IPO - Plytec Holding Berhad (Part 1)

MQTrader Jesse

Publish date: Fri, 27 Oct 2023, 10:23 AM

Company Background

The Company was incorporated in Malaysia under the Act on 1 June 2018 as a private limited company under the name of Sudut Swasta Holding Sdn. Bhd.. On 4 July 2019, the Company’s name was changed to PLYTEC Holding Sdn. Bhd. and was subsequently converted to a public limited company on 8 September 2022.

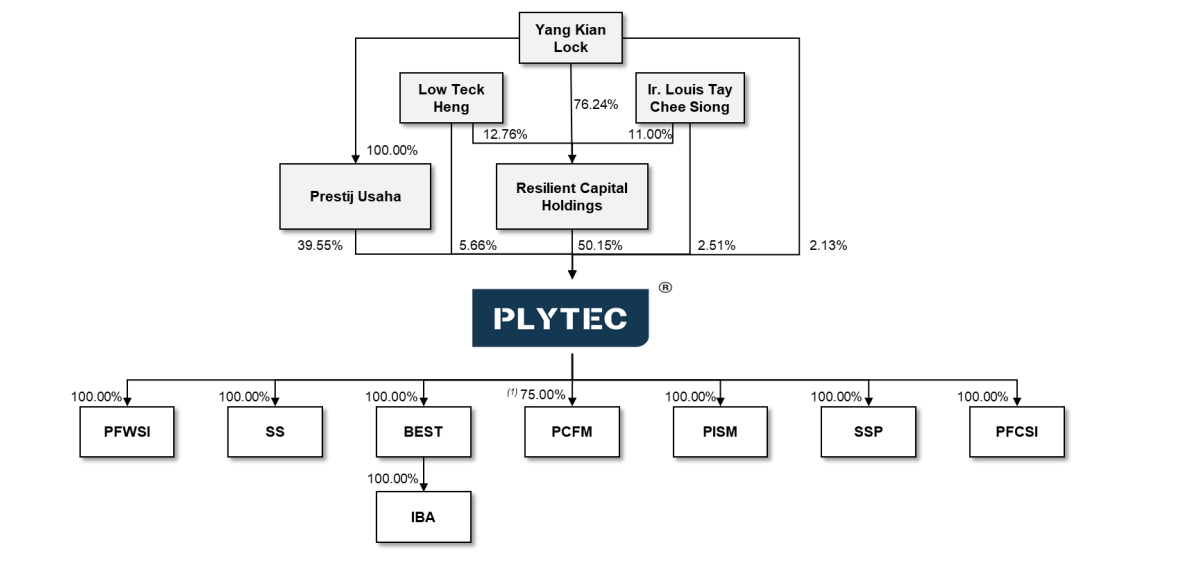

As at the LPD, the structure of the Group are as follows:

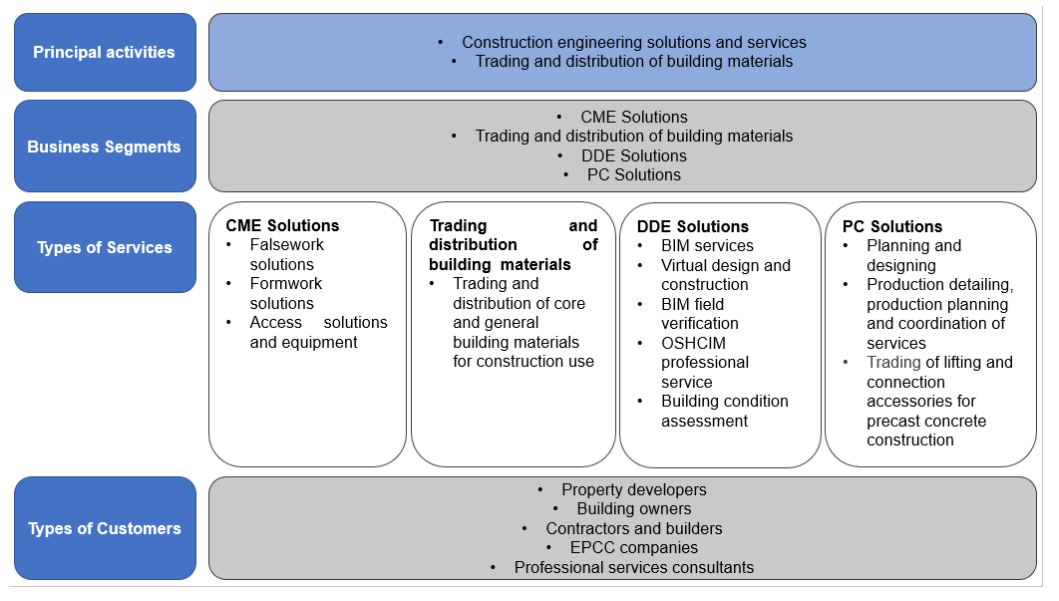

The Group is principally involved in the provision of construction engineering solutions and services and the trading and distribution of core and general building materials for construction projects.

Use of proceeds

- Capital expenditure - 21.55% (within 24 months)

- Repayment of borrowings - 24.24% (within 12 months)

- Construction of factories and centralised labour quarters on the Olak Lempit Land - 21.01% (within 24 months)

- Purchase of software systems and hardware - 5.39% (within 24 months)

- Working capital - 17.03% (within 12 months)

- Estimated listing expenses - 10.78% (Immediate)

Capital expenditure - 21.55% (within 24 months)

The company is committed to strengthen the position as the CME Solutions provider. Currently, the company generates its revenue from CME Solutions segment via sales and rental of temporary works equipment

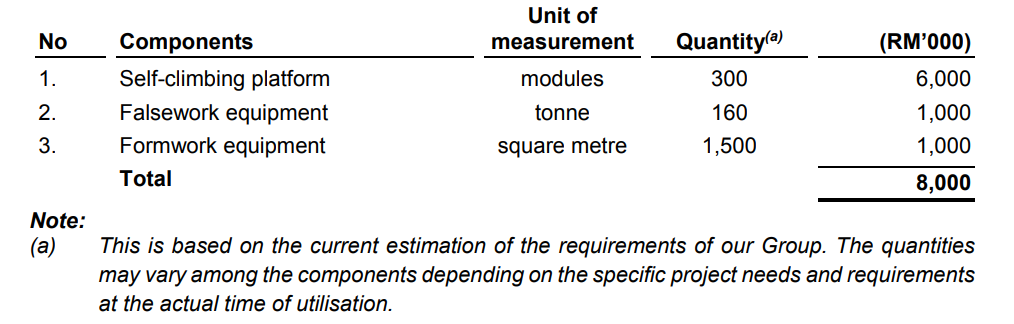

The company shall enlarge its resources in temporary works equipment to strengthen its value proposition in the CME Solutions segment. As such, they intend to utilise RM8.00 million representing approximately 21.55% of the total gross proceeds from the Public Issue as capital expenditure to acquire the following temporary works equipment:

Repayment of borrowings - 24.24% (within 12 months)

The company intends to utilise RM9.00 million representing approximately 24.24% from the total gross proceeds from the Public Issue to partially repay the borrowings as follows:

The expected annual interest savings from the repayment of the borrowings are approximately RM0.54 million based on the interest rates ranging from 5.71% to 7.20% per annum as tabulated above. However, the actual interest savings may vary depending on the then-applicable interest rates

Construction of factories and centralised labour quarters on the Olak Lempit Land - 21.01% (within 24 months)

The company intends to venture upstream into the manufacturing of falsework equipment to bolster the assets to support its trading and rental of these equipment. The company's intention to venture into the manufacturing segment stems from the following factors:

- To improve quality control of the products;

- To improve and have better control of production schedule and efficiencies; and

- Greater control of supply chain management.

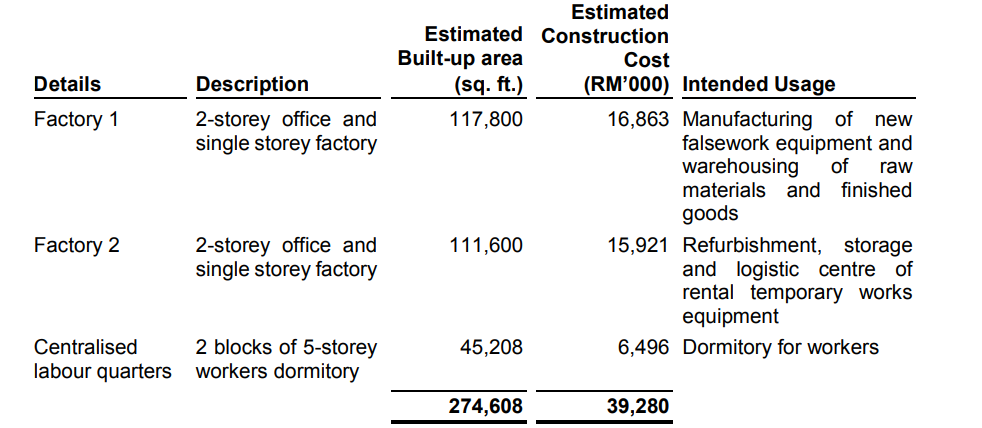

The expansion into the manufacturing segment involves the construction of new factories where the company will manufacture and warehouse the manufactured falsework equipment (Factory 1) as well as a centre for refurbishment, storage and logistic of rental equipment (Factory 2) and centralised labour quarters to accommodate existing and new workers to be hired for the manufacturing and refurbishment activities as well as to improve the living conditions of the workers.

The details of the estimated construction costs of the new factories and centralised labour quarters are as follows:

Purchase of software systems and hardware - 5.39% (within 24 months)

The company intends to utilise RM2.00 million, representing approximately 5.39% from the total gross proceeds from the Public Issue for implementation of ERP software system and purchase of new additional licenses and renewal of existing licenses for BIM software and purchase of equipment.

Working capital - 17.03% (within 12 months)

The company intends to utilise RM6.32 million representing approximately 17.03% from the total gross proceeds from the Public Issue to fund the working capital of the Group’s daily operation. The breakdown are as follows:

Business model

The Group is principally involved in the provision of construction engineering solutions and services and the trading and distribution of core and general building materials for construction projects. The construction engineering solutions and services include CME Solutions, DDE Solutions and PC Solutions that are aimed at increasing the efficiency and safety in construction activities via the adoption of industrialisation practices, supported by digitalisation of construction processes.

The business model is depicted as follows, with the types of services arranged in accordance to their contribution to the Group

Click here to continue the IPO - Plytec Holding Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on Initial Public Offering (IPO)