from clothes to cereal has risen sharply—all due to inflation.

Inflation is nothing more than broad-based price increases throughout the economy. To measure inflation, statistical agencies collect data on current prices for different goods and services and compare them to prices for the same things in the past.

For example, the CPI measures the changes in prices paid by U.S. consumers for food, fuel, housing, transportation, apparel, medical care and other expenses. The personal consumption expenditures price index (PCE) takes a similar approach.

These price indexes serve as representative samples that allow economists, investors and regular people to understand how prices change over time. When analysts talk about inflation, they’re referring to the percentage change of the index, which reflects the change in purchasing power of your money.

Impact of Inflation

Over time, inflation can cause a dollar to be worth less than it used to be, lowering all consumers’ purchasing power. As a result, they need to earn more money to maintain the same standard of living.

For example, let’s say you earned $3,000 monthly in July 2012. To maintain that same level of buying power and compensate for inflation, you’d need to make $3,800 today.

You can use the BLS’s online inflation calculator to see how the value of the dollar has changed over time.

What Causes Inflation?

Inflation significantly impacts people’s daily lives, but what causes inflation? There are a few contributing factors:

Demand-Pull Inflation

One factor is demand-pull inflation. That’s when there is an increase in demand for goods and services but not enough of a corresponding increase in supply. In the short term, businesses can’t scale their production quickly enough to meet the demand. As a result, prices increase.

Cost-Push Inflation

In some cases, it’s not just an increase in demand that drives up prices but also an increase in production costs for businesses. This issue is called cost-push inflation.

For example, increasing raw materials or labor costs could force businesses to raise prices on the goods and services they sell. If enough businesses are affected and raise their prices, it can lead to an overall increase in prices and higher inflation rates.

Devaluation

Devaluation occurs when a currency loses value in comparison to other currencies. This makes imports more expensive and can lead to inflation.

If the U.S. dollar devalues against the euro, it takes more dollars to purchase the same amount of euros. If a business imports goods from Europe, it may need to raise prices to cover the increased cost.

Rising Wages

There are conflicting views on how much higher wages affect inflation.

Although higher wages may sound like a good thing for workers, some economic experts believe there can be some consequences, particularly when it comes to raising the minimum wage for workers.

When workers earn more money, they may have more spending money on goods and services. Increased demand could cause businesses to raise their prices to cover higher production and labor costs.

Other experts disagree. They say that past minimum wage increases did not correspond with inflation hikes. Inflation rates may be curbed because employers might hire fewer workers, or there may be higher productivity levels.

Inflation Expectations

When companies and workers start worrying about inflation, their fears can lead them to expect higher inflation results. As a result, workers may ask for higher wages to offset the increased cost of living. But it’s a self-fulfilling prophecy: their fears can worsen the problem.

To afford higher wages for their workers, companies have to increase their prices. When companies think raw materials cost more, they will also hike their prices to maintain their profit margins. Combined, that means inflation expectations can cause inflation rates to rise.

How to Protect Your Finances From Inflation

Inflation can make it more expensive to buy the things you used to be able to afford easily. However, there are some steps you can take now to protect yourself from rising inflation:

- Switch to a high-yield savings account. Keeping cash in a checking account may seem safe, but your money is actually losing value due to inflation. Instead, tuck money away into a high-yield savings account so you’ll earn a higher annual percentage yield (APY). While you might not make up all losses in value to inflation, you won’t lose as much value as you would stashing money in a home safe or basic savings account.

- Invest in the stock market. Another way to keep up with inflation is by investing in the stock market. While volatile, the stock market’s average annual return between 1926 and 2021 with an all-stock portfolio was 12.3%, according to data published by Vanguard. Smoothing out the rough edges in years with losses means that your money can grow in value over time. That said, investing involves risks, so make sure you understand what you’re getting into before putting any money into the market.

- Diversify Your Portfolio. When it comes to investing, don’t put all your eggs in one basket. Diversifying your portfolio with stocks, bonds, and other assets can help minimize your losses if one investment doesn’t perform well. For example, investing in a broad market index fund allows you to invest in hundreds of stocks simultaneously.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.