IPO - Plytec Holding Berhad (Part 2)

MQTrader Jesse

Publish date: Fri, 27 Oct 2023, 10:24 AM

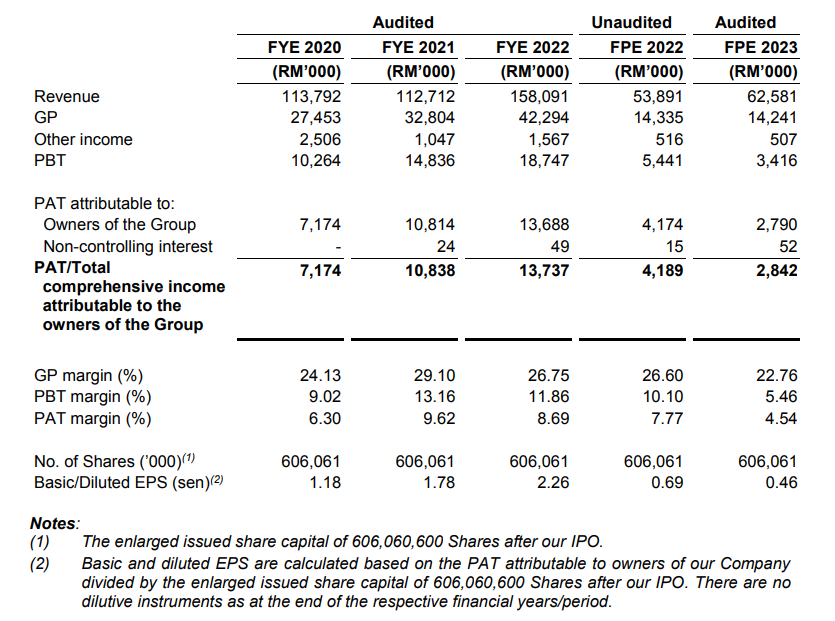

Financial Highlights

The key financial highlights based on the historical audited consolidated financial statements of the Group for the Financial Years/Period Under Review are set out below

- The revenue increased from RM 113 million (FYE 2020) to RM 158 mil (FYE 2022). However, the company's revenue does not consistently increase year by year.

- The GP margin remains between 24% and 29%. There is no significant growth in the GP margin, but it can still be maintained above 20%. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin remains between 6% to 9%.

- The gearing ratio is 0.75 times, which is above the healthy range. Therefore, the company could easily become involved in a crisis if they face liquidity issues. (A good gearing ratio should be between 0.25 – 0.5).

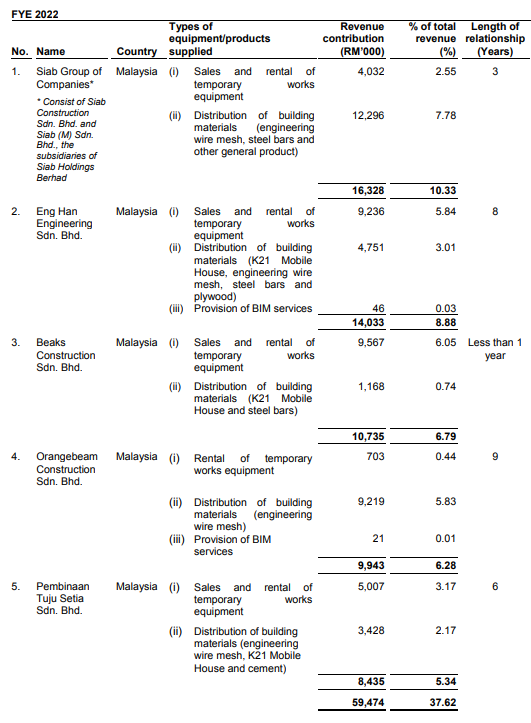

Major customers and supplier

Major Clients

The table below sets out the Group’s top five customers for FYE 2022:

According to the table, the top 5 customers contribute a total of 37.62% of revenue to the company. This shows that the company is not involved in high customer concentration risk. The management also mentioned that they are not dependent on any of the major customers listed above due to the nature of the business where the solutions are provided on purchase order basis or per project basis and as such, the composition of major customers will differ from year to year

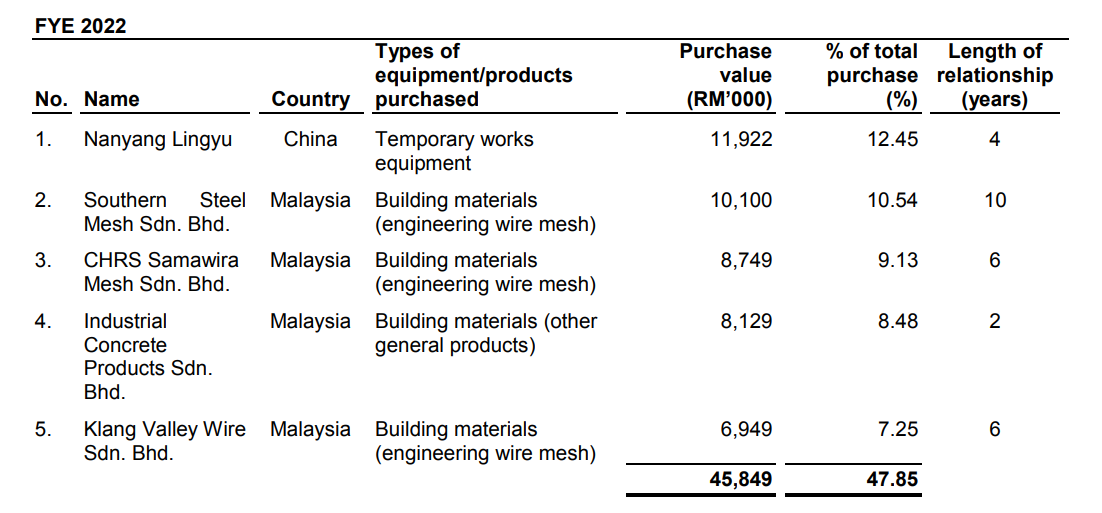

Major Suppliers

The table below sets out the Group’s top five suppliers for FYE 2022:

The total purchases from the top 5 suppliers account for 47.85% of the purchases. The management has mentioned that the company is not dependent on any of these major suppliers since they can source the same equipment/products from alternative suppliers.

Industry Overview

According to the research report from “Protégé Associates, the factors boosting growth within the construction industry are likely to come from the government-led initiatives and spending particularly those relating to infrastructure and housing development. While the elevated property overhang situation in the country is expected to reduce growth in the property market, a key source of demand for construction activities, this is expected to be cushioned by ongoing efforts by the Malaysian Government in providing housing for all such as various affordable housing programs. Changing lifestyle trends are expected to prompt developers into reconsidering the type of projects they undertake in the future. As online platforms gradually take over brick and mortar spaces and more companies adopt for work from home concepts, developers may opt to construct more residential buildings to cater for the growing population.

On the supply side, the industry is expected to be boosted by efforts from industry bodies such as CIDB and MBAM by providing necessary leadership in spearheading the development of the local construction industry as well as raising profile and pushing for the betterment of the construction industry in Malaysia. In addition,

The introduction of the CIPAA has also served as a strengthened mechanism to address payment disputes and facilitate adjudication within the industry. However, the Malaysian construction industry is expected to be hampered by labour shortage and high dependency on foreign workers, as well as the lack of traction in the adoption of IBS construction.

Protégé Associates projects the size (revenue) of the construction industry in Malaysia to expand at a CAGR of 4.09% from RM55.63 billion in 2023 to RM65.31 billion in 2027. In particular, the civil engineering and specialised trade works market is expected to reach RM31.72 billion in 2023 and grow at a CAGR of 5.87% to reach RM38.83 billion in 2027.

Source: Protégé Associates

Future plans and strategies for PLYTEC HOLDING BERHAD.

- Expanding the CME Solutions Segment

- Venture upstream into the manufacturing of falsework equipment

- Development of the facility on the Olak Lempit Land

- Investment in operational software

- Continuous development of DDE Solutions segment

MQ Trader View

Opportunities

- The company offers a diverse range of equipment/products and solutions supported by a substantial and varied inventory mix. As a provider of construction engineering solutions and services and as a trader and distributor of building materials, the company holds a substantial inventory of equipment/products, such as temporary works equipment and building materials. The company believes this will provide them with the advantage of securing orders and meeting customer’s demand for immediate supply of equipment/products.

Risk

- The company is affected by the availability and fluctuations in building material prices. The purchases for the trading and distribution of building materials business segment include engineering wire mesh, plywood, floor tiles, cement and steel bars. The company is dependent on the continuous supply of such materials which are sourced from a pool of local and overseas suppliers.

- The company has a relatively high debt ratio. As of the end of the fiscal year 2022, the company's gearing ratio was 0.75. By August 31, 2023, the gearing ratio had risen to 0.98. Even if the company allocates 24.24% of the funds raised from the IPO for debt repayment, the gearing ratio still remains between 0.65 and 0.70. This could potentially pose financial challenges for the company in the event of any market fluctuations, such as an economic recession.

Click here to refer the IPO - Plytec Holding Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)