IPO - KGW Group Berhad (Part 1)

MQTrader Jesse

Publish date: Fri, 07 Jul 2023, 09:01 AM

Company Background

The Company was incorporated in Malaysia on 14 March 2022 as a private limited company under the name of KGW Group Sdn Bhd. On 7 October 2022, it converted into a public limited company and assumed its current name.

The group structure after the IPO (assuming that the Eligible Persons will fully subscribe for their entitlement under the Pink Form Allocation and the Issue Shares made available for application by the Malaysian Public will be fully subscribed) is as follows:

The company is an investment holding company. Through its subsidiaries, they are principally involved in the provision of logistics services (ocean freight services, air freight services and freight forwarding services) as well as warehousing and distribution of healthcare-related products and devices.

Use of proceeds

- Renovation of the Target Property - 11.95% (within 12 months)

- Repayment of bank borrowing - 59.78% (within 3 months)

- Working capital - 4.36% (within 12 months)

- Estimated listing expense - 23.91% (within 1 month)

Renovation of the Target Property - 11.95% (within 12 months)

The Group operates from its existing offices and warehouse located at Ara Damansara, Selangor. These rented premises have a total built-up area of approximately 11,300 sq. ft. (including both office space and warehouse space) and currently house a total of 69 employees of our Group. Due to space constraints in these existing offices, they are unable to house additional employees to cater to business expansion.

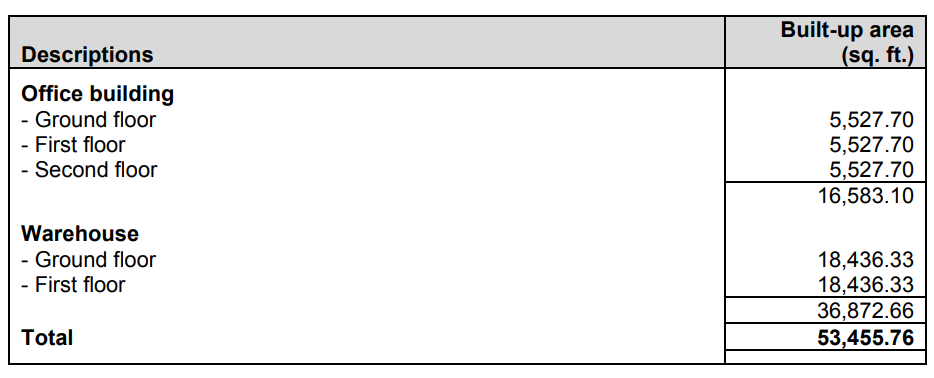

The Target Property is a freehold 3-storey office building with an annexed 2-storey warehouse. The breakdown of the built-up areas of the Target Property is as follows:

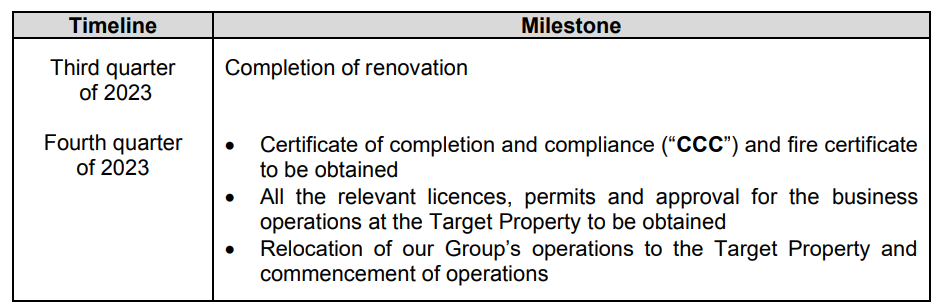

The tentative timeline for the renovation of and subsequent relocation to the Target Property is as follows:

Repayment of bank borrowing - 59.78% (within 3 months)

To facilitate the completion of its purchase of the Target Property, the company had in December 2022 obtained a term loan amounting to RM18.18 million from CIMB Islamic Bank Berhad to fully settle the balance purchase consideration for the Target Property (after excluding the deposit of RM 2.02 million paid in May and July 2022). The maturity date of this term loan is in December 2042. The loan agreement does not include any clause on early repayment penalty, hence they are not subject to any fees/charges for settling the aforesaid term loan before the maturity date. As at the LPD, the company has made 5 monthly installments totaling RM 0.55 million for this loan and its current outstanding principal amount stands approximately at RM 17.78 million.

Working capital - 4.36% (within 12 months)

The company has allocated RM0.73 million from its Public Issue proceeds to supplement the general working capital requirements. This allocation for working capital will be mainly used for the day-to-day operations of the logistics services business, including but not limited to payroll and administrative expenses, payment to suppliers, utility expenses, and office-related expenses.

Business model

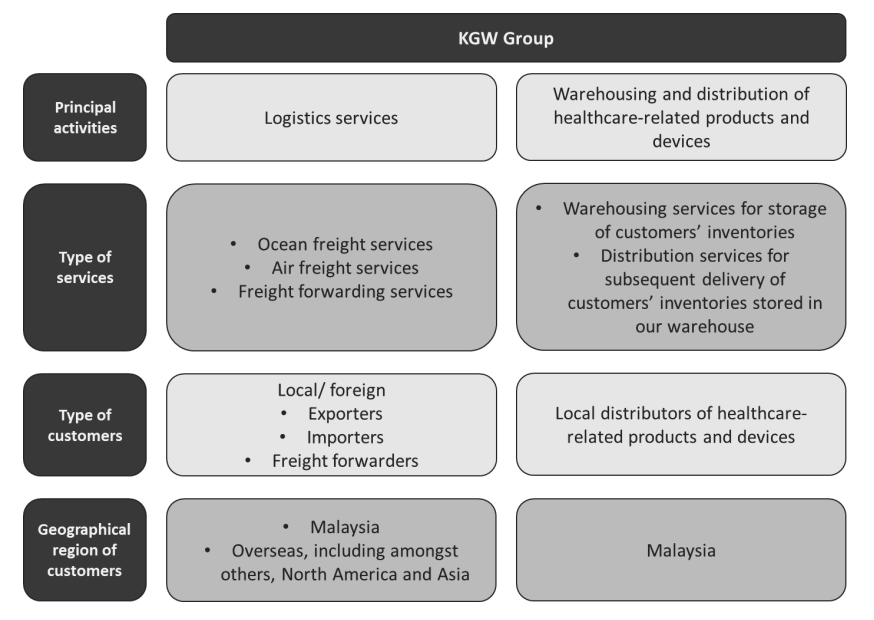

The business model is depicted in the diagram below:

Logistics is widely known as the overall process of managing how resources (such as raw materials, in-process stocks and finished goods) are acquired, stored and transported to their final destination.

Through the subsidiaries, namely KGW Logistics and Mattroy Logistics, the company provides logistics services including ocean freight services, air freight services and freight forwarding services.KGW Logistics focuses on logistics services for cargo shipments to and from the USA while Mattroy Logistics focuses on those to and from other countries. The customers for logistics services are exporters, importers and other freight forwarders, both local and foreign.

Besides the logistics services business, the Group, through KGW Medica, is also involved in the warehousing and distribution of healthcare-related products and devices within Malaysia.KGW Medica was incorporated on 24 June 2021 with the plan to venture into warehousing and distribution of healthcare-related products and devices. Pending the development of this business, KGW Medica briefly ventured into trading of healthcare-related products, mainly COVID-19 antigen self-test kits. KGW Medica will discontinue its trading of healthcare-related products operations upon full disposal of its existing inventories.

Click here to continue the IPO - KGW Group Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)