IPO - KGW Group Berhad (Part 2)

MQTrader Jesse

Publish date: Fri, 07 Jul 2023, 09:02 AM

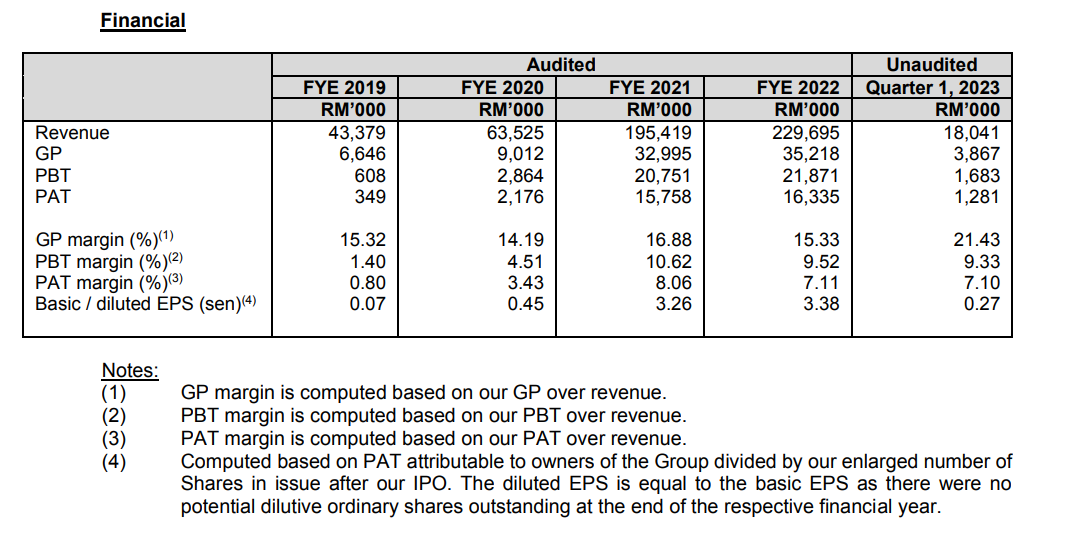

Financial Highlights

The following table sets out the key financial highlights of the Group for the Period Under Review:

- The revenue increased from RM 43 million (FYE 2019) to RM 229 million (FYE 2022), showing the company's growth rapidly in this sector.

- The gross profit margin maintains above 15%, which also shows that when revenue increases, the management team can still control costs wisely. (Generally, a GP margin of 20% is considered high/ good).

- PAT margin increased from 0.80% (FYE 2019) to 7.11% (FYE 2022).

- The gearing ratio is 0.70 times (before IPO). The gearing ratio is above the benchmark. This is also the reason why the company would like to proceed with an IPO to settle some debt. The management aims to increase risk tolerance by reducing a significant amount of debt. (A good gearing ratio should be between 0.25 – 0.5).

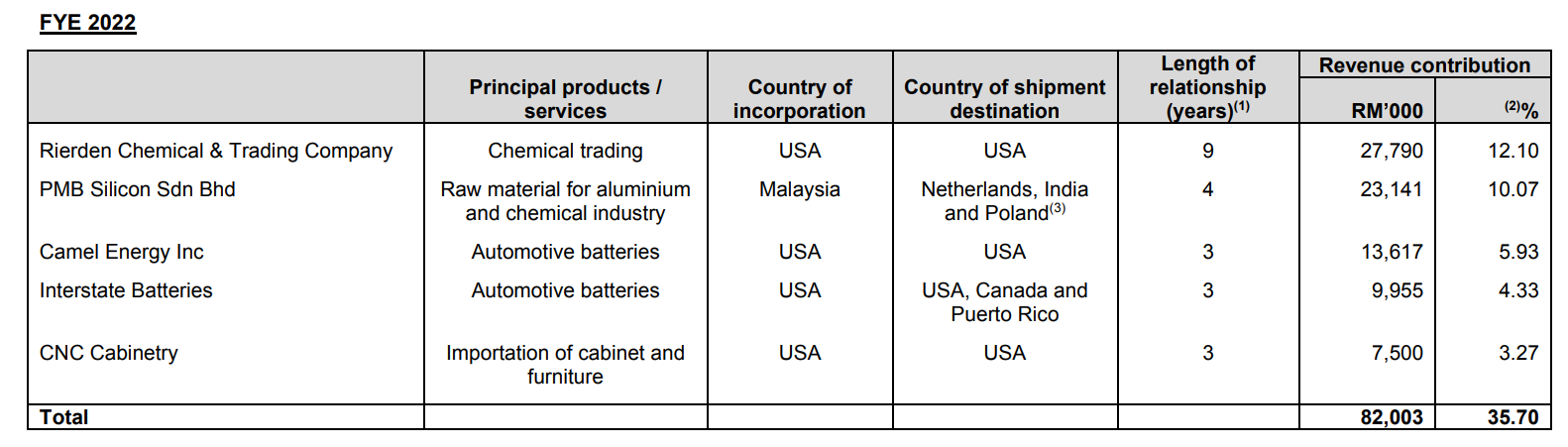

Major customer and supplier

Major Customers

The top 5 major customers for the Period Under Review are as follows:

According to the table, the top 5 customers contribute 35.70% of the company's revenue. The company mentioned that they have a large customer base, which includes local and foreign exporters, importers, and other freight forwarders, to whom they primarily provide ocean freight services. Additionally, their exporter and importer customers come from a wide range of industries, such as metal products, chemical products, and other industrial products. Due to this reason, they have been able to achieve revenue growth during the Period Under Review through contributions from different major customers. In conclusion, the company is not dependent on any single customer.

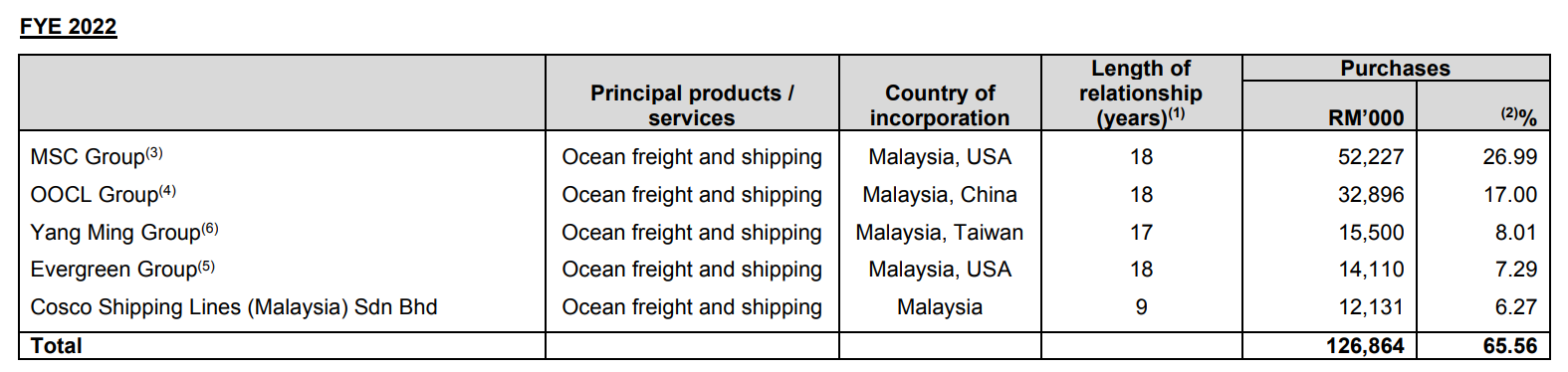

Major Suppliers

The top 5 major suppliers for the Period Under Review are as follows:

Based on the table, the top 5 suppliers account for approximately 65.56% of the total. The company selected these suppliers based on criteria such as cargo space availability, pricing, and shipping time. Additionally, besides the top 5 major suppliers, the company also maintains business relationships with other multinational ocean carriers such as CMA CGM Malaysia Sdn Bhd, Hapag-Lloyd Malaysia Sdn Bhd, and Ocean Network Express (Malaysia) Sdn Bhd. Therefore, the company believes that they are able to procure ocean cargo space from all the suppliers at comparable prices.

Industry Overview

According to the research report from Protégé Associates, the logistics industry in Malaysia plays a crucial role in the development of the country’s economic development. In 2021, the local logistics industry accounted for 3.0% of the country’s total GDP and was valued at RM 46.72 billion. This represented an improvement of 2.6% from the previous year when the global economy was affected by the COVID-19 pandemic. Going into 2022, the COVID-19 situation is expected to continue to improve along with global vaccination efforts. The Malaysian Government announced the transition of COVID-19 into an endemic phase starting 1 April 2022, with the Ministry of Health also announcing a set of relaxed standard operating procedures that took place in the country effective 1 May 2022. Moving forward, the outlook of the logistics industry remains positive as the recovery in global economic activities is expected to boost demand for transport and warehousing activities as more goods are transported.

Factors influencing the industry growth are expected to come from the growing prominence of e-commerce across the globe as well as the resulting increase in trade volumes. The expansion in the manufacturing sector is also expected to drive demand for logistics services as more goods are manufactured and transported to various destinations. However, the slowing economic growth coupled with various global events that have negatively impacted economic activities may in the short term affect the overall demand for logistic services. From the supply side, the logistics industry is expected to benefit from support from the Malaysian Government in charting the direction and goals of logistics infrastructure and export trade activities in Malaysia. Malaysia’s position as a strategic logistics hub has also helped the country develop its logistics infrastructure.

World Container Freight Rate, 2011 - February 2023

The freight rates for 2011 to May 2023 is as shown in the figure above. Freight rates hovered between around USD 1,400 (RM 5,807) and USD 1,600 (RM 6,636) per forty-foot equivalent unit of container (“FEU”) in December 2019 (RM 4.1475 =

USD 1.00). During the initial outbreak of the COVID-19 pandemic, freight rates remained around USD 1,500 (RM 6,375) per FEU (RM 4.2497 = USD 1.00). Since the second half of 2020, global freight rates have been on an upward trend with a recovery in global economic activities after the initial outbreak of COVID-19 boosting demand for shipping. The disruptions in the global supply chain caused by the pandemic further pushed up freight rates in the following year. Freight rates reached a peak of more than USD 10,000 (RM 41,677) per FEU at the end of September 2021 (RM 4.1677 = USD 1.00). While freight rates continued to remain high in January and February 2022 at around USD9,400 (RM 39,378) per FEU (RM 4.1892 = USD 1.00), freight rates began to drop by the end of March 2022 to around USD 8,000 (RM 33,606) per FEU (RM 4.2007 = USD 1.00). The subsequent high inflation and resulting rising interest rates also affected consumer demand which also contributed to lower shipping demand, thus lowering freight rates further. At the end of May 2023, freight rates stood at around USD 1,685 (RM 7,616) per FEU (RM 4.5199 = USD 1.00). Note: All foreign exchange rates are obtained from the average rate for the respective periods based on rates from Bank Negara Malaysia. While global port congestions are expected to slowly improve, the new International

Maritime Organization (IMO) emissions regulations as well as high raw material prices and vessel manufacturers working at limits are expected to sustain container freight rates for the rest of the year. Moving forward, as the logistics industry is still

volatile and fluid, it may be difficult at this point to provide a forecast on future freight rates for 2023 and 2024 due to various factors. While supply chain disruption issues may have eased in light of COVID-19 being brought under control, other factors

such as the ongoing war between Russia and Ukraine, the trade tension between the US and China, as well as the slowdown in the global economy, is expected to impact demand for goods worldwide. Nonetheless, regardless of the fluctuations in freight rates, total trade in Malaysia has remained resilient and growing over the years. Total trade was valued at RM 2.85 trillion in 2022, up from RM 1.17 trillion in 2010. In terms of volume, total container throughput rose from 26.4 million TEUs in 2019 to 28.4 million TEUs in 2021. While there had been a slight dip in container throughput in 2022 to 27.3 million TEUs, it is still higher than the 26.7 million TEUs recorded in 2020.

The Malaysian logistics industry is projected to reach RM 66.25 billion in 2023 and grow to RM 87.57 billion in 2027, expanding at a CAGR of 7.1% for the forecast period. In particular, the warehouse and storage market in Malaysia is forecast to reach RM 2.58 billion in 2023 and expand at a CAGR of 8.2% to RM 3.59 billion in 2027.

Source: Protégé Associates

Business strategies and prospects for KGW GROUP BERHAD.

- Relocation to the Target Property to facilitate the business expansion.

- Expansion of headcount to scale up operations.

- Enhancement of warehouse facilities and capabilities.

- Offering warehousing services to the logistics services customers as well as new customers.

- Expansion of warehousing and distribution services for healthcare-related products and devices.

- Development of new business opportunities for logistics services through providing e-commerce solutions.

MQ Trader View

Opportunities

- The company has a diversified and growing customer base. The company provides its logistics services to customers from a diversified range of industries. These industries include, among others, metal products, rubber gloves, and chemical products. The diversified customer base provides them with more business opportunities to grow their business as they stand to benefit from the collective demand for logistics services of different industries.

Risk

- The company is subject to the risk of fluctuation in foreign exchange rates. The Group’s revenue is mainly derived from ocean freight services for international shipments. Quotes from its suppliers for ocean cargo space are usually in USD and some of the customers pay us in USD.

- The business operations and financial performance may be adversely affected by fluctuations in ocean freight rates. As the revenue is mainly derived from the ocean freight services for international shipments, the business operations and financial performance are subject to fluctuation in ocean freight rates.

Click here to refer the IPO - KGW Group Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)