IPO - Mercury Securities Group Berhad (Part 2)

MQTrader Jesse

Publish date: Fri, 01 Sep 2023, 10:46 AM

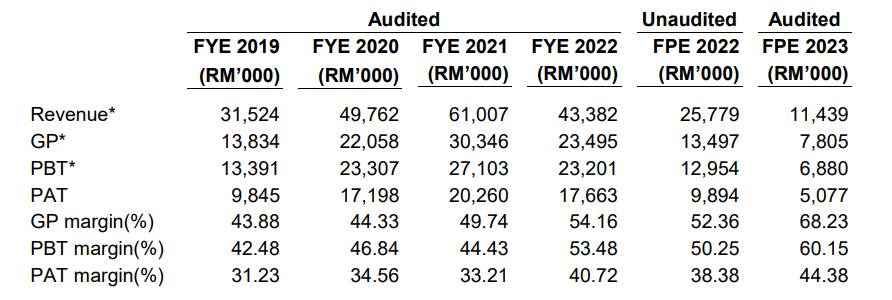

Financial Highlights

The following table sets out the financial highlights of the Group based on the historical audited combined statements of comprehensive income for the Financial Years and Period Under Review:

- The revenue increased from RM 31 million (FYE 2019) to RM 61 million (FYE 2021) and declined to RM 43 million (FYE 2022). This also indicates that the industry started to decline after reaching its peak in 2022.

- The gross profit margin consistently grew from 43.88% (FYE2019) to 54.16% (FYE2022). Although the revenue is declining, the management can still improve its profit margin. This also shows the capability of the management. (Generally, a GP margin of 20% is considered high/ good).

- PAT margin increased from 31.23% (FYE 2019) to 40.72% (FYE 2022).

- The company didn’t hold any debt. This also reflects that when facing a crisis, the company has sufficient assets to maintain liquidity. However, having zero debt is also a relatively conservative strategy, which might prevent the company from maximizing its own resources.

Major clients and supplier

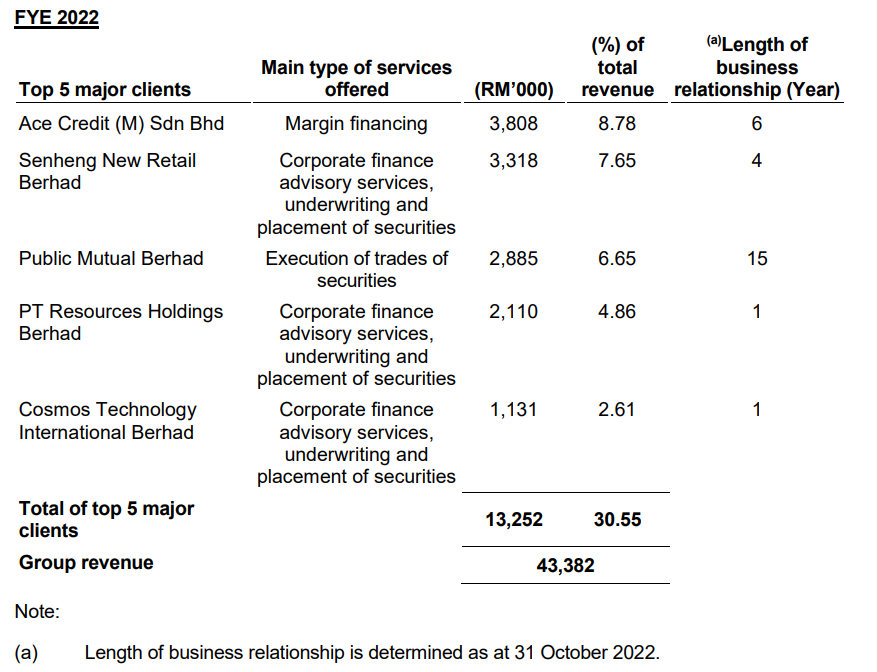

Major Clients

The top 5 major clients for the Financial Years and Period Under Review:

The top 5 major clients contributed 30.55% of revenue to the company in FYE 2022. The management mentioned that they are dependent on Public Mutual Berhad as the revenue contribution from Public Mutual Berhad is declining from FYE 2022 which directly affects the company's total revenue.

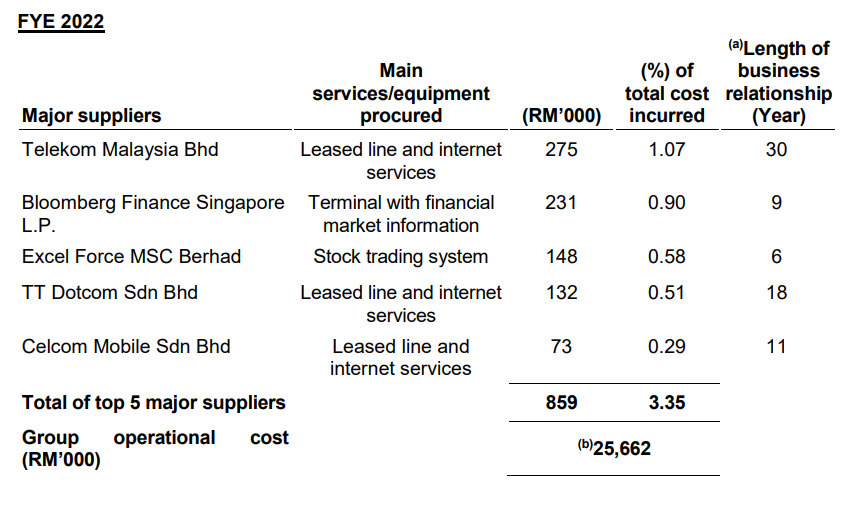

Major Suppliers

The top 5 major suppliers or vendors for the Financial Years and Period Under Review:

Based on the table, the top 5 suppliers account for 3.35% of total purchases. The company has mentioned that they are not dependent on the major suppliers as there are other available suppliers for the service/equipment. Moreover, they do not have any long-term contracts with the major suppliers and there has been no material dispute in the past. They will select the suppliers based on the quality of service and reliability of the suppliers.

Industry Overview

According to the research report from Vital Factor Consulting, the Malaysian capital market experienced significant volatility in 2020; however, it remained resilient and orderly throughout 2021. The funds raised in the capital market remained robust, with notable improvement in fundraising activities across all market segments. Overall, the total capital market, comprising the equity and bond markets, increased by 3.0% to RM3.5 trillion in 2021, with the equity market declining by 1.5% and the bond market growing by 8.2%. In 2022, the total capital market grew by 2.2% to RM3.6 trillion compared to 2021, contributed to by a 3.0% decline in the equity market and a 7.5% growth in the bond market.

From the perspective of the corporate finance industry in Malaysia, in 2022, the SC cleared 18 offer documents involving a total offer value of RM2.10 billion. These 18 offer documents included 5 proposed privatisations. Out of the 18 offers, 16 were related to companies listed on the Main Market, 1 was in relation to an offeree company listed on the LEAP Market, and 1 was related to an unlisted public company. Additionally, fundraising activities (right issues/private placements) have notably improved with an enhanced fundraising process and diversified financing avenues. Between 2020 and 2022, funds raised via alternative financing grew at a CAGR of 75.5%, where equity crowdfunding, peer-to-peer financing, venture capital, and private equity amounted to RM0.1 billion, RM1.6 billion, RM0.1 billion, and RM1.1 billion, respectively, in 2022 (Source: SC).

Source: Vital Factor Consulting

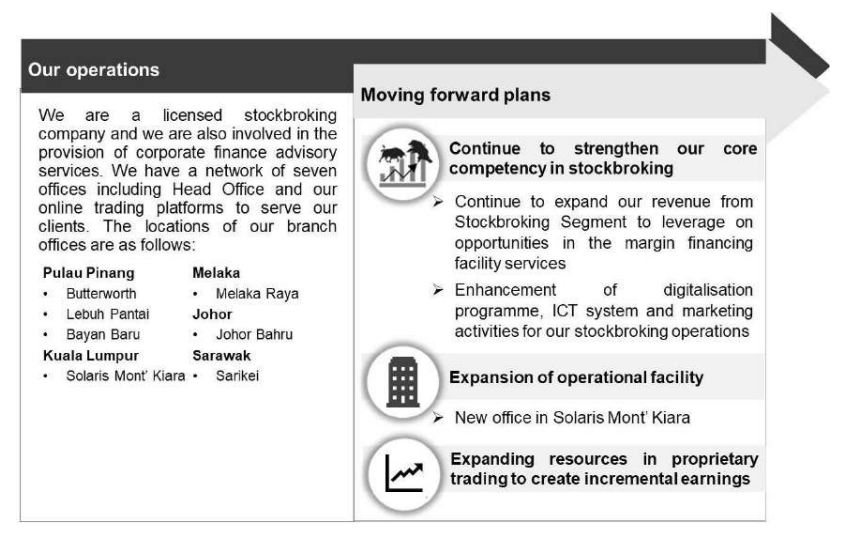

Business strategies and plan for MERCURY SECURITIES GROUP BERHAD.

The business strategies and plans are focused on the Stockbroking Segment to drive the business growth and expansion. In addition, the company also intends to expand its operational facility and resources. This is set out below:

- Continue to expand the revenue from Stockbroking Segment to leverage on opportunities in the margin financing facility services.

- Enhancement of digitalisation programme, ICT system and marketing activities for the stockbroking operations.

- Enhancement of online trading functions and features.

- Upgrade of backroom administration and support systems.

- Marketing activities to expand online trading clients’ base.

- Expansion of the operational facility.

- Expanding resources in proprietary trading to create incremental earnings.

- Human resources to expand its proprietary trading team.

- Set up of a new algorithmic trading desk.

MQ Trader View

Opportunities

- The company possesses a robust management team. Firstly, the company has no debt, which allows it to be more flexible in choosing different approaches during crises. Furthermore, despite the market's pessimistic sentiment leading to a decline in revenue for FYE2022, the management is still able to consistently improve the gross profit margin. This also reflects the capability of the management.

- The company has 2 client bases to provide client diversity and sources of revenue. The company operates in 2 segments of the capital market services industry that provide us with 2 client bases to grow the business as well as minimise dependencies on any 1 group of clients.

Risk

- The financial performance of the Stockbroking Segment is highly dependent on the performance of the securities market and overall market conditions. Within the Stockbroking Segment, the company’s financial performance is highly dependent on clients’ demand to execute buying and selling of securities, where trading activities to a certain extent are influenced by the overall investors’ sentiments and other factors such as, economic, political, monetary, fiscal development in Malaysia and the performance of major regional and global markets.

Click here to refer the IPO - Mecury Securities Group Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)