IPO - Prolintas Infra Business Trust

MQTrader Jesse

Publish date: Thu, 07 Mar 2024, 02:50 PM

Company Background

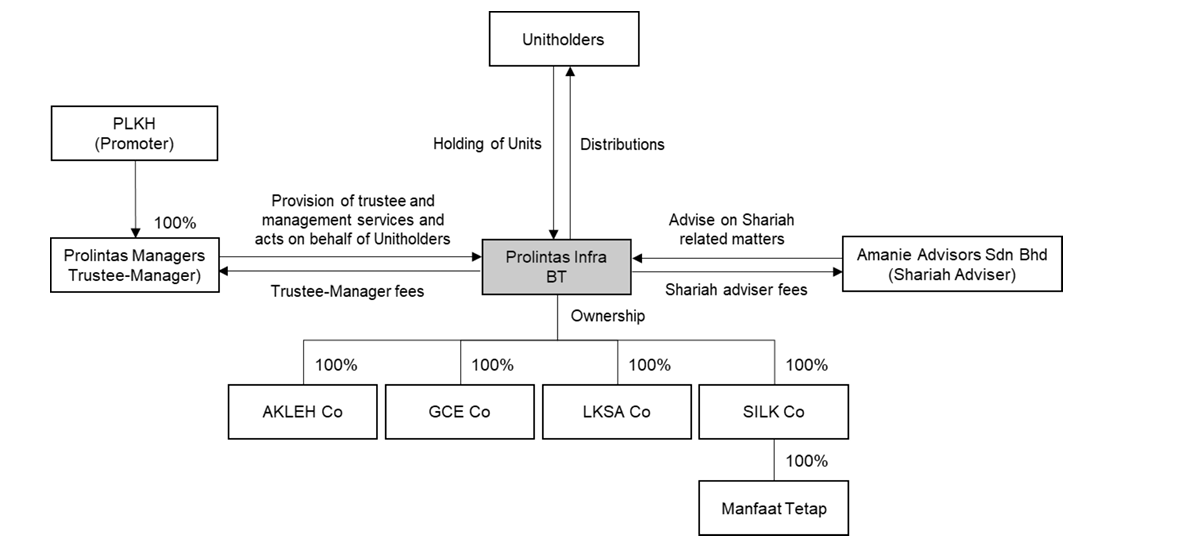

Prolintas Infra Business Trust is an Islamic business trust constituted under the laws of Malaysia under the Trust Deed and registered with the SC on 11 December 2023 and is managed by Prolintas Managers, the Trustee-Manager. The following diagram illustrates the relationship between Prolintas Infra BT, the Trustee-Manager, the Shariah Adviser and the Unitholders upon the Listing:

The Trust Group is principally involved in the:

- construction, toll collection, operation and maintenance of the Highways; and

- provision of ancillary facilities to complement the operation of the Highways and enhance road users’ experience and convenience.

Use of proceeds

As Prolintas Infra BT will not be issuing any new Units for the IPO, the Trust will not receive any proceeds from the IPO. The total gross proceeds from the Offer for Sale based on the Institutional Price of up to approximately RM445.3 million will accrue entirely to the Selling Unitholder. The Selling Unitholder will bear its own expenses including, but not limited to, the placement fee and underwriting fee in relation to the Offer for Sale which is estimated to be approximately up to RM10.2 million.

Business model

The Trust Group is principally involved in the:

- construction, toll collection, operation and maintenance of the Highways; and

- provision of ancillary facilities to complement the operation of the Highways and enhance road users’ experience and convenience.

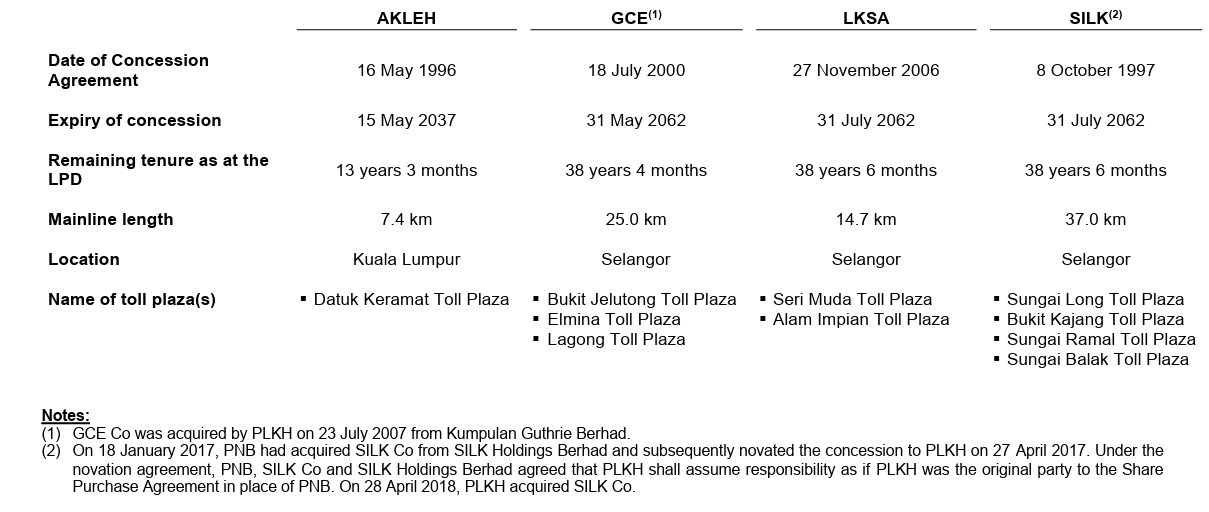

The summary of the Highways held by the Trust Group (through the Concession Companies) are as follows:

The Highways are strategically located within the Klang Valley and have benefited from the economic activity centred in the region. The Klang Valley, which comprises Kuala Lumpur and its adjoining towns in Selangor, is the focus region for approved domestic investments. Klang Valley has close proximity to Port Klang which aided exports and trade in this area. Based on the IMR Report, the total industry revenue based on toll collection and compensation received from the Government for the urban highways in the Klang Valley (excluding the Setiawangsa-Pantai Expressway (SPE) and the New Klang Valley Expressway (NKVE)) is RM2.3 billion in 2021. Based on the Trust Group’s revenue of RM340.3 million from toll collection and compensation received from the Government, the Trust Group captures a market share of 14.9% of the total industry revenue in 2021.

The Highways generated RM295.2 million and RM214.7 million in revenue from toll collection, representing 76.8% and 93.9% of the Trust Group’s total revenue in FYE 2022 and FPE 2023 respectively. A total of RM83.7 million and RM10.5 million, representing 21.8% and 4.6% is derived from toll compensation received from the Government in accordance with the respective Concession Agreements and the balance of RM5.3 million and RM3.4 million, representing 1.4% and 1.5% which is derived from non-toll revenue and construction revenue for FYE 2022 and FPE 2023 respectively.

Financial Highlights

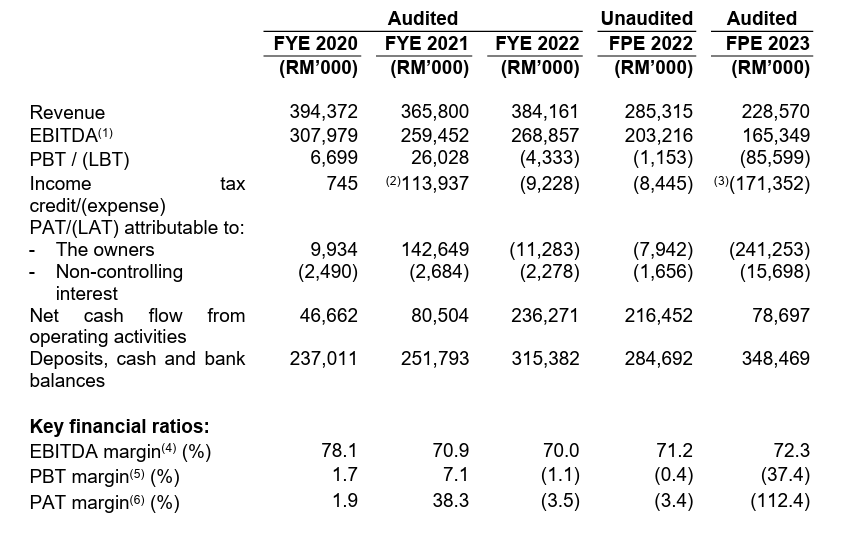

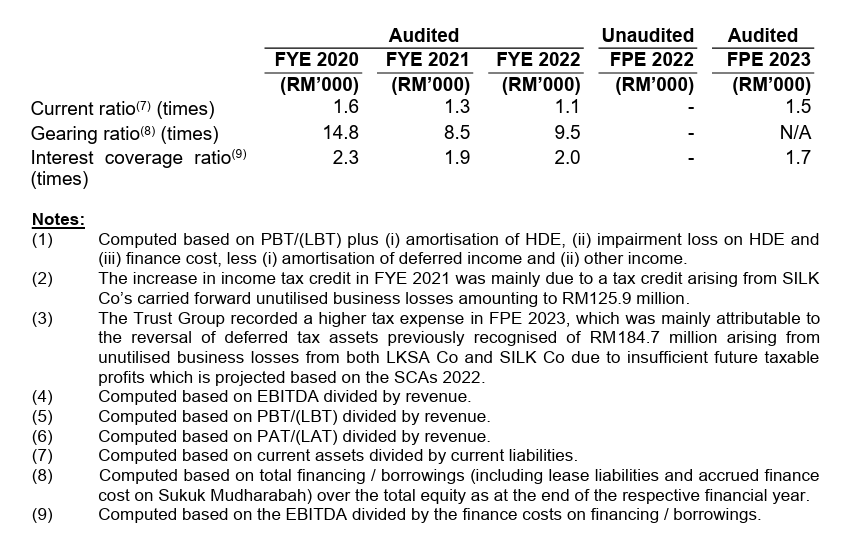

All the entities included in the Trust Group have been under the common control of PLKH for the Period Under Review. The combined financial statements of the Trust Group have been prepared as if the Trust Group has operated as a single economic entity throughout the Period Under Review and have been prepared from the books and records maintained by each entity. The key financial information of the Trust Group for the Period Under Review are as follows:-

- Due to the nature of the business, revenue is passively determined by the volume of active vehicles passing through the toll.

- The EBITDA margin has been maintained at 70% for the past three years. Since there is no toll cost, it will only be affected by (i) amortization of HDE, (ii) impairment loss on HDE, and (iii) finance costs, offset by (i) amortization of deferred income and (ii) other income.

- The 3-year PAT margin recorded 1.9% in FYE 2020, 38.3% in FYE 2021, and -3.5% in FYE 2022. The increase in PAT in FYE 2021 is attributed to the rise in income tax credit, primarily resulting from a tax credit arising from SILK Co’s carried forward unutilized business losses amounting to RM125.9 million.

- Due to the nature of the business, the gearing ratio will be maintained at a high position, which is 9.5 times in FYE 2022.

Major customers and supplier

Major Customers

As a highway operator, the Trust Group’s customer base primarily comprises the road users using the four Highways. The traffic volume on the Highways, measured based on the total number of toll transactions at the Highways, are recorded at 158.2 million transactions for FYE 2022 and 124.4 million transactions for FPE 2023. Accordingly, the revenue contribution from each customer as a percentage of the Trust Group’s revenue is negligible. As such, the Trust Group does not have any material exposure to nor is dependent on any particular customer for its business.

Major Suppliers

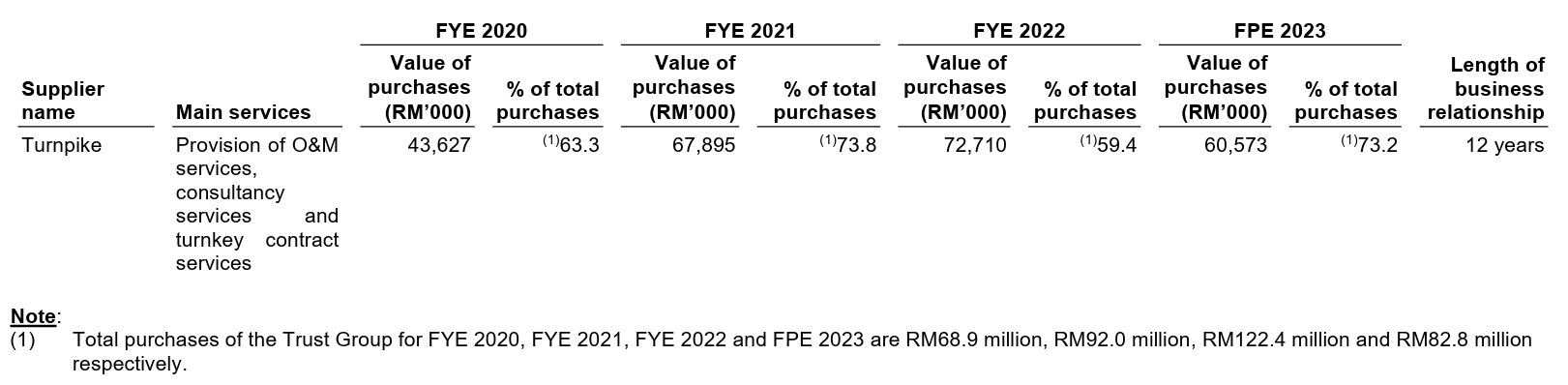

The Trust Group’s major supplier, contributing 10% or more of purchases of the Trust Group for the Period Under Review is as follows:

For the Period Under Review and up to the LPD, AKLEH Co, GCE Co and LKSA Co outsourced the majority of the O&M Services to Turnpike, a wholly owned subsidiary of PLKH. Turnpike further subcontracts part of the O&M Services to external service providers via separate operation and maintenance contracts for certain O&M Services, such as the provision of routine highway maintenance services and ad-hoc highway repair and maintenance services.

Industry Overview

According to research from Frost & Sullivan, the year 2020 and 2021 have been marked by the COVID-19 pandemic, which impacted the daily routines of many Malaysians. During this period, the mobility of people was heavily affected due to multiple phases of lockdowns and business restrictions, which resulted in a significant drop in revenue and traffic for highway operators in Klang Valley.

Nonetheless, as Malaysia transitioned to the endemic phase starting in April 2022, it observed a strong recovery of mobility in the Klang Valley, leading to the recovery of tolled traffic towards pre-pandemic levels. The challenges faced by road users pre-pandemic, such as the overcapacity of public roads and the limitation of public transport, are expected to resurface and persist in the coming years. In addition, the sustained strong demand for tolled highways will also be driven by the growing income and therefore greater affordability of vehicle ownership and toll usage. As Frost & Sullivan forecasts the market size in terms of revenue of urban highways in Klang Valley to grow at a CAGR of 4.6% from RM3.1 billion in 2023 to RM3.7 billion in 2027.

The four highways operated by Prolintas Infra BT are developed for different purposes and are in different stages of maturity. For instance, AKLEH and SILK are developed to disperse traffic in KL city centre and Kajang, respectively. These two highways are expected to benefit from the recovery of traffic volume in Klang Valley due to the resumption of business activities and work-related travel. On the other hand, the traffic volume on the GCE and LKSA is expected to grow as a result of rapid development and population growth in their respective catchment areas such as Klang, Shah Alam, Rawang, and Kota Kemuning, among other areas. As such, Frost & Sullivan believes that Prolintas Infra BT is strategically positioned to take advantage of the strong recovery and growth of the highway industry in Klang Valley in the coming years.

Source: Frost & Sullivan

MQ Trader View

Opportunities

- The Trust Group’s Highways are located in high-traffic areas. The Highways are strategically situated across Klang Valley. These Highways play a crucial role by either providing an alternative route to the highly congested public roads or enhancing the connectivity of urbanised townships, serving almost half a million road users every day which is

- AKLEH - links Kuala Lumpur’s eastern corridor to the city centre, as an alternative route to Jalan Ampang

- GCE - connectivity to nearby townships such as Shah Alam, Bukit Jelutong, Denai Alam, Elmina, Subang, Sungai Buloh and Rawang, facilitating convenient access to multiple destinations.

- LKSA - connects areas of Shah Alam and Kota Kemuning, serving as the primary link to Shah Alam Expressway (“KESAS”) in the south from Shah Alam and to Federal Highway Route 2 in the north from Kota Kemuning.

- SILK - alleviates the traffic in the Kajang town centre, covers catchment areas around the Kajang and its vicinities such as Bangi, Sungai Ramal, Sungai Long and Semenyih and has emerged as the primary ring road of Kajang, enabling the local community to circumvent the congested public roads.

Risk

- The expiration or early termination of the concession agreements. The Trust Group's concession rights to collect tolls from the Highways were granted by the Government under the respective Concession Agreements. The Trust Group's businesses and operations and hence, its financial performance, will be adversely affected if, notwithstanding the legality of the Concession Agreements, the Government were to terminate the Concession Agreements before the expiry of their respective terms. The Government may terminate the corresponding Concession Agreement if the relevant Concession Company does not perform its obligations under the terms of the Concession Agreement and fails to remedy the breach within the stipulated period after notification by the Government or via expropriation of a Concession Company if the Government considers such expropriation to be in the national interest.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)