IPO - Alpha IVF Group Berhad (Part 2)

MQTrader Jesse

Publish date: Wed, 06 Mar 2024, 12:05 PM

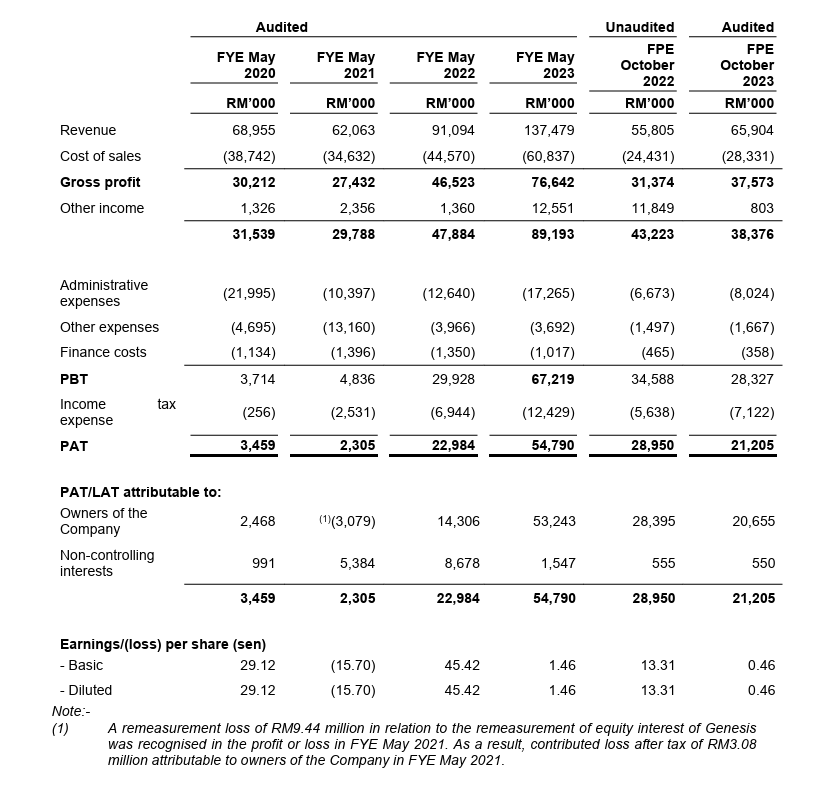

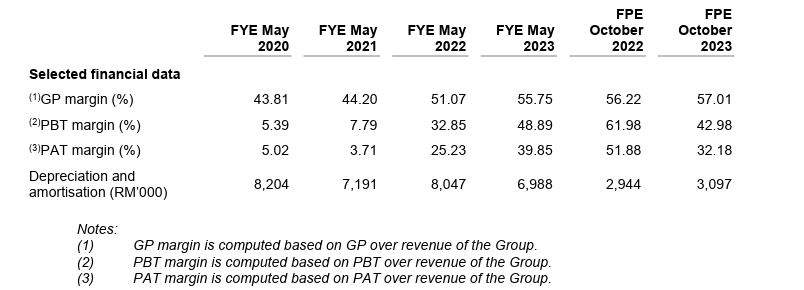

Financial Highlights

The following table sets out the selected historical combined and consolidated financial data for the years/periods indicated.

- The revenue increased from RM 68 million in FYE 2020 to RM 137 million in FYE 2023. This indicates that the company is expanding its market share within the industry.

- The gross profit margin declined from 43.81% in FYE 2020 to 55.75% in FYE 2023. The increase in the GP margin was mainly due to the higher number of IVF stimulation and pick-ups performed and ancillary services rendered. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin increased from 5.02% in FYE 2020 to 39.85% in FYE 2023

- The gearing ratio was 0.08 in FYE 2023. The company is lower than a healthy range for the gearing ratio, which means that the company can still increase the debt ratio to maximize the efficiency of debt. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and supplier

Major Customers

The company’s customers are mainly couples and each couple contributed less than 1% of the total revenue for the Financial Periods Under Review. The company does not have any major customers who contributed more than 5% of the total revenue for the Financial Periods Under Review. As such, the company is not dependent on any of its customers.

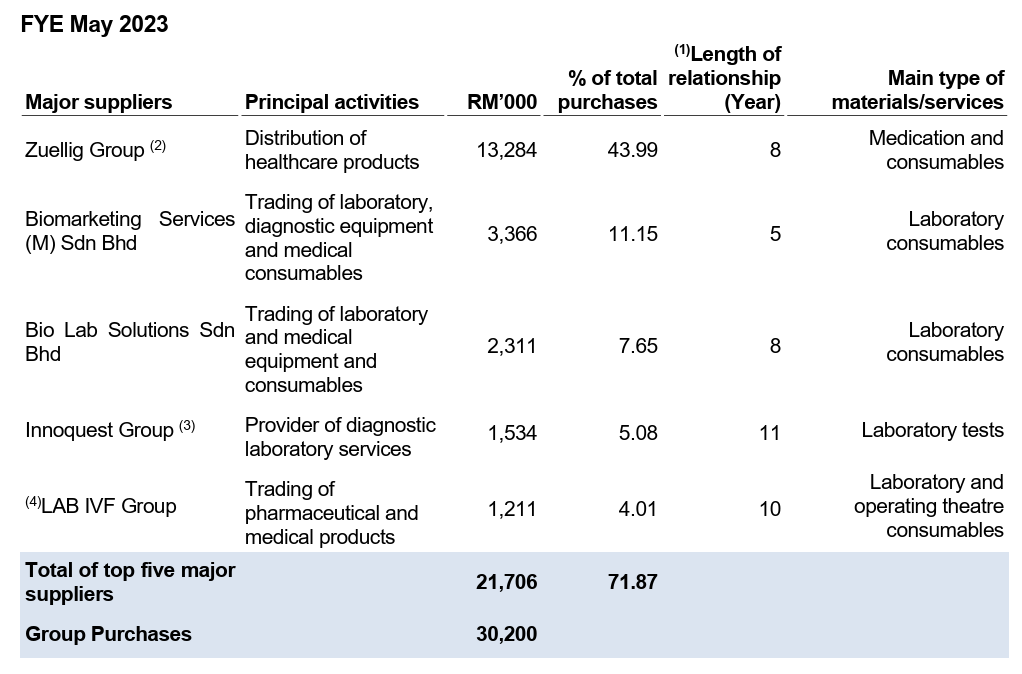

Major Suppliers

The top five major suppliers for Financial Periods Under Review are as follows:

The total purchases from the top 5 suppliers account for 71.87%. The management mentioned they are only dependent on Zuellig Group, which accounts for 43.99% of its total purchases. The other supplier, who contributed less than 12% of the total purchases of materials and services, has alternatives available from other suppliers in the market.

Industry Overview

According to research from Vital Factor Consulting, ARS, which stands for Assisted Reproductive Services, is a medical specialist discipline under obstetrics and gynecology, and is part of the overall health services. The following section will assess the performance of health services in Malaysia and Singapore.

In Malaysia, the health services can be divided into public and private sectors. Alpha Group is involved in the provision of health services in the private sector, focusing on ARS. Between 2020 and 2022, the real GDP of health services in Malaysia grew at a Compound Annual Growth Rate (CAGR) of 3.7%. The growth was largely attributed to the private health sector, which experienced a CAGR of 8.2% during the same period and was partially driven by the positive recovery of the healthcare travel industry following the reopening of borders. For the first nine months (9M) of 2023, the private health sector grew by 9.0% compared to 9M 2022, according to DOSM. In 2021, private medical services, including ARS and private dental services, accounted for 12.4% of the overall GDP of health services (Source: DOSM).

In Singapore, Value added is a measure of an economic activity’s contribution to GDP. Based on the latest available statistics, the value added of health services in Singapore rebounded with a growth of 10.5% in 2021 following a decline of 6.2% in 2020. This indicated a recovery from the impact of the COVID-19 pandemic. In the specialized medical services segment of Singapore, under which ARS falls, there was a modest growth of 0.3% in 2021, following a decline of 10.7% in 2020. Nevertheless, this segment has yet to reach its pre-COVID-19 level.

For Singapore, an ART (Assisted Reproductive Technology) cycle refers to the process where ovarian stimulation is done and embryos are either frozen or transferred to the woman’s reproductive system. Between 2017 and 2019, being the latest available statistics, the number of ART cycles in Singapore grew at a CAGR of 6.3%. This was in tandem with the declining fertility rate from 1.16 in 2017 to 1.14 in 2019, according to the Ministry of Health, Singapore. Growth in the number of ART cycles in Singapore indicates growing demand for ARS and thus provides opportunities for operators in the industry.

The factors contributing to the demand for ARS in Malaysia are declining fertility rates, the healthcare travel industry, and incentives and drivers. For Singapore, the factors are declining fertility rates and incentives and drivers.

Source: Vital Factor Consulting

Future plans and strategies for ALPHA IVF GROUP BERHAD.

The strategy is to continue with the existing business and leverage the core competency in IVF to expand the business. A summary of its expansion plans is as follows

MQ Trader View

Opportunities

- The company has consistently demonstrated excellent financial performance in its historical records. The GP margin and PAT margin have continuously grown due to the improvement in financial results, as reflected in the overall revenue. Moreover, the company's gearing ratio is lower than the benchmark, which means it will not easily be involved in financial issues because of the low debt in its financial structure.

- Demand is increasing as more people choose to have children at a later age, and a growing number of individuals are accepting this technology. Environmental factors lead people to delay marriage, and increasing age may also decrease the probability of pregnancy. This prompts individuals to seek medical services and technologies to enhance their chances of conceiving. Moreover, with the progress of civilization, an increasing number of people are becoming more willing to embrace these technologies.

Risk

- The company’s business method is highly dependent on its executive directors, key senior management, and skilled personnel. The growth and continuing success of the Group’s business are, to a significant extent, dependent on the abilities, skills, experience, and expertise of the executive directors, key senior management, and skilled personnel who play significant roles in the day-to-day operations, as well as the implementation of the business strategies. Nonetheless, the loss of any of these medical specialists without suitable and timely replacement, or the inability to attract, hire, and retain suitable candidates, may result in the inability to retain its patients or attract new ones.

Click here to refer the IPO - Alpha IVF Group Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)