IPO - AGX Group Berhad (Part 1)

MQTrader Jesse

Publish date: Mon, 22 Jan 2024, 09:57 AM

Company Background

The company was incorporated in Malaysia under the Act on 26 November 2019 as a public limited company under the name of AGX Group Berhad. The group was established in 2004 with the incorporation of AGX Malaysia in Malaysia and commenced business operations in 2005.

The Group structure after the IPO is as set out below:

Through the subsidiaries, the company is involved in logistics, warehousing, and transportation services and carries out business in several countries.

Use of proceeds

- Business expansion – setting up new warehouses and offices in Malaysia and South Korea - 25.8% (within 12 months)

- Repayment of bank borrowings - 12.2% (within 3 months)

- Working capital – marketing expenses, upgrading of IT infrastructure, and operating and administrative expenses - 48.7% (within 24 months)

- Estimated listing expenses – professional fees, fee to authorities, estimated underwriting, placement and brokerage fees, printing, advertisement, and other incidental charges relating to the Listing - 13.3% (within 3 months)

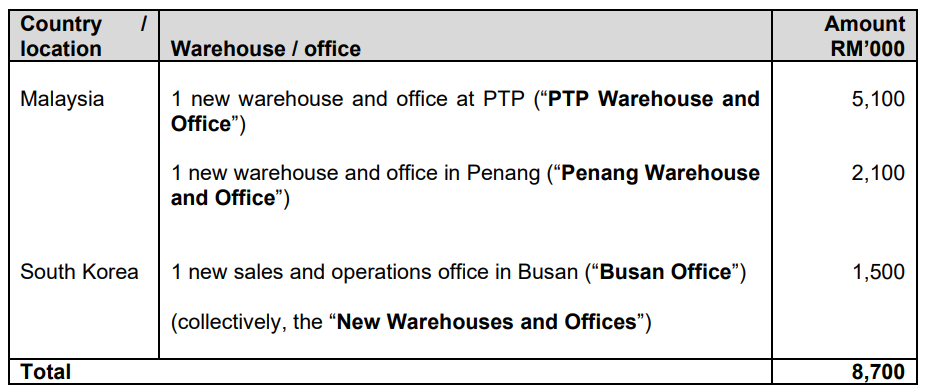

Business expansion – setting up new warehouses and offices in Malaysia and South Korea - 25.8% (within 12 months)

In line with the business strategies and plans as set out, the company intends to allocate proceeds of RM8.70 million to expand its presence in Malaysia and South Korea by establishing new warehouses and offices, as follows:

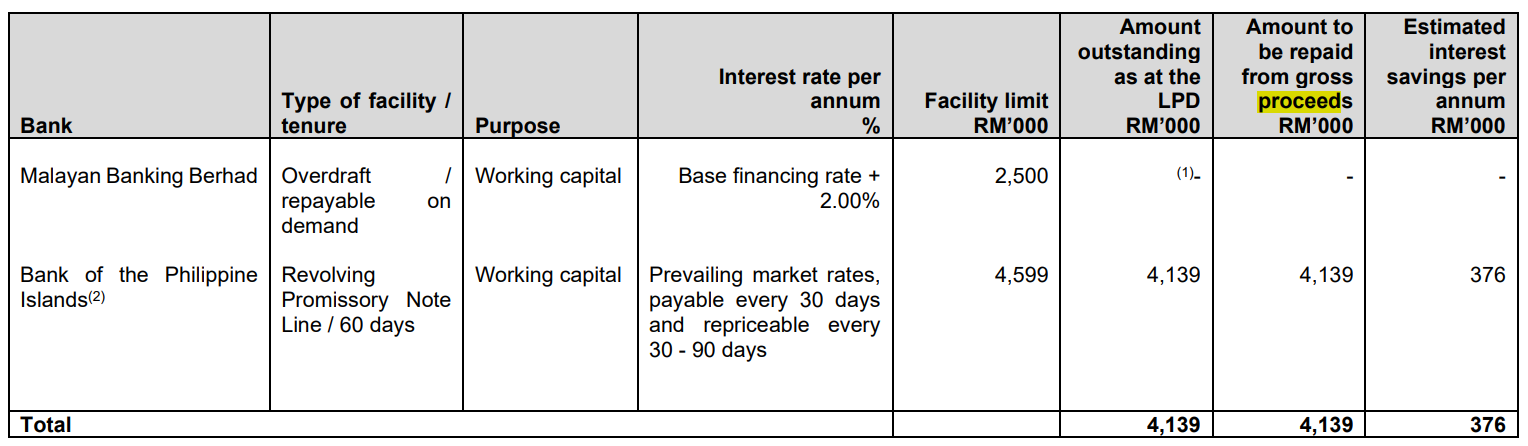

Repayment of bank borrowings - 12.2% (within 3 months)

The company’s total borrowings amounted to approximately RM12.32 million, which include hire purchases, term loans, overdraft facilities and revolving credit granted by financial institutions. The company intends to settle part of its borrowings in the following manner:

There are no covenants attached to the facilities above which may have a material impact on the repayment of bank borrowings and the repayment of bank borrowings is not expected to result in any early repayment penalties arising therefrom.

Based on the pro forma consolidated statement of financial position as at 31 August 2023, the repayment of bank borrowings is expected to reduce the gearing level of the Group from 0.21 times (pro forma after Public Issue) to 0.17 times.

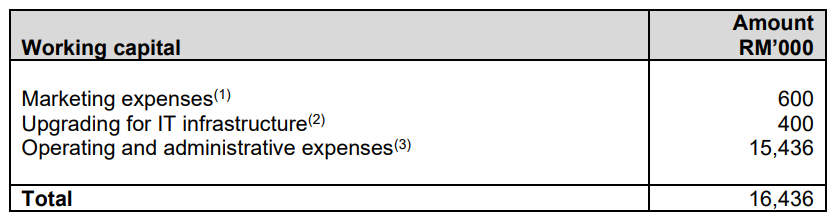

Working capital – marketing expenses, upgrading of IT infrastructure, and operating and administrative expenses - 48.7% (within 24 months)

The group’s working capital requirement is expected to increase in tandem with the business expansion in the establishment of the New Warehouses and Offices. In this regard, the company intends to allocate the balance proceeds of RM16.44 million for working capital purposes, as follows:

The freight charges amounted to approximately RM112.00 million for FYE 2022, which translates into an average monthly freight charges of approximately RM9.33 million. Assuming the entire proceeds allocated herein are utilised for freight charges only, the proceeds are able to fund freight charges of the Group for approximately 1.6 months.

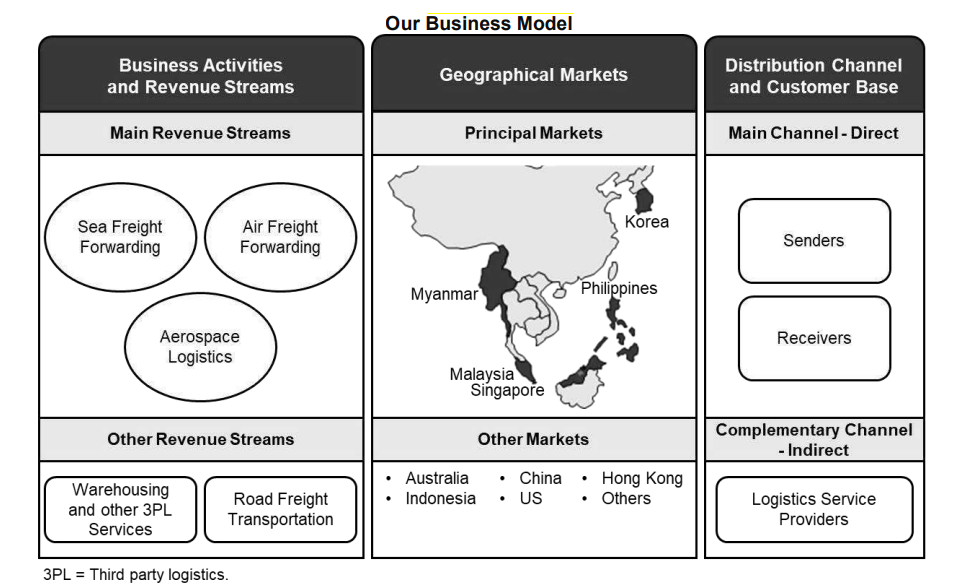

Business model

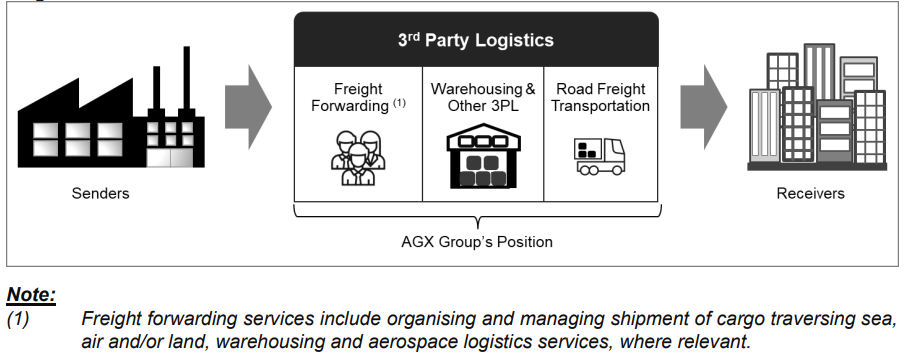

The business model is depicted in the following diagram:

The company is primarily a 3PL service provider where the services comprise sea and air freight forwarding, aerospace logistics, warehousing and other 3PL, and road freight transportation services. These services accounted for all of the revenues for the Financial Years and Period Under Review.

The Group’s position in the logistics industry value chain is summarised in the following diagram:

The company is primarily a 3PL service provider where the services comprise sea and air freight forwarding, aerospace logistics, warehousing and other 3PL, and road freight transportation services. The company provides its services to assist senders or receivers in transporting their goods from the point of origin to their final destinations.

Logistic Service

The company does not own the ships or aircrafts used to transport the cargo for the sea and air freight forwarding services, and aerospace logistics that they provide. The company provides sea and air freight forwarding, and aerospace logistics services in all the countries where they have a physical presence, namely Malaysia, the Philippines, Korea, Myanmar and Singapore. Sea and air freight forwarding, and aerospace logistics services accounted for at least 90% of the total revenue in each of the respective years of the Financial Years and Period Under Review.

Warehousing and other 3PL Services

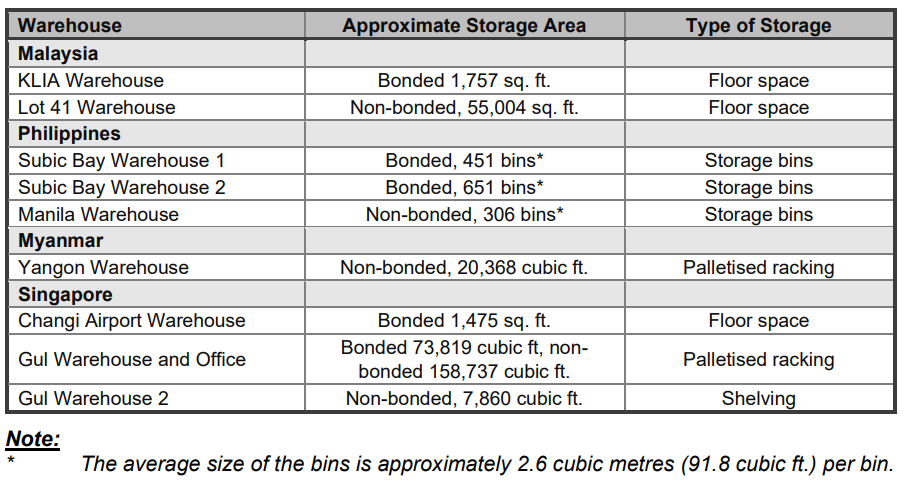

The company uses leased warehouses for warehousing and other 3PL services. They provide warehousing for general goods. The company's other 3PL services include the provision of domestic distribution management and e-fulfilment services. They carry out domestic distribution management services in Malaysia and Singapore, and e-fulfilment services in the Philippines and Singapore. The company also utilise its warehouses to support the sea and air freight forwarding, aerospace logistics, and road freight transportation services. As at the LPD, the warehouse facilities are as follows:

Road freight transportation services

The company’s road freight transportation services involve the transportation of freight from one point to another by road. The company’s road freight transportation services are provided as standalone services, as well as to support sea and air freight forwarding, aerospace logistics, warehousing, and other 3PL services. They only provide carriage of general goods that do not require temperature or humidity-controlled transportation, including container haulage and trucking of noncontainerised goods. The company provides road freight transportation in Malaysia, Myanmar, and Singapore. They own and lease vehicles such as prime movers, trailers and trucks in Malaysia, Myanmar and Singapore to provide this service. In addition, they own and lease vehicles in the Philippines, although these vehicles are not used to provide road freight transportation services on a standalone basis and are instead used to transport goods in support of its sea and air freight forwarding, aerospace logistics, and warehousing and other 3PL services.

Click here to continue the IPO - AGX Group Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)