IPO - Evergreen Max Capital Berhad (Part 1)

MQTrader Jesse

Publish date: Tue, 05 Sep 2023, 12:43 PM

Company Background

The Company was incorporated in Malaysia under the Act on 3 September 2021 as a private limited company under the name of Evergreen Max Cash Capital Sdn Bhd and was subsequently converted to a public limited company on 25 April 2022. The company is principally involved in the pawnbroking service.

The Group’s structure is as follows:

Use of proceeds

- Expansion of pawnshops - 31.1% (within 24 months)

- Cash capital for the pawnbroking business - 46.7% (within 24 months)

- Repayment of bank borrowings - 6.2% (within 1 month)

- Working capital - 8.8% (within 12 months)

- Estimated listing expense - 7.2% (within 1 month)

Expansion of pawnshops - 31.1% (within 24 months)

The company has established a network of 22 “Pajaking” pawnshops in Peninsular Malaysia, of which 19 pawnshops are located in Kuala Lumpur and Selangor, 2 pawnshops in Negeri Sembilan, and 1 pawnshop in Pahang.

As part of the expansion plans, the company intends to grow its pawnbroking business through the opening of 5 new “Pajaking” pawnshops in Kuala Lumpur, Selangor and Pahang. The ‘Garis Panduan Urusan Pelesanan Pemegang Pajak Gadai’ issued by KPKT, a minimum paid-up capital of RM4.0 million is required to obtain a pawnbroker’s licence for each new pawnshop.

As such, the company plans to utilise RM20.0 million of the Public Issue proceeds to fund the share capital of the new pawnshop subsidiaries. In turn, they intend for each of the new pawnshop subsidiaries to utilise RM0.3 million of their respective RM4.0 million capital injection to defray the renovation costs of their respective pawnshops, whilst the remaining RM3.7million will be utilised to fund the cash capital of their respective pawnshops. The renovation costs of RM0.3 million for each new “Pajaking” pawnshop were estimated based on quotations received from contractors and suppliers, which include the required fixtures, fittings and equipment for the operation of the new pawnshop.

Cash capital for the pawnbroking business - 46.7% (within 24 months)

The company has earmarked RM30.0 million of the Public Issue proceeds to be allocated as cash capital for the existing 22 “Pajaking” pawnshops in the following proportion, which was determined based on the historical growth of each pawnshop:

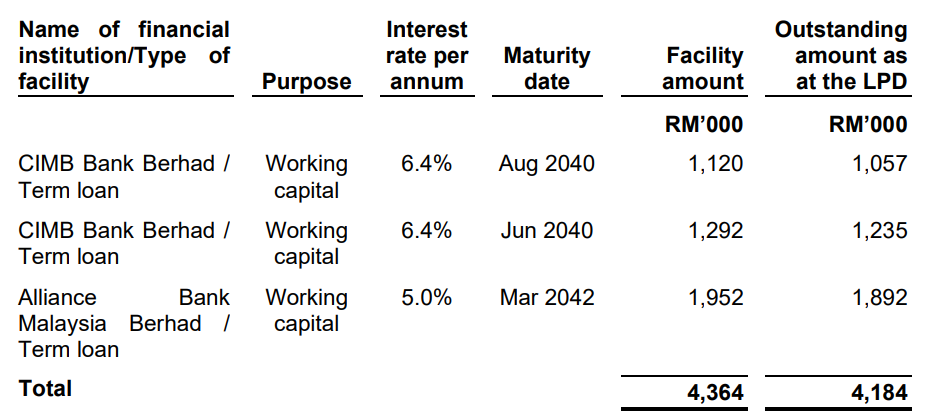

Repayment of bank borrowings - 6.2% (within 1 month)

The following banking facilities are secured by legal charge over assets owned by the Promoters and/or related parties:

The full repayment of these bank borrowings will also result in annual interest savings to the Group of approximately RM0.2 million per annum, computed based on the prevailing interest rates of the relevant banking facilities. The actual interest savings may vary depending on the then-applicable interest rates and the actual repayment amount of the respective banking facilities. However, the company expects to incur early settlement fees of approximately RM0.2 million as a result of full repayment of these bank borrowings

The proposed repayment of these bank borrowings coupled with the increase in total equity from the Public Issue will also provide the Group with better borrowing capabilities to increase the cash capital for the disbursement of pawn loans to the pawnbroking customers in the future.

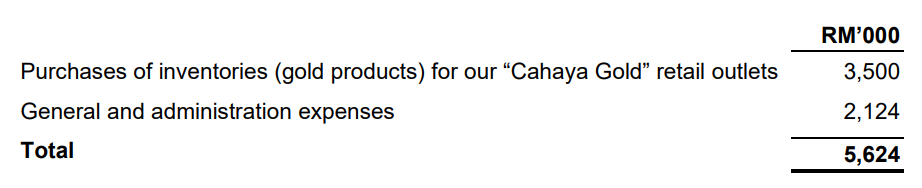

Working capital - 8.8% (within 12 months)

The company plans to utilise RM5.6 million of the Public Issue proceeds to finance the gold and luxury products retail and trading business as well as the Group’s day-to-day operating expenses. The breakdown of the allocation is as follows

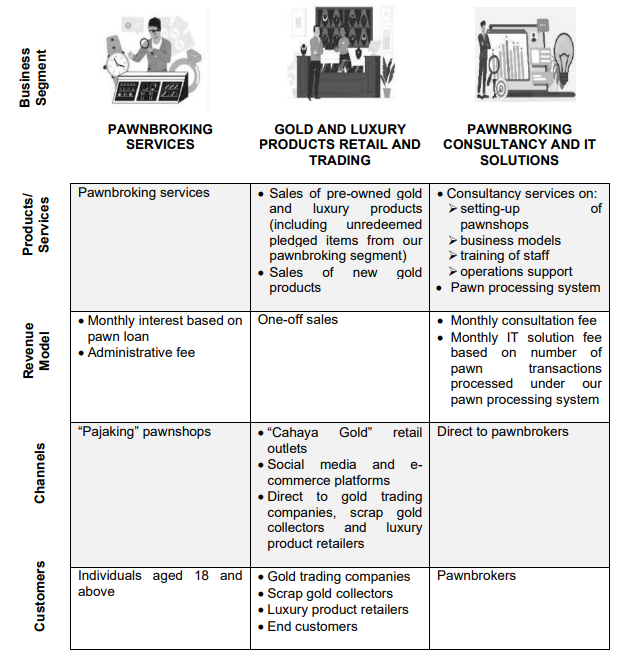

Business model

The company is principally involved in the provision of pawnbroking services.

In addition, the company is also involved in the business of retail and trading of gold and luxury products as well as provision of pawnbroking consultancy services and IT solutions to third-party pawnbrokers.

The Group’s businesses are as illustrated below:

Click here to continue the IPO - Evergreen Max Cash Capital Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)