IPO - Evergreen Max Capital Berhad (Part 2)

MQTrader Jesse

Publish date: Tue, 05 Sep 2023, 12:43 PM

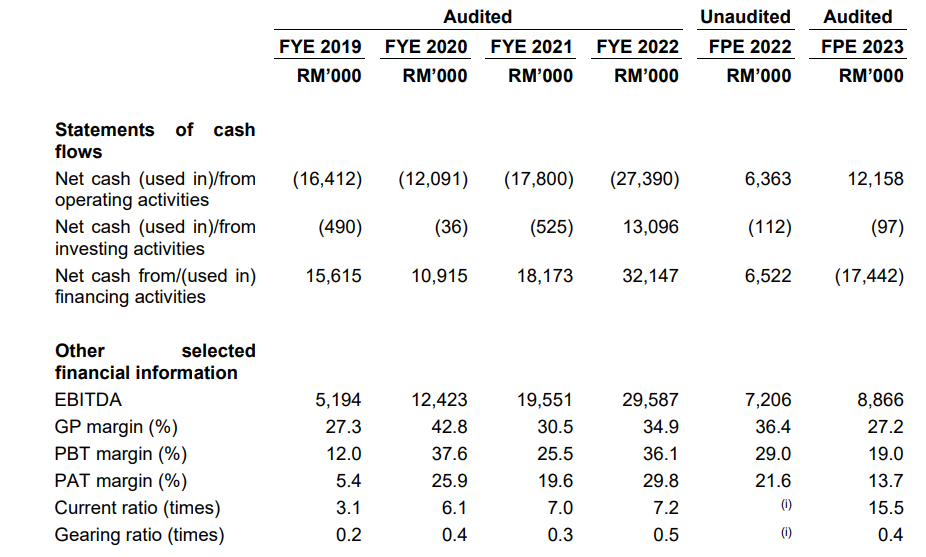

Financial Highlights

The following table sets out the financial highlights of the Group based on the historical audited combined statements of comprehensive income for the Financial Years and Period Under Review:

- The revenue increased from RM 14.8 million (FYE 2019) to RM 67.1 million (FYE 2022). The growth of revenue also indicates that the company is expanding.

- The gross profit margin grew from 27.3% (FYE 2019) to its highest point at 42.8% (FYE 2020) and subsequently reached 34.9% by FYE 2022. The margin decreased because there was no significant increase in the gold price or, in fact, it experienced a significant decrease. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin increased from 5.4% (FYE 2019) to its peak at 25.9% (FYE 2020) and then declined to approximately 30% to 34% by FYE 2021 and FYE 2022.

- The gearing ratio is 0.5 times, which is still within the healthy range. However, it had reached the maximum end of that range, so we will need to continue monitoring its debt in the future. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and supplier

Major Clients:

Pawnbroking Service

The pawnbroking segment has consistently contributed a significant portion of its total revenue, accounting for 41.9% in FYE 2022. Customers of the pawnbroking segment are walk-in customers, and the individual contribution from each customer as a percentage of the total revenue is negligible.

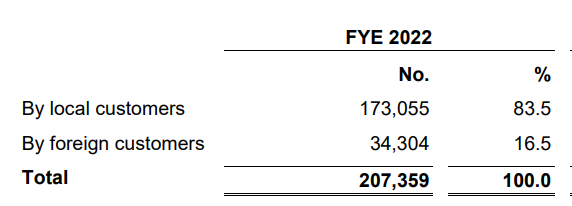

Gold and Luxury Products Retail and Trading

Customers of the gold and luxury products retail and trading segment comprise gold trading companies, scrap gold collectors, luxury product retailers and individual customers. For FYE 2022, 55.7% of the total revenue is derived from sales of gold and luxury products.

Pawnbroking Consultancy and IT solutions

The pawnbroking consultancy and IT solutions segment contributed less than 5% of its total revenue for the financial year/period under review. The customers of this business segment are third-party pawnbrokers.

The major customers for the financial year/period under review are as follows:

Major Suppliers

The company does not purchase nor require any supplies for the provision of pawnbroking services. Nevertheless, in the event of default and as part of its cash recovery process, they will procure the unredeemed pledged items from the pawnbroking customers from public auctions (for unredeemed pledged items with defaulted pawn loans amount above RM200) or take possession of (for unredeemed pledged items with defaulted pawn loans amount RM200 and below), whereby the consideration for such purchases will be set off against the pawn receivables.

Industry Overview

According to the research report from Providence Strategic Partners, the pawnbroking industry size in Malaysia is expected to grow at a CAGR of 5.9% between 2022 and 2024 to reach RM12.0 billion in 2024. Meanwhile, the pawnbroking industry size in Selangor, Kuala Lumpur, Negeri Sembilan and Pahang is forecast to grow to reach RM5.8 billion in 2024, registering a CAGR of 6.6% between 2022 and 2024.

Key Demand Drives

- The country’s unbanked population will drive demand for pawnbroking services.

- Pawnbroking services provide immediate access to funds.

Industry Risk and Challenge

- Industry players are subject to changes in regulatory requirements impacting the pawnbroking industry.

- Industry players require substantial cash capital to carry out pawnbroking services.

- The industry is subjected to unlawful transactions made with wrongfully obtained pawned items.

- The industry may be affected by the volatility of gold prices.

Source: Providence Strategic Partners

Business strategies and plan for EVERGREEN MAX CASH CAPITAL BERHAD.

The company has identified the following strategies to grow and expand the pawnbroking, gold and luxury products retail and trading businesses:

- The company intends to continue expanding its pawnbroking business.

- The company plans to increase the market visibility of the gold and luxury products retail and trading business.

MQ Trader View

Opportunities

- The company leverages its proprietary pawn processing system to enhance operational efficiency and standardise operating procedures. The proprietary pawn processing system allows for the recording of details and photos of pledged items, pawn ticket details, customers' personal information, pawn loan amounts, and interests. The system also includes features to prevent transactions with individuals blacklisted under the sanction lists maintained by BNM, UNSCR, MOHA, FATF, or those with a history of pawning counterfeit or unlawful items. Additionally, the system will notify users when dealing with Politically Exposed Persons and related individuals, ensuring enhanced customer due diligence is conducted for such transactions.

Risk

- The pawnshops are required to maintain and renew their pawnbroker’s licences. Each pawnshop is required to hold a valid pawnbroker’s licence issued by KPKT in order to operate. As at the LPD, all of the 22 pawnshops have valid pawnbroker’s licences, whereby each pawnbroker’s licence is valid for 2 years and such licence must be renewed 60 days before its expiry.

- The company’s financial result is subject to volatility in the price of gold. As gold is a globally traded commodity, the price for gold can fluctuate widely and is affected by various market factors that are beyond the control, such as supply and demand for gold, inflation, the USD exchange rate, interest rates as well as global and regional political and economic conditions.

Click here to refer the IPO - Evergreen Max Cash Capital Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)