IPO - Mercury Securities Group Berhad (Part 1)

MQTrader Jesse

Publish date: Fri, 01 Sep 2023, 10:45 AM

Company Background

The Company was incorporated in Malaysia under the Act on 18 May 2021 as a private limited company under the name of Mercury Securities Group Sdn Bhd. The Company was subsequently converted into a public limited company on 28 February 2022.

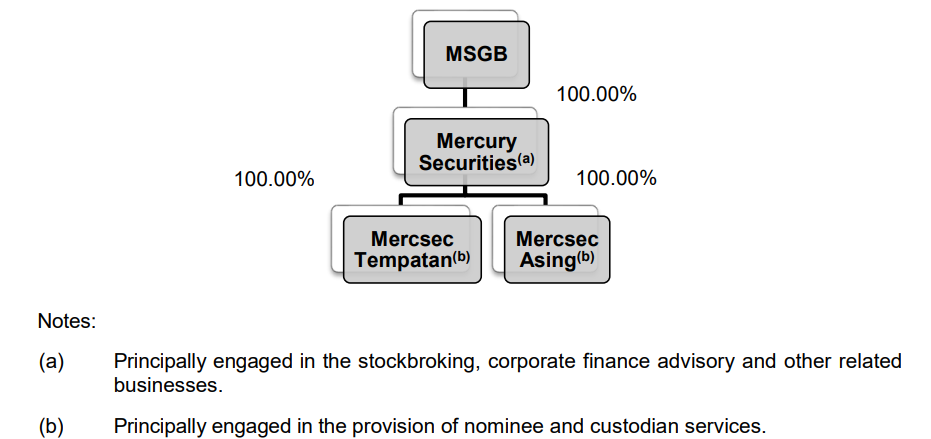

They are an investment holding company and through its Subsidiaries, the company is principally engaged in stockbroking, corporate finance advisory and other related businesses as well as the provision of nominee and custodian services. As at the LPD, the Group structure is as follows:

Use of proceeds

- Margin financing facility services - 68.39% (within 24 months)

- Enhancement of digitalisation programme and marketing activities to enhance the stockbroking business and operations of the Group - 7.33% (within 18 months)

- Working capital - 11.80% (within 12 months)

- Estimated listing expense - 12.48% (within 3 months)

Margin financing facility services - 68.39% (within 24 months)

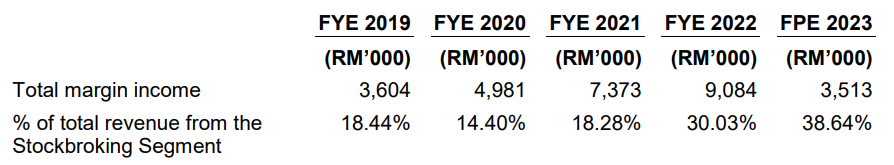

One of the revenue streams of the Stockbroking Segment is margin income which comprises interest, processing fees, roll-over fees and commitment fees. From FYE 2019 to FYE 2022, the margin income as shown below grew at a CAGR of 36.09% due to higher demand for margin financing facility services from the stockbroking clients.

Currently, the company is using internally generated funds for the provision of margin financing facilities services. The amount available for margin financing facilities services is determined based on the availability of the shareholders’ funds after setting aside funds required for working capital at the material time, which varies from time to time. As such, the company intends to allocate RM26.86 million of the proceeds from the Public Issue to expand the provision of margin financing facility services to fund its existing and new stockbroking clients for their purchase of securities mainly quoted on Bursa Securities. This would in turn help to further enhance the revenue for the Stockbroking Segment via margin income. In addition to margin income, the company would be able to generate brokerage fees from the purchase and sale of quoted securities made by the margin clients.

Enhancement of digitalisation programme and marketing activities to enhance the stockbroking business and operations of the Group - 7.33% (within 18 months)

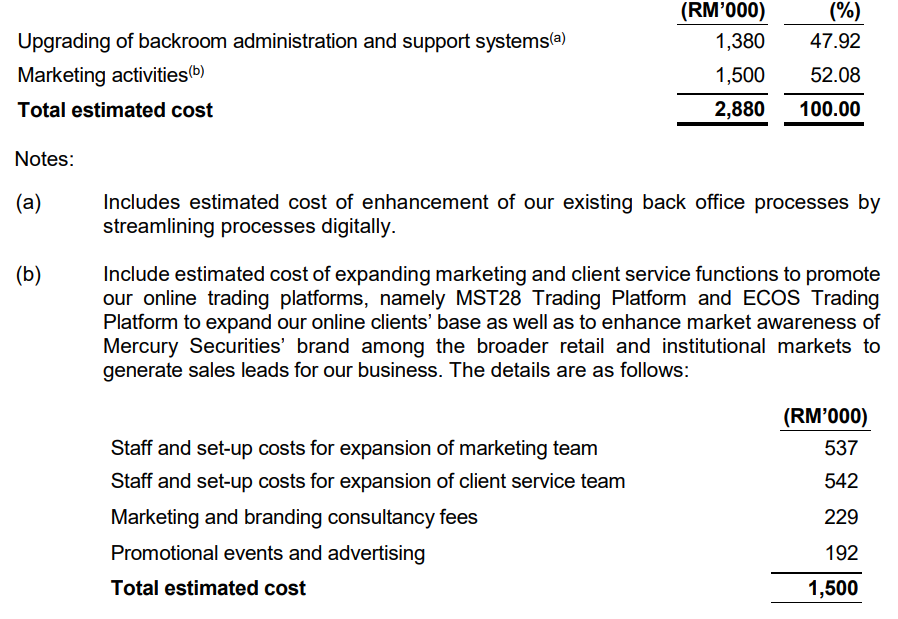

Part of the Group’s business strategies and plans is to enhance the digitalisation programme for its stockbroking operations as well as related marketing activities. As such, the company has earmarked RM2.88 million of the proceeds from the Public Issue for the following: (RM’000)

Working capital - 11.80% (within 12 months)

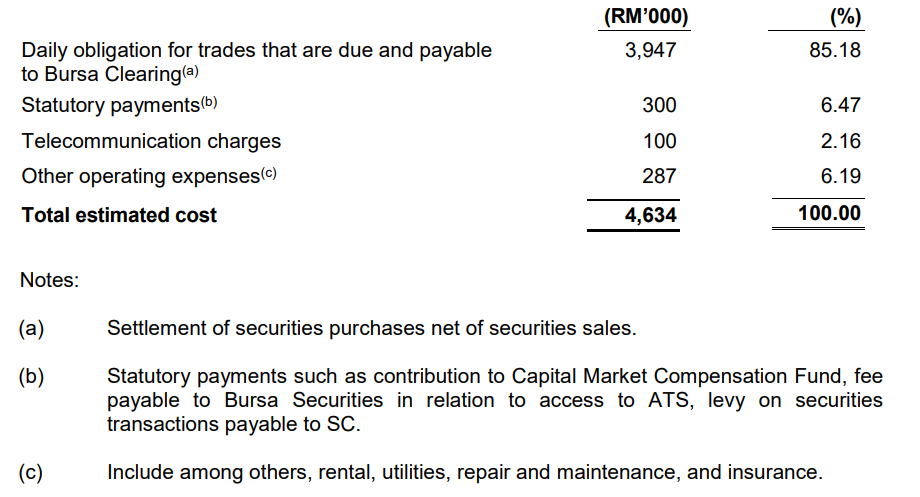

The Group’s working capital requirements are expected to increase in tandem with the expected growth in the business. The Group intends to utilise an estimated amount of RM4.63 million from the IPO proceeds to fund its working capital requirements, which include, but are not limited to settle the daily obligations for trades that are due and payable to Bursa Clearing for its stockbroking business, general administrative and daily operational expenses such as statutory payments, telecommunication charges and other operating expenses.

The following is a breakdown of the expected utilisation for the Group’s working capital requirements:

Business model

For the Financial Years and Period Under Review, the business model is as follows:

The Subsidiary, Mercury Securities is a licensed 1+1 broker involved in the provision of stockbroking and corporate finance advisory services.

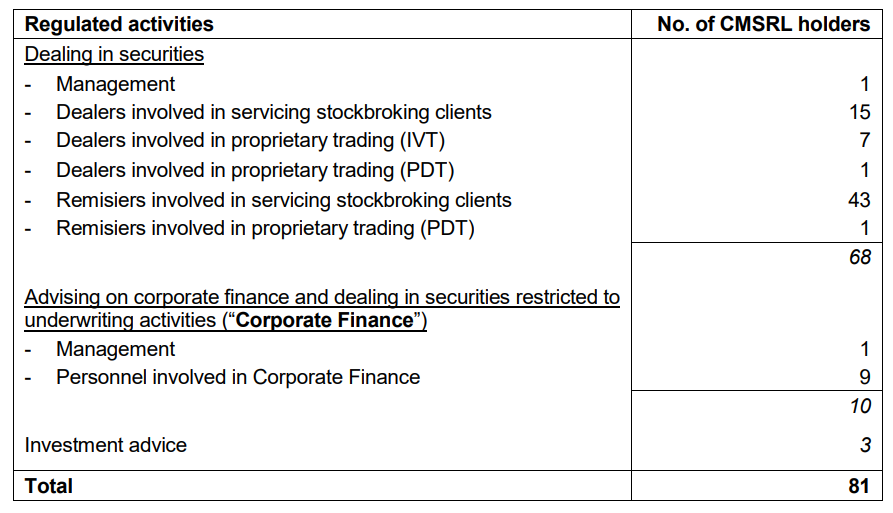

As at the LPD, the company has a total of 81 CMSRL holders to support the following regulated activities undertaken by Mercury Securities:

Click here to continue the IPO - Mecury Securities Group Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on Initial Public Offering (IPO)