IPO - DC Healthcare Holdings Berhad (Part 2)

MQTrader Jesse

Publish date: Fri, 30 Jun 2023, 02:31 PM

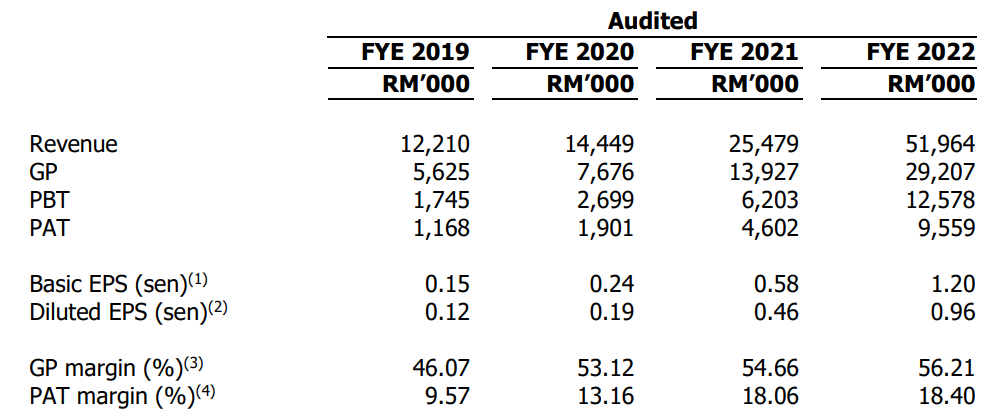

Financial Highlights

The table below sets out the historical financial information based on the audited consolidated financial statements for the Financial Periods Under Review:

- The revenue increased from RM 12 million (FYE 2019) to RM 51 million (FYE 2022), showing the company is expanding its market share in this sector.

- The gross profit margin consistently grew from 46.07% (FYE2019) to 56.21% (FYE2022), which also shows that the management can still control costs and negotiate for higher prices. (Generally, a GP margin of 20% is considered high/ good).

- PAT margin increased from 9.57% (FYE 2019) to 18.40% (FYE 2022).

- The gearing ratio is 0.29 times, which falls within the healthy benchmark range. This also shows that the company has leveraged its resources at a reasonable level. (A good gearing ratio should be between 0.25 – 0.5).

Major customer and supplier

Major Customers

The company’s business is not dependent on a single major customer for the Financial Years Under Review as the customers are primarily consumers or individuals. The customer base primarily comprises walk-in customers at its physical clinics and customers who purchase products on online platforms. The sales contribution from each customer as a percentage of the Group’s revenue is negligible. As such, the company does not have any major customers and hence they are not dependent on any single customer for the business.

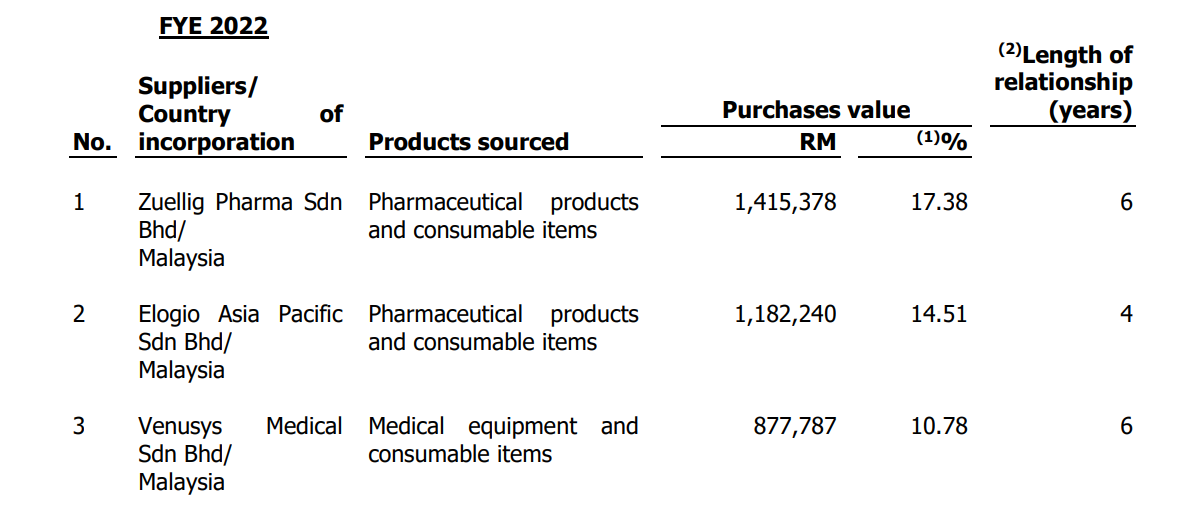

Major Suppliers

The table below lists the top 5 major suppliers for the Financial Years Under Review.

Based on the table, the top 5 suppliers account for approximately 51% of total purchases. The company has mentioned that they do not have any long-term agreements or arrangements with any of the major suppliers. During the Financial Years Under Review, they have not encountered any significant supply disruptions or delays caused by the major suppliers. Therefore, they are not dependent on any single supplier.

Industry Overview

According to the research report from Protégé Associates, the aesthetic medicine market is anticipated to grow at a CAGR of 18.8% from RM366.3 million in 2021 to RM1.03 billion in 2027, mirroring the general upward trend of beauty-related expenditure as consumers readjust to socialising post-COVID-19. The increased utilisation of aesthetic medical services is underpinned by overall population growth and income growth. The higher disposable income among Malaysians is likely to lead to greater consumption of aesthetic medical services. The middle-income and

high-income group acts as enablers to more complex treatments or procedures in aesthetic clinics.

The aesthetic medicine market has seen a fundamental shift in marketing approach, moving away from web-based advertising and traditional offline promotions towards the utilisation of online-to-offline service platforms, short videos, and social media networking platforms to connect to consumers. The increased consumerism and growing influence from a social media culture that removes the stigma associated with aesthetic medical procedures to improve one’s appearance have resulted in an increase in attention to personal appearance and are anticipated to drive a growing acceptance of these treatments.

From the supply side, the constant technological innovation in the form of aesthetic products and devices will further drive the growth of aesthetic medicine. On a downside risk, there is a shortage of medical practitioners and specialists in the field of aesthetic medicine treatment because strict training and assessments are mandated due to the relatively high safety risk of aesthetic treatment procedures. Due to a long time it takes to become an LCP-certified aesthetic physician, the supply gap is unlikely to be filled in the short term. The standardization and tightening of regulations relating to aesthetic medical procedures will have stimulate a positive impact on the growth of the aesthetic medicine market in the long run.

Source: Protégé Associates

Business strategies and prospects for DC HEALTHCARE HOLDINGS BERHAD.

The business strategies are summarised below:

- Geographical expansion of its services

- Expansion of its aesthetic medical team

- Purchase of new medical machines and equipment for its existing and new aesthetic medical clinics

MQ Trader View

Opportunities

- The company's financial performance demonstrates the company's sustainable development capabilities. Whether it is revenue, gross profit margin, or net profit margin, the company continues to reach new highs, which further indicates the management's ability to ensure profitability while expanding the company.

- The aesthetic medical clinics are equipped with modern medical machines and equipment. The company aims to stay up to date with the latest aesthetic technology while ensuring the health and safety of its customers remains its top priority. Therefore, they have also implemented quality control procedures across each of their aesthetic medical clinics.

Risk

- The company's operations are reliant on certain approvals, licenses, permits, and certificates. The company operates in an industry that is highly regulated by the Ministry of Health (MOH).

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)