IPO - HE Group Berhad (Part 2)

MQTrader Jesse

Publish date: Tue, 16 Jan 2024, 03:22 PM

Financial Highlights

The following table sets out a summary of the Group’s audited combined financial statements for the Financial Years and Period Under Review

- The revenue increased from RM 33 million in FYE 2020 to RM 107 million in FYE 2022. The significant revenue growth indicates that the company is aggressively expanding its market share.

- The gross profit margin declined from 11.33% in FYE 2020 to 10.54% in FYE 2021 but increased to 13.95% in 2022. The movement in the GP margin is mainly due to the price fluctuations of power cables and wires made from copper. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin declined from 6.18% in FYE 2020 to 5.45% in FYE 2021 and increased to 7.42% in FYE 2022.

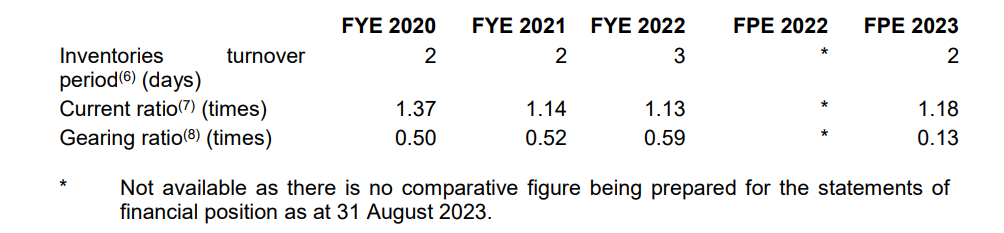

- The gearing ratio was 0.59 in FYE 2022, exceeding the healthy range. The company's gearing ratio increased year by year from 0.50 in FYE 2020 to 0.59 in FYE 2022. This is not a good sign, indicating that the management is not effectively handling its debt portion. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and supplier

Major Customers

The top 5 major customers for the FYE 2022.

The top 5 customers contribute 87.97% of the company's revenue. The management discloses that they are not dependent on specific customers because they operate a project-based business, and all their business is conducted through contracts. Therefore, they will need to continue finding new customers to enhance the company’s order book.

Major Suppliers

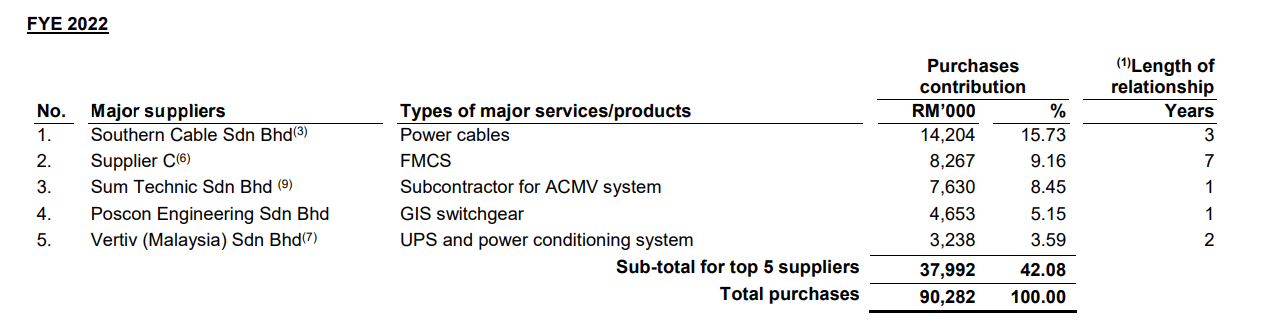

The top 5 major suppliers for the FY 2022

The total purchases from the top 5 suppliers account for 42.08%. The management mentioned that the company is not dependent on these suppliers because the subcontracted services, and the materials, electrical equipment and products that they purchased are available for purchase from other local suppliers.

Industry Overview

In Malaysia, the electrical installation includes electrical wiring and fittings, telecommunications wiring, computer network and cable television wiring, and lighting and security systems. The value of construction work completed for electrical installation grew at a CAGR of 20.6% between 2020 and 2022, partially attributed to the implementation of small-scale projects (Source: Bank Negara Malaysia (BNM)). For the first 9 months of 2023, the value of construction work completed for electrical installation grew by 18.4% compared to the corresponding period in 2022 (Source: DOSM).

The Energy Commission (ST) requires all electrical installations to be registered. As such, the number of applications for new electrical installations indicates the demand for electrical installation, while the number of applications for existing electrical installations represents opportunities new and existing electrical installations grew at a CAGR of 20.7% and 4.3% respectively. For the first 9 months of 2023, the number of applications for new electrical installations grew by 0.1%, while the number of applications for existing electrical installations declined by 15.3%, compared to the corresponding period in 2022 (Source: ST) for maintenance or upgrading works. Between 2020 and 2022, the number of applications for new and existing electrical installations grew at a CAGR of 20.7% and 4.3% respectively. For the first 9 months of 2023, the number of applications for new electrical installations grew by 0.1%, while the number of applications for existing electrical installations declined by 15.3%, compared to the corresponding period in 2022 (Source: ST).

Demand dependencies

As such, growth in these user industries and their ecosystems in Malaysia may provide an attractive environment for both domestic and foreign entities to establish and expand their manufacturing facilities in Malaysia, which will provide opportunities for operators to develop power distribution systems for critical and high-value industries.

- Semiconductor and Electronic Product Industry

- Medical Devices Industry

- Data centres in Malaysia

Market Size and Share

The market size of electrical installation works and the share of Hexatech Group are estimated as follow:

Source: Vital Factor Consulting

Future plans and strategies for HE GROUP BERHAD.

The company is an electrical engineering service provider focusing on providing power distribution systems for end-user premises including industrial plants and industrial and commercial substations.

- Expand the capabilities to be an integrated mechanical, electrical and process utility (MEP) engineering service provider.

- Set-up physical offices in Kedah and Johor.

- Expand the end-user industry coverage to include data centres.

MQ Trader View

Opportunities

- The company serves clients from various industries, enabling it to mitigate the risks associated with the decline of individual sectors. The company services growth end-user industries including semiconductors, medical devices and electronic product industries providing them with opportunities to sustain and drive its business growth.

- The industry still has room to grow. From the revenue results, we can see that the company is growing aggressively, indicating that there is still ample room for the company to expand within this industry.

Risk

- The business and financial performance are dependent on the ability to secure new and sizable projects promptly to ensure the continuity of the order to sustain its business. As the nature of the business is project-based, the company’s revenue is derived from the execution and completion of projects. In this respect, the company’s financial performance is dependent on its ability to continually submit tender bids and quotation proposals, secure new projects and replenish the order book.

- The increasing gearing ratio will raise the company’s financial risk. Based on the financial results, we observe a year-over-year increase in the gearing ratio, diminishing the company's ability to respond to risks. Therefore, it is crucial to pay attention to upcoming results and ensure that the management can improve its debt position.

- The fluctuations in the prices of its major raw materials, such as copper, may adversely affect its profitability. Power cables and wires are one of the key materials used in the provision of power distribution systems and The prices of power cables are subject to price fluctuations as it is made largely from copper, which is a globally traded commodity. As such, any fluctuations in copper prices would directly affect the prices of power cables and wires.

Click here to refer the IPO - HE Group Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)